First Interstate BancSystem Inc (FIBK) Reports Mixed Q4 Earnings Amidst Economic Challenges

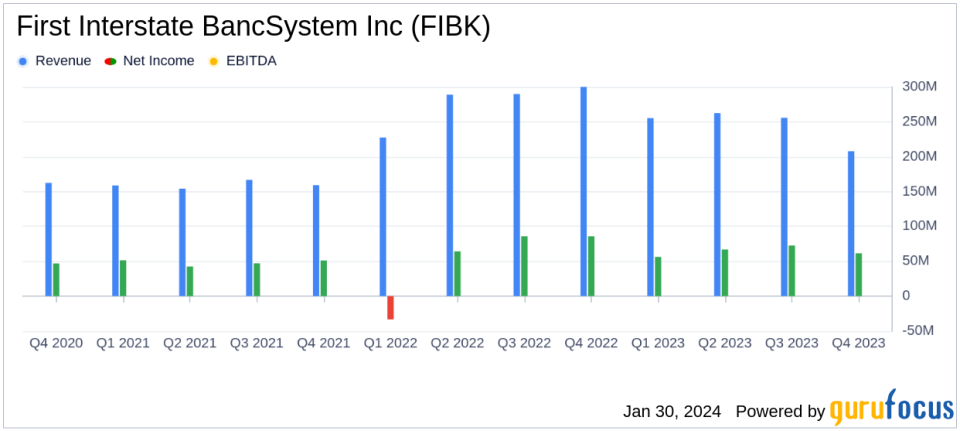

Net Income: Q4 net income fell to $61.5 million from $72.7 million in Q3 and $85.8 million in the previous year's Q4.

Earnings Per Share (EPS): Q4 EPS decreased to $0.59, down from $0.70 in Q3 and $0.82 year-over-year.

Annual Performance: Full-year net income rose to $257.5 million ($2.48 per share) from $202.2 million ($1.96 per share) in 2022.

Loan Growth: Loans held for investment saw a modest increase, signaling potential for future revenue.

Dividend: A dividend of $0.47 per common share was declared, maintaining shareholder returns.

Net Interest Margin: Experienced a decrease, reflecting the impact of a challenging interest rate environment.

Non-Interest Income: Increased to $44.5 million in Q4, up from $42.0 million in Q3 and $41.6 million year-over-year.

On January 30, 2024, First Interstate BancSystem Inc (NASDAQ:FIBK) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The company, a financial holding entity and parent of First Interstate Bank, operates extensively across the Northwestern United States, providing a wide array of banking and financial services.

The reported net income for Q4 stood at $61.5 million, or $0.59 per share, a decrease from $72.7 million, or $0.70 per share, in the previous quarter, and down from $85.8 million, or $0.82 per share, in the same quarter of the previous year. Despite the quarterly dip, the annual figures showed an improvement, with net income for the year ending December 31, 2023, reaching $257.5 million, or $2.48 per share, compared to $202.2 million, or $1.96 per share, in 2022.

Financial Highlights and Challenges

The bank's loan portfolio exhibited growth, with loans held for investment increasing by $66.3 million compared to the end of the third quarter, and by $180.4 million compared to the previous year. However, non-performing assets also rose, indicating potential future risks to asset quality.

Net interest margin, a key profitability metric for banks, saw a decrease to 2.99% in Q4, reflecting the impact of rising interest rates on the cost of interest-bearing liabilities. The bank's net interest income consequently decreased by 2.8% from Q3 and by a significant 19.6% from the previous year's Q4.

Non-interest income showed resilience, increasing to $44.5 million in Q4, up from $42.0 million in Q3 and $41.6 million year-over-year. This was primarily due to gains from the disposition of premises and equipment.

Strategic Moves and Capital Strength

First Interstate BancSystem Inc (NASDAQ:FIBK) also completed a strategic share repurchase, buying back 1.0 million of its common shares, and reported an increase in book value per common share to $31.05. President and CEO Kevin P. Riley highlighted the company's execution of cost savings initiatives and the maintenance of a healthy dividend as key achievements in a challenging environment.

"With our strong financial performance, we had increases in our capital ratios and were able to maintain a healthy dividend, providing value for our shareholders," said Riley. "We believe we are well positioned coming into 2024."

The company's balance sheet showed a slight increase in total assets, driven by investment securities and loan growth. The bank's capital position remains robust, with tangible book value per common share increasing to $19.41, up from $17.82 in the previous quarter.

Outlook and Dividend Declaration

Looking ahead, First Interstate BancSystem Inc (NASDAQ:FIBK) is poised to navigate the uncertain economic landscape with a strong capital and liquidity position. The board of directors declared a dividend of $0.47 per common share, payable on February 19, 2024, to stockholders of record as of February 9, 2024.

The company's performance and strategic decisions during the quarter reflect its commitment to shareholder value and its ability to adapt to economic headwinds. Investors and stakeholders will be watching closely as First Interstate BancSystem Inc (NASDAQ:FIBK) moves into 2024 with a focus on growing its client base and delivering solid financial performance.

Explore the complete 8-K earnings release (here) from First Interstate BancSystem Inc for further details.

This article first appeared on GuruFocus.