First Majestic (AG) Closes Sale of La Parrilla Silver Mine

First Majestic Silver AG announced the closure of the previously announced sale of its fully-owned past-producing La Parrilla Silver Mine in Mexico to Golden Tag Resources Ltd.

The sale of the mine was approved by Comisión Federal de Competencia Económica and the TSX Venture Exchange.

First Majestic received around CDN$27 million ($20 million) worth of common shares of Golden Tag as part of the sale. First Majestic will additionally receive up to $13.5 million in three milestone payments. The milestone payments will be made in cash or Golden Tag shares, as determined by the anniversary date.

First Majestic also announced that it took part in Golden Tag's offering of

subscription Receipts. It purchased 18,009,000 Subscription Receipts, which have now been converted into Golden Tag common shares and share purchase Warrants.

Following the closure of the sale and the conversion of the Subscription Receipts, AG has 161,682,684 Golden Tag common shares and 9,004,500 Warrants. First Majestic did not possess any Golden Tag securities prior to the transaction's completion and the acquisition of the Subscription Receipts.

If the Warrants were exercised, First Majestic would own 170,687,184 Golden Tag common shares in total. This, on a partially diluted basis, would represent roughly 42.2% of the company's issued and outstanding common shares.

According to the agreement, First Majestic may distribute to its shareholders all common shares in excess of 19.9% of the issued and existing Golden Tag common shares. These excess shares will be exempt from the contractual resale restrictions that apply to the consideration shares.

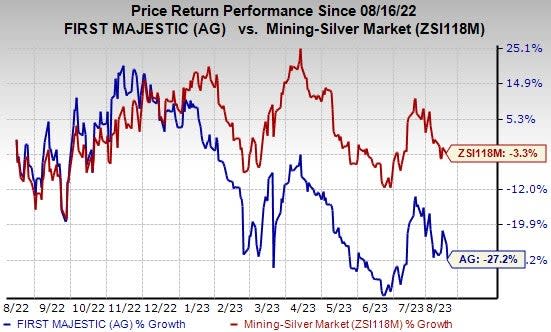

Price Performance

Shares of the First Majestic have lost 27.2% in the past year compared with the industry's 3.3% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

First Majestic currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Carpenter Technology Corporation CRS, PPG Industries, Inc. PPG and L.B. Foster Company FSTR. CRS and PPG sport a Zacks Rank #1 (Strong Buy) at present, and FSTR has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology has an average trailing four-quarter earnings surprise of 10%. The Zacks Consensus Estimate for CRS’s fiscal 2024 earnings is pegged at $3.23 per share. The consensus estimate for 2023 earnings has moved 12% north in the past 60 days. Its shares gained 54.7% in the last year.

The Zacks Consensus Estimate for PPG Industries’ fiscal 2023 earnings per share is pegged at $7.47, indicating growth of 23.5% from the prior-year actual. Earnings estimates have moved 3% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 7.3%. PPG’s shares have gained 3.5% in the past year.

L.B. Foster has an average trailing four-quarter earnings surprise of 134.5%. The Zacks Consensus Estimate for FSTR’s 2023 earnings is pegged at 53 cents per share. Earnings estimates have been unchanged in the past 60 days. FSTR’s shares gained 25.6% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

First Majestic Silver Corp. (AG) : Free Stock Analysis Report