First Eagle Investment Trims Stake in IPG Photonics Corp

Transaction Overview

First Eagle Investment (Trades, Portfolio) has recently adjusted its investment in IPG Photonics Corp (NASDAQ:IPGP), a leading developer and manufacturer of high-performance fiber lasers and amplifiers. On December 31, 2023, the firm reduced its holdings by 3,157 shares, resulting in a total ownership of 4,257,637 shares in the company. This trade action represents a slight portfolio change, with the trade price recorded at $108.54 per share. Despite the reduction, IPG Photonics Corp still constitutes 1.2% of First Eagle Investment (Trades, Portfolio)'s portfolio, with the firm holding a 9.07% stake in the company.

First Eagle Investment (Trades, Portfolio)'s Heritage and Philosophy

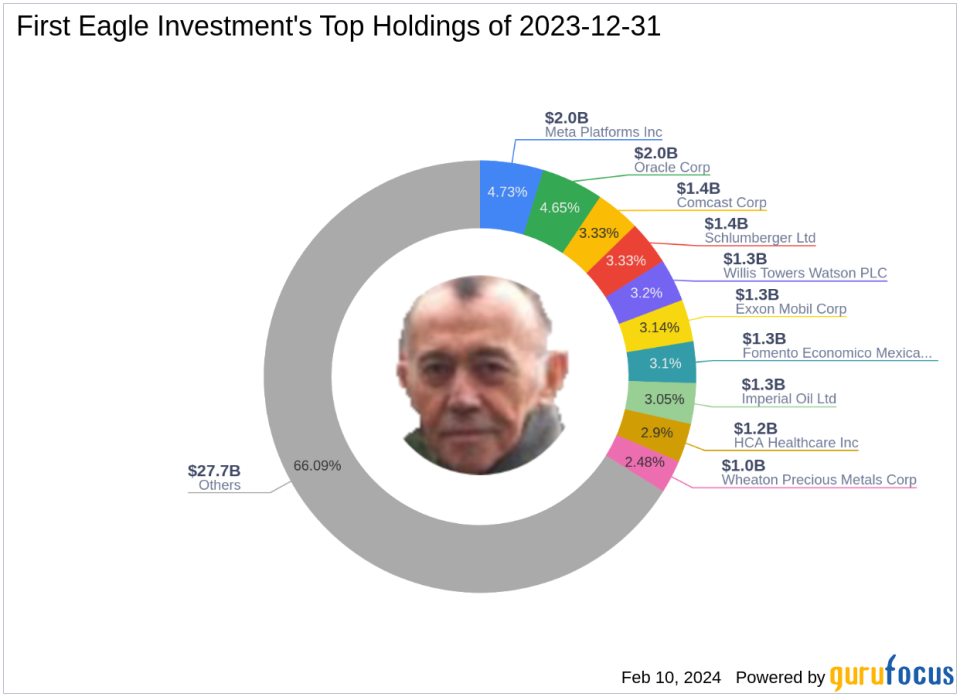

First Eagle Investment (Trades, Portfolio), with a rich heritage dating back to 1864, is a respected name in the investment management industry. The firm offers advisory services across a spectrum of investment strategies and is known for its value-oriented approach. First Eagle Investment (Trades, Portfolio) focuses on absolute long-term performance and capital preservation, employing rigorous bottom-up fundamental analysis to mitigate risk. The firm's investment team actively engages in on-site research, visiting companies and speaking with management to gain a comprehensive understanding of potential investments. First Eagle Investment (Trades, Portfolio)'s portfolio includes a diverse array of 412 stocks, with top holdings in companies like Comcast Corp (NASDAQ:CMCSA), Meta Platforms Inc (NASDAQ:META), and Oracle Corp (NYSE:ORCL). The firm's equity stands at $41.97 billion, with a strong inclination towards the Technology and Basic Materials sectors.

IPG Photonics Corp at a Glance

IPG Photonics Corp, headquartered in the USA, has been a public entity since December 13, 2006. The company is renowned for its vertically integrated production of advanced fiber lasers and diode lasers used across various industries, including manufacturing, automotive, and aerospace. With a significant portion of its revenue stemming from materials processing applications, IPG Photonics has a global footprint, with China being a major market. The company's market capitalization stands at $4.82 billion, with a current stock price of $102.82, reflecting a modest undervaluation according to the GF Value of $119.38. Despite a PE Ratio of 56.49, the stock has experienced a 5.27% decline since the trade date and a year-to-date decrease of 3.53%.

Impact of the Trade on First Eagle Investment (Trades, Portfolio)'s Portfolio

The recent reduction in IPG Photonics Corp shares by First Eagle Investment (Trades, Portfolio) is a strategic move that aligns with the firm's investment philosophy. Although the trade impact on the portfolio is minimal, it reflects the firm's ongoing portfolio adjustments to optimize long-term performance. The trade price of $108.54 compared to the current stock price of $102.82 suggests that First Eagle Investment (Trades, Portfolio) capitalized on a higher valuation at the time of the sale.

Market Valuation and Stock Performance

IPG Photonics Corp's current market valuation indicates that the stock is modestly undervalued, with a Stock GF Value Rank of 7/10. The stock's price-to-GF Value ratio stands at 0.86, and despite a recent decline in stock price, the company has shown a significant increase of 311.28% since its IPO. The GF Score of 84/100 suggests good outperformance potential, supported by strong Financial Strength and Profitability Rank.

Sector and Industry Positioning

First Eagle Investment (Trades, Portfolio)'s top sectors indicate a strategic focus on Technology and Basic Materials, with IPG Photonics Corp fitting well within this framework. The semiconductor industry, where IPG operates, is a key component of the firm's investment strategy, reflecting the importance of innovation and growth potential in these sectors.

Other Notable Investors in IPG Photonics Corp

First Eagle Investment (Trades, Portfolio) is not the only prominent investor in IPG Photonics Corp. Other notable gurus such as Ken Fisher (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), and Charles Brandes (Trades, Portfolio) also hold shares in the company. However, First Eagle Investment (Trades, Portfolio) remains the largest guru shareholder, demonstrating significant confidence in IPG Photonics' future prospects.

Conclusion

The recent trade by First Eagle Investment (Trades, Portfolio) in IPG Photonics Corp is a calculated adjustment within its portfolio. While the firm has slightly reduced its stake, it maintains a substantial position in the company, indicative of its belief in IPG Photonics' intrinsic value and long-term potential. As market conditions evolve, First Eagle Investment (Trades, Portfolio)'s active management approach will continue to shape its investment decisions, with a keen eye on preserving capital and achieving absolute long-term performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.