First Merchants Corp (FRME) Reports Mixed Results Amidst Economic Headwinds

Assets and Loans: Total assets reached $18.3 billion, with total loans at $12.5 billion.

Deposits: Total deposits grew to $14.8 billion, demonstrating a solid deposit base.

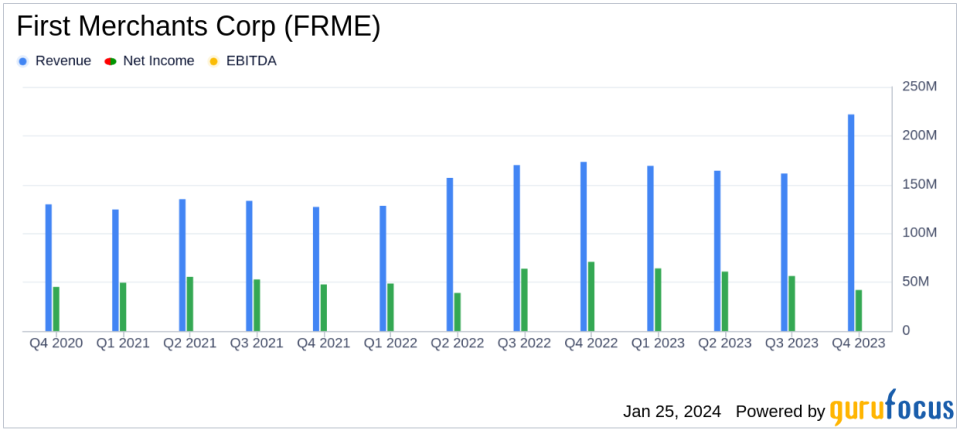

Net Income & EPS: Net income for Q4 stood at $42.0 million, with earnings per share (EPS) of $0.71, affected by one-time charges.

Efficiency Ratio: The efficiency ratio increased to 63.26%, indicating higher noninterest expenses.

Capital Ratios: Tangible common equity ratio improved to 8.44%, reflecting a stronger capital position.

Dividend Yield: The dividend yield for the year remained attractive at 3.61%.

On January 25, 2024, First Merchants Corp (NASDAQ:FRME) released its 8-K filing, revealing the financial results for the fourth quarter of 2023. The company, a prominent financial services provider offering a range of banking services, reported mixed results amidst challenging economic conditions.

Company Overview

First Merchants Corp, through its subsidiaries, delivers comprehensive financial services to its customers. With a focus on community banking, the company offers personal and business banking solutions, real estate mortgage lending, cash management services, brokerage, wealth management, and insurance. Operating from its headquarters in Central Indiana, First Merchants Corp has established itself as a significant player in the financial sector.

Financial Performance and Challenges

The company's performance in the fourth quarter showed resilience in certain areas, with annualized loan growth of 6.6% and deposit growth of 4.8%. However, reported EPS of $0.71 fell short of the previous year's $1.19, primarily due to one-time charges. Excluding these charges, the adjusted EPS was $0.87. The efficiency ratio increased to 63.26%, reflecting higher noninterest expenses, including one-time charges related to the FDIC special assessment, early retirement, severance costs, and lease termination.

Financial Achievements

Despite the challenges, First Merchants Corp managed to increase its tangible common equity by $222 million, boosting the tangible common equity ratio from 7.34% to 8.44%. This improvement in the company's capital position is a testament to its financial resilience and strategic management.

Key Financial Metrics

First Merchants Corp's balance sheet and asset quality remained robust, with total assets increasing by 7.0% on a linked quarter basis. The total risk-based capital ratio stood at 13.67%, and the allowance for credit losses on loans decreased slightly to 1.64%. Net charge-offs were at 0.10% of average loans, indicating stable credit quality.

"Our loan growth of 5.1%, adjusted for non-relationship, term loan B portfolio loan sale of $116 million in the second quarter, alongside a deposit growth of 3.1%, reflects our commitment to maintaining strong credit quality and a robust allowance for credit losses," stated Mark Hardwick, CEO of First Merchants Corp.

Analysis of Company's Performance

First Merchants Corp's strategic focus on loan and deposit growth has paid off, with both metrics showing positive trends. However, the increase in noninterest expenses and one-time charges has impacted the bottom line. The company's ability to navigate economic headwinds and maintain a strong capital position bodes well for its future stability and growth potential.

Value investors may find First Merchants Corp's improved tangible common equity ratio and consistent dividend yield appealing, as these factors suggest a solid foundation for long-term value creation. The company's performance, coupled with its strategic initiatives, positions it as a potentially attractive investment in the banking industry.

For a detailed analysis of First Merchants Corp's financial results and strategic direction, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from First Merchants Corp for further details.

This article first appeared on GuruFocus.