First Majestic (AG) Q3 Silver Equivalent Production Falls Y/Y

First Majestic Silver Corp. AG announced that its total production reached 6.3 million silver equivalent (AgEq) ounces in the third quarter of 2023. The figure consists of 2.5 million silver ounces and 46,720 gold ounces.

On a year-over-year basis, silver production was down 10%, whereas gold production plunged 30%. Overall silver equivalent ounces declined 28% from the record level of 8.8 silver equivalent ounces in the third quarter of 2022.

Compared with the second quarter of 2023, silver equivalent ounces produced were down 1%. The 4% rise in gold output was offset by a 7% drop in silver production.

In the third quarter of 2023, Santa Elena produced 2.7 million AgEq ounces, which consisted of 347,941 ounces of silver and 28,367 ounces of gold. The figure marks a 2% decline from the year-ago quarter. On a sequential basis, production surged 49% driven by higher silver and gold grades in the quarter. Silver and gold recoveries from Ermitano attained record levels, averaging 64% and 95%, respectively, during the quarter. The improvement in recoveries is attributable to the operational optimization of the 3,000-tons-per-day filter press and dual-circuit plant.

San Dimas produced 3.01 million AgEq ounces, which were down 20% year over year. The mine produced 1.55 million ounces of silver and 17,863 ounces of gold, down 6% and 25%, respectively, from the year-ago quarter. Silver and gold production was down 8% and 13% from the second quarter of 2023, respectively. This was primarily due to 6% lower throughput combined with lower silver and gold grades. Silver and gold recoveries during the quarter averaged 95% and 96%, respectively.

Jerritt Canyon produced 32,463 ounces of gold. Mining activities at the mine have been suspended since March 20, 2023. The output indicates the residual work in process inventory poured during the third quarter.

Lastly, La Encantada produced 573,458 ounces of silver in the quarter, a 27% year-over-year decline and a 29% sequential decline. Production in the quarter was impacted by the limited water availability due to the collapse of a well, which occurred at the end of the second quarter of 2023. Construction of a new replacement well is underway and is expected to be operational in the fourth quarter of 2023. Production is expected to be in line with as per expectations once the new well is on line.

2023 Guidance

Total production is expected to be in the range of 26.2 and 27.8 million AgEq ounces in 2023, comprising 10.5-11.2 million ounces of silver and 190,000-201,000 ounces of gold.

The mid-point of the guidance of 27 million AgEq ounces suggests a decline of 14% from the 31.5 million AgEq ounces reported in 2022. Improved performance at Santa Elena due to the strong recovery performance of the dual-circuit plant and processing of higher silver and gold grades from the Ermitaño mine will be offset by the absence of gold production at Jerritt Canyon.

In the first nine-month period of 2023, First Majestic has produced 7.6 million ounces of silver and 152,336 ounces of gold, amounting to a total production of 20.2 million AgEq ounces.

The all-in sustaining cost is anticipated to be between $19.37 and $20.15 per AgEq ounce.

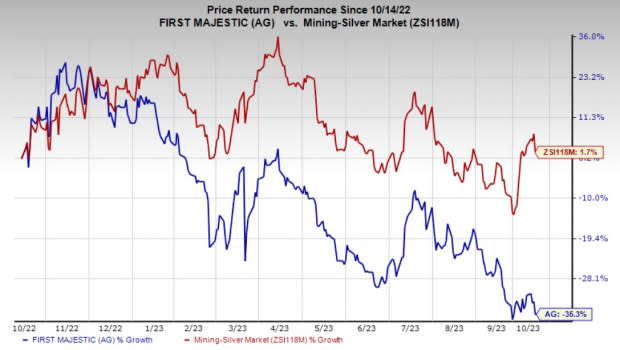

Price Performance

First Majestic's shares have declined 35.3% in the past year against the industry's 1.7% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

First Majestic currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Yara International ASA YARIY, Carpenter Technology Corporation CRS and L.B. Foster Company FSTR. YARIY sports a Zacks Rank #1 (Strong Buy) at present, and CRS and FSTR carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Yara International has an average trailing four-quarter earnings surprise of 56%. The Zacks Consensus Estimate for YARIY’s fiscal 2023 earnings is pegged at $1.27 per share. The consensus estimate for 2023 earnings has moved 9% north in the past 60 days. Its shares have gained 5.2% in the last year.

Carpenter Technology has an average trailing four-quarter earnings surprise of 10%. The Zacks Consensus Estimate for CRS’s fiscal 2024 earnings is pegged at $3.48 per share. The consensus estimate for 2023 earnings has moved 8% north in the past 60 days. Its shares have gained 109.6% in the last year.

L.B. Foster has an average trailing four-quarter earnings surprise of 134.5%. The Zacks Consensus Estimate for FSTR’s 2023 earnings is pegged at 53 cents per share. Earnings estimates have been unchanged in the past 60 days. FSTR’s shares have gained 98.4% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

Yara International ASA (YARIY) : Free Stock Analysis Report

First Majestic Silver Corp. (AG) : Free Stock Analysis Report