First Internet Bancorp (INBK) Reports Solid Q4 and Full Year 2023 Earnings Growth

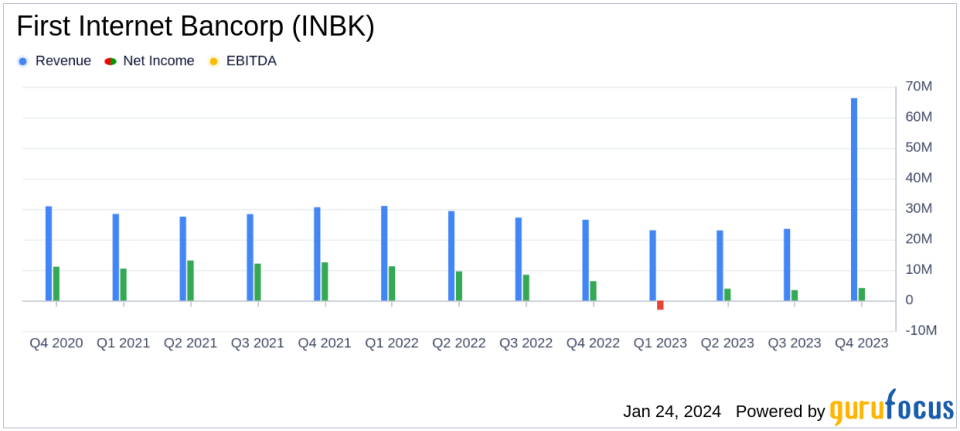

Net Income: $4.1 million in Q4, a 21.5% increase from Q3 2023.

Diluted EPS: Grew to $0.48, up 23.1% from the previous quarter.

Net Interest Income: Rose to $19.8 million, a 14.0% increase from Q3 2023.

Loan Growth: Total loans increased by $105.2 million, marking a 2.8% growth from Q3 2023.

Asset Quality: Nonperforming loans to total loans stood at 0.26%.

Capital Strength: Tangible common equity to tangible assets was 6.94%, with a CET1 ratio of 9.60%.

Share Repurchase: Repurchased 40,000 shares at an average price of $18.78 in Q4.

On January 24, 2024, First Internet Bancorp (NASDAQ:INBK), the parent company of First Internet Bank, announced its financial and operational results for the fourth quarter and full year ended December 31, 2023. The company released its 8-K filing, detailing a period of robust growth and financial performance.

First Internet Bancorp, a bank holding company, operates through its subsidiary, First Internet Bank, which offers a variety of banking services such as commercial real estate lending, SBA financing, and treasury management services, all delivered through an internet-based platform without physical branches.

Financial Performance and Challenges

The fourth quarter results highlighted the company's strategic balance sheet repositioning over the past 18 months. With asset yields repricing higher and solid loan growth, INBK delivered net interest margin expansion and net interest income growth. The bank's efforts to optimize its loan portfolio mix paid off, with significant contributions from construction and franchise finance lending. However, the company faces the challenge of maintaining this growth trajectory in a dynamic interest rate environment.

First Internet Bancorp's financial achievements, particularly in net interest income and loan growth, are significant for the banking industry. These metrics are critical indicators of a bank's profitability and its ability to generate earnings from its core business operations. The bank's focus on variable rate and higher-yielding products is a strategic move to improve its interest rate risk profile and overall financial health.

Key Financial Metrics

The company's net interest margin (NIM) improved to 1.58%, and fully-taxable equivalent net interest margin (FTE NIM) increased to 1.68%, both up 19 basis points from the third quarter of 2023. The yield on funded portfolio loan originations was 8.85% in the fourth quarter, relatively stable from the previous quarter and up 278 basis points from the fourth quarter of 2022. This indicates the bank's ability to earn more from its lending activities.

First Internet Bancorp's asset quality remained strong, with nonperforming loans to total loans at 0.26% and net charge-offs to average loans at 0.12%. The bank's capital levels also remained robust, with tangible common equity to tangible assets at 6.94% and a CET1 ratio of 9.60%.

"The fourth quarters results showcase our efforts over the past 18 months to reposition our balance sheet. With asset yields continuing to reprice higher, coupled with solid loan growth, we delivered welcome net interest margin expansion and net interest income growth," said David Becker, Chairman and Chief Executive Officer.

Analysis of Company's Performance

First Internet Bancorp's performance in the fourth quarter of 2023 reflects a strategic focus on high-yield lending and cost management, which has resulted in increased profitability. The bank's ability to maintain a low level of nonperforming loans and its proactive share repurchase program demonstrate a commitment to shareholder value. As the bank approaches its 25th anniversary, it is positioned with a strong balance sheet and capital levels to support future growth.

For more detailed information and analysis on First Internet Bancorp's financial results, investors and interested parties can access the full earnings report and join the upcoming conference call and webcast.

First Internet Bancorp's continued focus on optimizing its loan portfolio and maintaining strong asset quality sets a positive tone for its operational strategy moving forward. The bank's performance is a testament to its adaptability and strategic planning in a changing financial landscape.

Explore the complete 8-K earnings release (here) from First Internet Bancorp for further details.

This article first appeared on GuruFocus.