First Financial (THFF) Slashes Dividend Payout by 16.7%

First Financial Corporation THFF has slashed its dividend payment. The company announced a cash dividend of 45 cents per share, which is 16.7% lower than the prior payout. This dividend will be paid out on Jan 16, 2024, to shareholders on record as of Jan 2.

Prior to this, THFF hiked the semi-annual dividend by 1.8% to 54 cents per share in May 2022. Also, the company announced payment of a special dividend of 20 cents per share in November 2022.

Concurrently, First Financial announced its plan to pay dividends on a quarterly basis going forward.

While the company hasn’t mentioned any reason behind lowering the dividend amount, the current challenging operating backdrop where companies are trying to preserve/build capital seems to be one of the primary causes for this.

Additionally, THFF has a share repurchase program in place. In April 2022, the company announced a buyback plan to purchase up to 10% or 1.24 million shares. As of Sep 30, 2023, approximately 0.5 million shares remained available.

Further, earlier this month, First Financial announced the signing of an agreement to acquire Dayton, TN-based SimplyBank for $73.4 million. The completion of the deal, expected in the second quarter of 2024, is subject to customary closing conditions, as well as the receipt of regulatory and SimplyBank stockholder approvals.

Under the terms of the deal, First Financial will pay $718.38 per share in cash for each share of SimplyBank’s shares. Norman L. Lowery, president and CEO of First Financial, stated, “SimplyBank provides us with an opportunity to deepen our commitment to the Tennessee market while expanding into attractive new MSAs.”

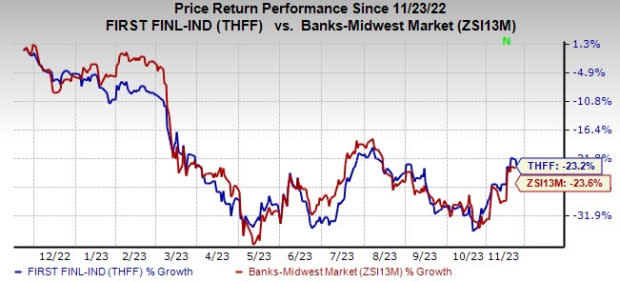

In the past year, shares of THFF have lost 23.2% compared with the 23.6% fall for the industry.

Image Source: Zacks Investment Research

Currently, THFF carries a Zacks Rank #3 (Hold).

Bank Stocks Worth a Look

A couple of better-ranked stocks in the banking space are Bank OZK OZK and Northrim BanCorp, Inc. NRIM.

The consensus estimate for Bank OZK’s current-year earnings has been revised 1.7% upward in the past 30 days. In the past three months, shares of OZK have gained 4.2%. The stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Over the past six months, NRIM’s shares have gained 14.2% The consensus estimate for Northrim BanCorp’s current-year earnings has been revised 9.4% upward over the past 30 days. The company also carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Financial Corporation Indiana (THFF) : Free Stock Analysis Report

Northrim BanCorp Inc (NRIM) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report