First Financial Bancorp (FFBC) Reports Solid Loan Growth Amid Rising Funding Costs

Net Income: $56.7 million for Q4, down from $63.1 million in Q3.

Earnings Per Share: $0.60 diluted EPS for Q4; $2.69 for the full year 2023.

Net Interest Margin: Decreased to 4.26% on a fully tax-equivalent basis.

Loan Growth: Increased by $286.4 million, or 10.7% on an annualized basis.

Deposit Growth: Average deposit balances rose 12.9% on an annualized basis.

Asset Quality: Stable to improving, with a notable increase in tangible book value per share.

Dividend: Quarterly dividend of $0.23 per common share announced.

On January 25, 2024, First Financial Bancorp (NASDAQ:FFBC) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The company, a regional bank holding company known for its community banking business model, operates through First Financial Bank and offers a variety of banking and financial services across multiple states.

Despite a challenging environment characterized by rising funding costs, First Financial Bancorp reported a net income of $56.7 million for the fourth quarter, translating to $0.60 per diluted common share. This performance marks a decrease from the third quarter's net income of $63.1 million, or $0.66 per diluted common share. For the full year, the company achieved earnings per diluted share of $2.69, up from $2.30 in the previous year.

Financial Highlights and Challenges

The company's net interest margin on a fully tax-equivalent basis was 4.26%, a 7 basis point decrease from the linked quarter, primarily due to increasing funding costs. However, the margin remains robust, supported by higher asset yields and a favorable earning asset mix, which significantly offset a 31 basis point increase in the cost of deposits.

Loan growth was a highlight of the quarter, with balances increasing by $286.4 million, representing a 10.7% growth on an annualized basis. This growth was driven by commercial real estate, specialty lending, residential mortgages, and finance leases. Deposit growth also remained strong, with average balances increasing by $415.7 million, fueled by growth in money market accounts, interest-bearing checking accounts, retail CDs, and brokered CDs.

Asset quality showed signs of stability and improvement, with the tangible book value per share increasing by $1.47, or 13.5%, from the linked quarter. The total allowance for credit losses stood at $159.9 million, with the provision expense driven by net charge-offs and loan growth. Classified assets were stable at $141.0 million, and annualized net charge-offs were 46 basis points of total loans.

Management Commentary

"I am pleased with our fourth quarter performance. Adjusted earnings per share were $0.62, which resulted in an adjusted return on assets of 1.37% and an adjusted return on tangible common equity ratio of 22.2%. As expected, rising funding costs outpaced our asset yields, however our net interest margin remained very strong at 4.26%. Additionally, balance sheet trends were positive during the quarter, with loans increasing $286 million, or 11% on an annualized basis, and average deposits increasing $416 million, or 13% on an annualized basis," said Archie Brown, President and CEO of First Financial Bancorp.

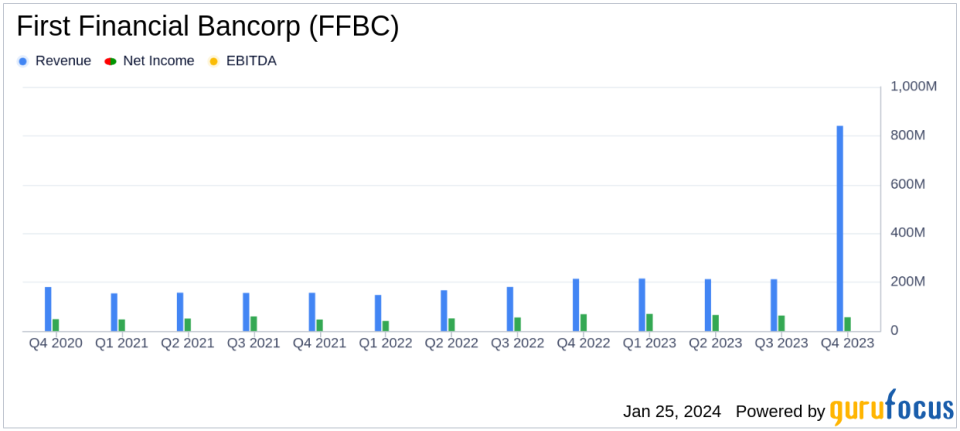

"2023 was a record year for First Financial. Adjusted earnings per share increased 17% from the prior year to $2.77, while adjusted return on assets was 1.55%, adjusted return on tangible common equity was 25.4% and our adjusted efficiency ratio was 56%. Total revenue of $840.2 million was the highest in the Company's history, increasing 18.5% over the prior year. Our balance sheet responded favorably to the interest rate environment, resulting in a 21% increase in net interest income. Additionally, record years from wealth management and Summit drove a 12% increase in noninterest income," Brown continued.

First Financial Bancorp's solid loan growth and stable asset quality, despite the headwinds of rising funding costs, demonstrate the company's resilience and strategic focus. The increase in tangible book value and the sustained dividend payout reflect a commitment to shareholder value. As the company navigates the complexities of the current economic landscape, these results position it well for continued success in 2024.

For more detailed financial information and performance analysis, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from First Financial Bancorp for further details.

This article first appeared on GuruFocus.