First Majestic Silver Corp (AG): A Deep Dive into Its Performance Potential

Long-established in the Metals & Mining industry, First Majestic Silver Corp (NYSE:AG) has enjoyed a stellar reputation. It has recently witnessed a daily gain of 3.13%, juxtaposed with a three-month change of -12.9%. However, fresh insights from the GF Score hint at potential headwinds. Notably, its diminished rankings in financial strength, growth, and valuation suggest that the company might not live up to its historical performance. Join us as we dive deep into these pivotal metrics to unravel the evolving narrative of First Majestic Silver Corp.

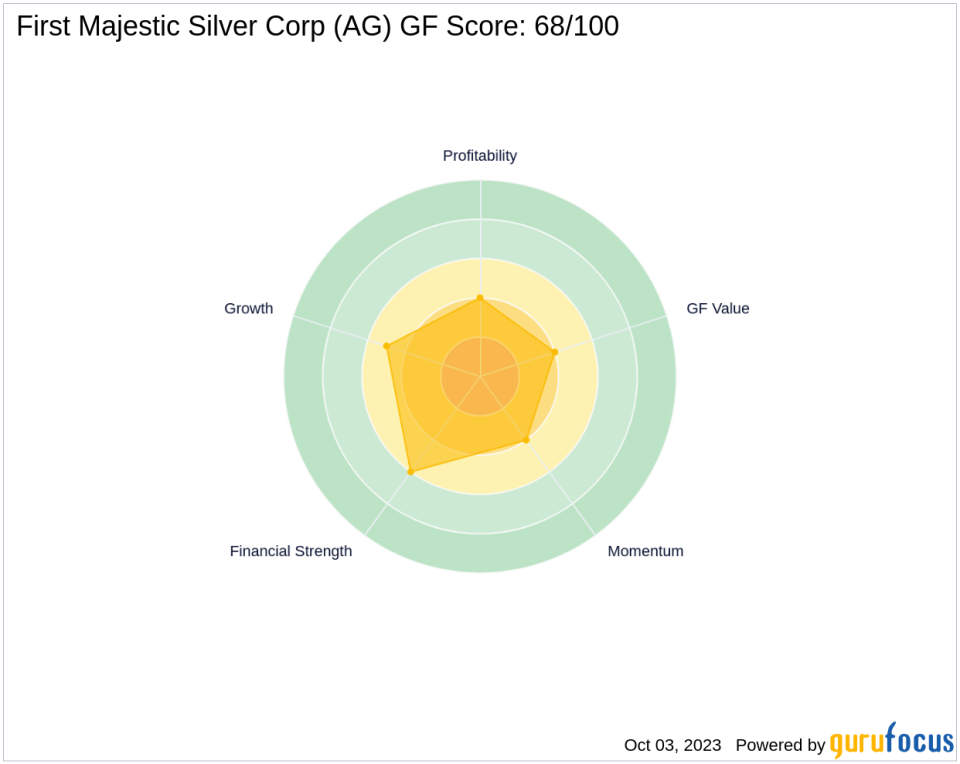

Understanding the GF Score

The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. The stocks with a higher GF Score generally generate higher returns than those with a lower GF Score. Therefore, when picking stocks, investors should invest in companies with high GF Scores. The GF Score ranges from 0 to 100, with 100 as the highest rank.

Financial strength rank: 6/10

Profitability rank: 4/10

Growth rank: 5/10

GF Value rank: 4/10

Momentum rank: 4/10

Based on the above method, GuruFocus assigned First Majestic Silver Corp the GF Score of 68 out of 100, which signals poor future outperformance potential.

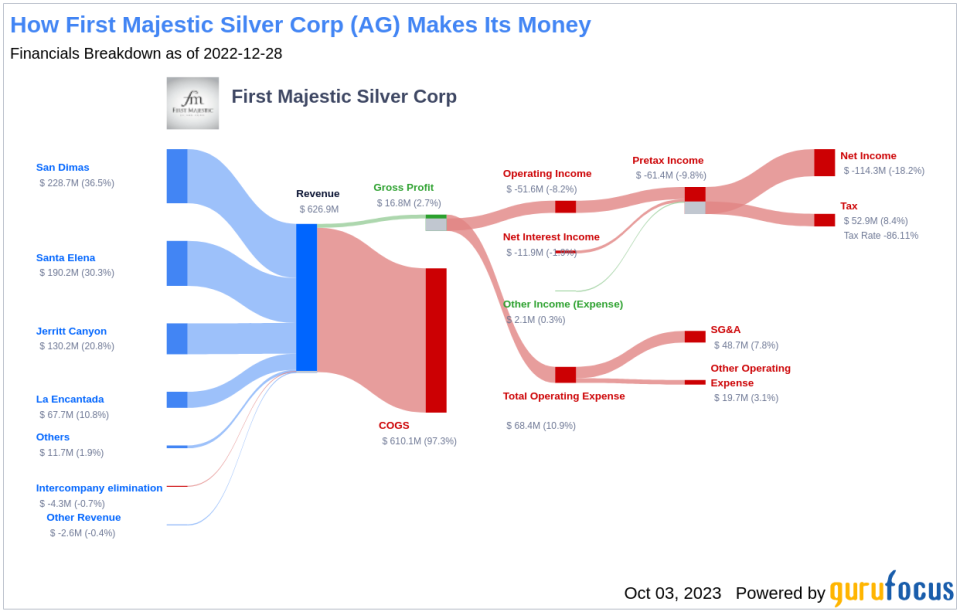

First Majestic Silver Corp: A Snapshot

First Majestic Silver Corp, with a market cap of $1.47 billion, is engaged in the production, development, exploration, and acquisition of mineral properties with a focus on silver and gold production in North America. It owns four producing mines, three mines in Mexico consisting of the San Dimas Silver/Gold Mine, the Santa Elena Silver/Gold Mine, the La Encantada Silver Mine and the Jerritt Canyon Gold Mine in Nevada. The company's sales stand at $614.18 million, but it has an operating margin of -14.28%, indicating potential profitability issues.

Profitability Concerns

First Majestic Silver Corp's low Profitability rank can also raise warning signals. This rank, combined with the company's negative operating margin, suggests that First Majestic Silver Corp may struggle to generate profits in the future, which could impact its overall performance and growth.

Looking Ahead

Considering the company's financial strength, profitability, and growth metrics, the GF Score highlights the firm's unparalleled position for potential underperformance. While First Majestic Silver Corp has a strong presence in the Metals & Mining industry, its current financial and growth indicators suggest that it may face challenges in maintaining its historical performance. Therefore, investors should exercise caution and conduct thorough research before investing in this stock.

GuruFocus Premium members can find more companies with strong GF Scores using the following screener link: GF Score Screen

This article first appeared on GuruFocus.