First Financial (THFF) Signs a Merger Deal With SimplyBank

First Financial Corporation THFF announced the signing of an agreement to acquire Dayton, TN-based SimplyBank for $73.4 million. The completion of the deal, expected in the second quarter of 2024, is subject to customary closing conditions, as well as the receipt of regulatory and SimplyBank stockholder approvals.

Following the deal closure, SimplyBank will be merged with and into First Financial Bank, a wholly-owned subsidiary of THFF. Under the terms of the deal, First Financial will pay $718.38 per share in cash for each share of SimplyBank’s common stock outstanding.

SimplyBank operates 13 bank branches and one loan production office in Tennessee and Georgia, with assets of around $702 million. Among the bank branches, ten branch offices are in Tennessee in the communities of Benton, Chattanooga, Cleveland, Dayton, Decatur, Harriman, Rockwood, Soddy-Daisy and Spring City. The remaining three branch offices are in Georgia in the communities of Flintstone, Ringgold and Rossville.

The Indiana-based financial institution, First Financial, has total assets of approximately $4.8 billion. Assuming the proposed deal is finalized as planned, it is expected to have combined consolidated assets valued at around $5.5 billion.

Norman L. Lowery, president and CEO of First Financial, stated, “SimplyBank provides us with an opportunity to deepen our commitment to the Tennessee market while expanding into attractive new MSAs.”

John Owen, CEO of SimplyBank, said, “We are pleased for our stakeholders, but are also delighted that our customers will continue to enjoy a great relationship with the local SimplyBank employees as they continue working with a strong community-focused financial organization through the SimplyBank branch network. We are excited about the stability and additional growth opportunities that our agreement with First Financial will provide.”

The deal will foster THFF’s footprint expansion in Tennessee and Georgia. Driven by these expansion initiatives, it will continue to record solid revenues across diverse footprints and businesses.

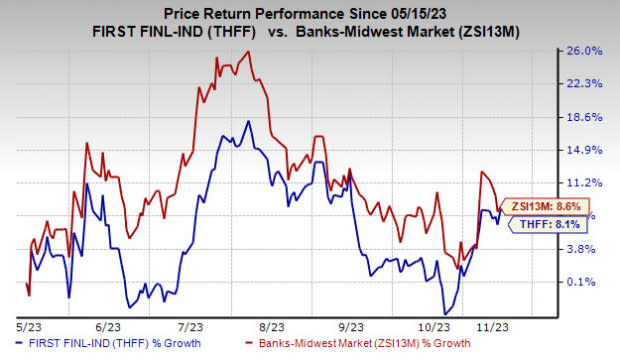

In the past six months, shares of THFF have gained 8.1% compared with the 8.6% rise recorded by the industry.

Image Source: Zacks Investment Research

Currently, THFF carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Inorganic Expansion Efforts by Other Banks

Peoples Financial Services Corp. PFIS has entered into an agreement with FNCB Bancorp FNCB, wherein both companies agreed to combine in an all-stock merger transaction valued at $129 million.

The merger is expected to result in a combined bank holding company with approximately $5.5 billion in assets and a market capitalization of around $444 million.

The closing of the deal, subject to the approval of PFIS and FNCB shareholders, regulatory approvals and satisfaction of customary closing conditions, is expected in the first half of 2024.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Financial Corporation Indiana (THFF) : Free Stock Analysis Report

FNCB Bancorp, Inc. (FNCB): Free Stock Analysis Report

Peoples Financial Services Corp. (PFIS) : Free Stock Analysis Report