First Eagle Investment Trims Stake in Flowserve Corp

Overview of First Eagle Investment (Trades, Portfolio)'s Recent Trade

First Eagle Investment (Trades, Portfolio), a seasoned investment management firm, has recently adjusted its holdings in Flowserve Corp (NYSE:FLS). On December 31, 2023, the firm reduced its stake in the company by 26,740 shares, resulting in a new total of 10,719,655 shares. This transaction, executed at a price of $41.22 per share, reflects a subtle portfolio change with a 0.25% share decrease and a trade impact of 0%. Despite this reduction, First Eagle Investment (Trades, Portfolio) maintains a significant position in Flowserve Corp, with the stock comprising 1.14% of its portfolio and representing 8.17% of the company's outstanding shares.

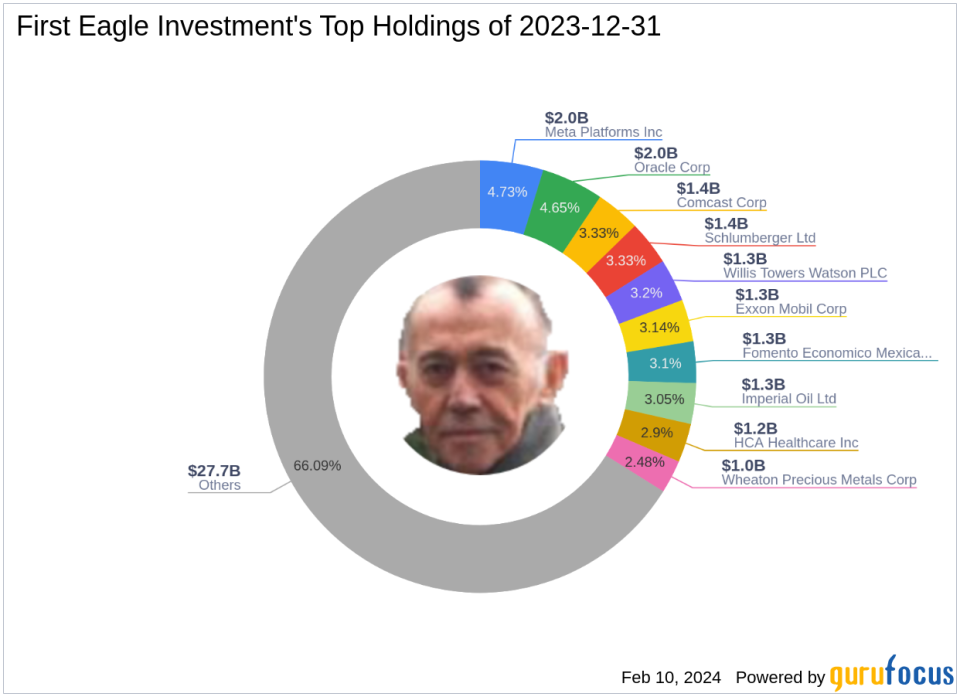

First Eagle Investment (Trades, Portfolio)'s Investment Profile

With roots stretching back to 1864, First Eagle Investment (Trades, Portfolio) is an independent firm dedicated to providing investment advisory services across various platforms. The firm's value investing philosophy emphasizes absolute long-term performance and capital preservation over short-term index competition. First Eagle Investment (Trades, Portfolio) employs a meticulous bottom-up fundamental analysis, often involving direct company visits and management discussions, to identify securities with intrinsic value that surpasses market risk. Currently, the firm manages a diverse portfolio of 412 stocks, with top holdings in companies like Comcast Corp (NASDAQ:CMCSA), Meta Platforms Inc (NASDAQ:META), and Oracle Corp (NYSE:ORCL), and has an equity portfolio valued at $41.97 billion, with a strong focus on the technology and basic materials sectors.

Flowserve Corp's Market Presence

Flowserve Corp, trading under the symbol FLS in the United States since its IPO on June 30, 1972, is a leading manufacturer and service provider of flow control systems. The company specializes in precision-engineered equipment such as pumps, valves, and seals, catering to industries like oil and gas, chemicals, power generation, and water management. With a global footprint, Flowserve operates Quick Response Centers worldwide, ensuring efficient aftermarket services. The company's market capitalization stands at $5.45 billion, with a current stock price of $41.50.

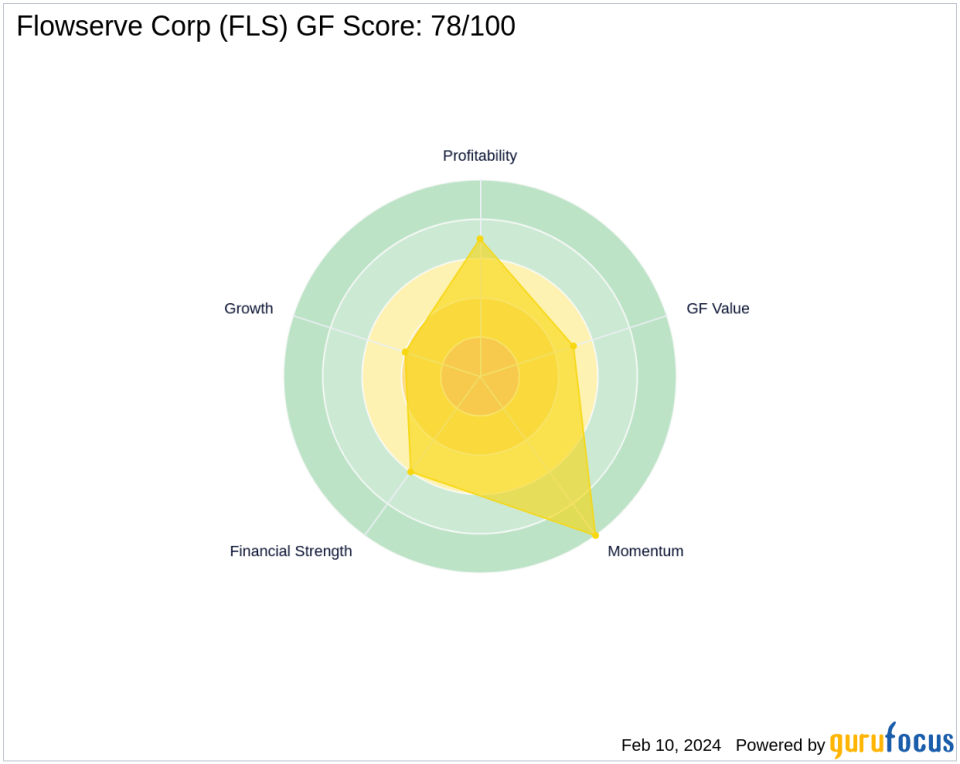

Flowserve Corp's Financial Health and Performance

Flowserve Corp's financial metrics present a mixed picture. The stock's PE ratio is 22.31, indicating profitability, and it is deemed "Fairly Valued" according to GuruFocus's GF Valuation, with a GF Value of $40.91 and a price to GF Value ratio of 1.01. Since the trade date, the stock has seen a modest gain of 0.68%, and an impressive 9,122.22% increase since its IPO. The year-to-date performance shows a 2.44% rise. Flowserve's GF Score stands at 82/100, suggesting good potential for outperformance.

Impact of the Trade on First Eagle Investment (Trades, Portfolio)'s Portfolio

The recent transaction by First Eagle Investment (Trades, Portfolio) has slightly altered its exposure to Flowserve Corp, yet the firm remains a major shareholder. The current holding of over 10 million shares indicates a continued belief in the company's value and prospects. This move aligns with First Eagle's strategy of seeking long-term value and may reflect a strategic rebalancing rather than a shift in conviction.

Flowserve Corp's Market Performance and Rankings

Flowserve Corp's stock performance has been relatively stable post-trade, with a slight uptick in value. The company's financial health is reflected in its rankings: a Financial Strength of 6/10, a Profitability Rank of 7/10, and a Growth Rank of 6/10. The GF Value Rank and Momentum Rank stand at 5/10 and 10/10, respectively. The Piotroski F-Score is 5, and the Altman Z-Score is a healthy 3.50, indicating low bankruptcy risk. However, the company's operating margins and revenue growth have faced challenges, as evidenced by the negative growth figures.

Comparative Analysis with Other Gurus

First Eagle Investment (Trades, Portfolio) is not alone in recognizing the potential of Flowserve Corp. Other notable investors, including Mario Gabelli (Trades, Portfolio), HOTCHKIS & WILEY, and Ken Fisher (Trades, Portfolio), also hold stakes in the company. First Eagle Investment (Trades, Portfolio), however, stands as the largest guru shareholder, underscoring its significant influence and commitment to Flowserve Corp.

Flowserve Corp in the Industrial Products Sector

Within the industrial products industry, Flowserve Corp plays a crucial role with its extensive range of flow control solutions. First Eagle Investment (Trades, Portfolio)'s top holdings indicate a diversified approach, with Flowserve Corp fitting into its broader investment strategy. The firm's keen interest in technology and basic materials sectors complements Flowserve's business model, which is integral to the functioning of various critical industries.

In conclusion, First Eagle Investment (Trades, Portfolio)'s recent reduction in Flowserve Corp shares appears to be a strategic portfolio adjustment rather than a shift in the firm's long-term investment philosophy. With Flowserve's solid market position and First Eagle's history of value investing, this transaction offers valuable insights into the firm's ongoing investment strategies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.