First Eagle Investment's Q2 2023 Portfolio Update: Key Trades and Holdings

First Eagle Investment (Trades, Portfolio), an independent investment management firm with a heritage dating back to 1864, recently filed its 13F report for the second quarter of 2023. The firm is known for its investment advisory services provided to private investment funds, institutional accounts, high-net-worth individuals, financial professionals, and their clients through a range of investment strategies and retail mutual funds.

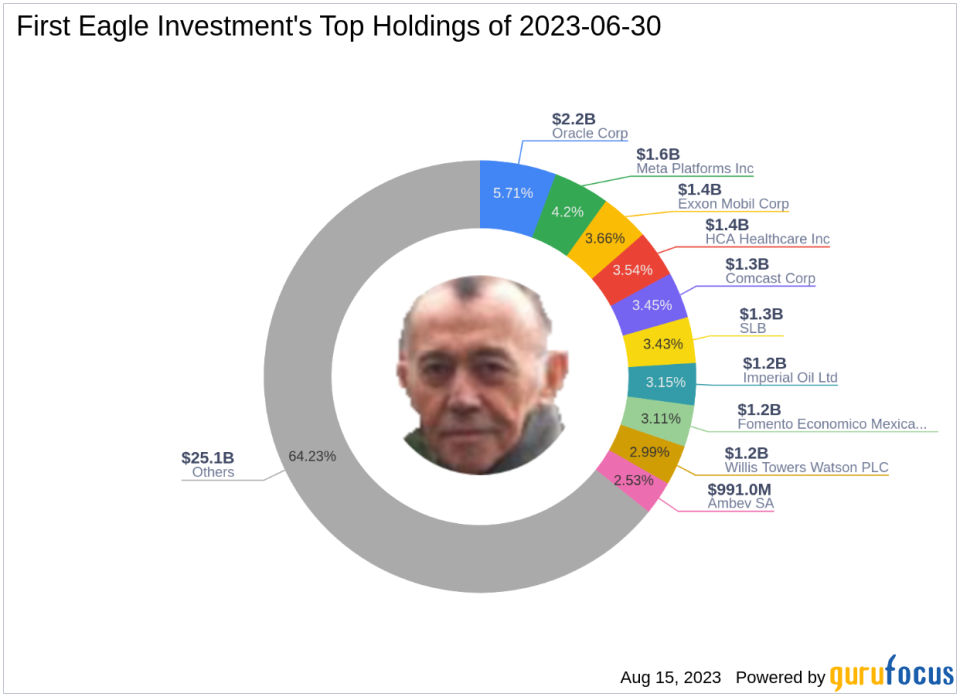

Overview of First Eagle Investment (Trades, Portfolio)'s Q2 2023 Portfolio

As of June 30, 2023, First Eagle Investment (Trades, Portfolio)'s portfolio contained 388 stocks with a total value of $39.11 billion. The firm's top holdings were Oracle Corp (NYSE:ORCL) with 5.71%, Meta Platforms Inc (META) with 4.20%, and Exxon Mobil Corp (XOM) with 3.66%.

Key Trades of the Quarter

First Eagle Investment (Trades, Portfolio) made several significant trades during the second quarter of 2023. Here are the top three:

Microsoft Corp (NASDAQ:MSFT)

The firm reduced its investment in Microsoft Corp (NASDAQ:MSFT) by 678,782 shares, impacting the equity portfolio by 0.52%. During the quarter, MSFT traded at an average price of $313.01. As of August 15, 2023, MSFT had a market cap of $2,401.89 billion and a stock price of $323.28, returning 11.63% over the past year. GuruFocus gives MSFT a financial strength rating of 8 out of 10 and a profitability rating of 10 out of 10. The company's valuation ratios include a price-earnings ratio of 33.36, a price-book ratio of 11.65, a PEG ratio of 1.80, a EV-to-Ebitda ratio of 22.37, and a price-sales ratio of 11.41.

Oracle Corp (NYSE:ORCL)

First Eagle Investment (Trades, Portfolio) also reduced its investment in Oracle Corp (NYSE:ORCL) by 1,939,057 shares, impacting the equity portfolio by 0.48%. During the quarter, ORCL traded at an average price of $103.23. As of August 15, 2023, ORCL had a market cap of $318.60 billion and a stock price of $117.3784, returning 51.43% over the past year. GuruFocus gives ORCL a financial strength rating of 4 out of 10 and a profitability rating of 9 out of 10. The company's valuation ratios include a price-earnings ratio of 38.36, a price-book ratio of 293.45, a PEG ratio of 4.51, a EV-to-Ebitda ratio of 21.00, and a price-sales ratio of 6.50.

RPM International Inc (NYSE:RPM)

During the quarter, First Eagle Investment (Trades, Portfolio) bought 977,461 shares of RPM International Inc (NYSE:RPM), bringing its total holding to 1,254,638 shares. This trade had a 0.23% impact on the equity portfolio. During the quarter, RPM traded at an average price of $82.26. As of August 15, 2023, RPM had a market cap of $13.33 billion and a stock price of $103.32, returning 11.47% over the past year. GuruFocus gives RPM a financial strength rating of 5 out of 10 and a profitability rating of 9 out of 10. The company's valuation ratios include a price-earnings ratio of 27.77, a price-book ratio of 6.21, a PEG ratio of 2.55, a EV-to-Ebitda ratio of 17.50, and a price-sales ratio of 1.83.

In conclusion, First Eagle Investment (Trades, Portfolio)'s Q2 2023 portfolio update reveals a strategic approach to managing its investments, with significant trades in Microsoft, Oracle, and RPM International. These trades reflect the firm's commitment to providing robust investment advisory services to its clients.

This article first appeared on GuruFocus.