First Mid Bancshares Inc Reports Solid Q4 Earnings, Boosted by Blackhawk Merger

Net Income: $18.1 million, or $0.76 diluted EPS for Q4 2023.

Adjusted Net Income: $22.4 million, or $0.94 diluted EPS (non-GAAP).

Net Interest Income: Increased by $7.0 million, or 13.9%, from Q3 2023.

Loan Portfolio: Grew to $5.58 billion, with Ag operating loans seeing the largest increase.

Asset Quality: Continued strong performance with minimal net charge-offs for the quarter.

Dividend: Declared regular quarterly dividend of $0.23 per share.

Capital Levels: Remained strong and above "well capitalized" levels.

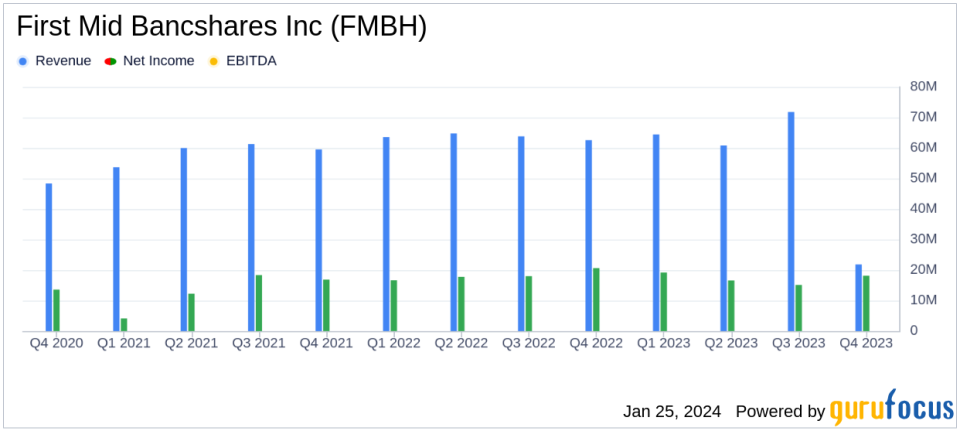

On January 25, 2024, First Mid Bancshares Inc (NASDAQ:FMBH) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The United States-based financial holding company, which operates through its subsidiary First Mid Bank and provides banking, wealth management, and insurance services, reported a net income of $18.1 million, or $0.76 diluted earnings per share (EPS). The adjusted net income, a non-GAAP measure, stood at $22.4 million, or $0.94 diluted EPS.

Financial Highlights and Strategic Moves

The fourth quarter marked the first full period inclusive of Blackhawk Bank, following the merger and integration which significantly contributed to First Mid Bancshares Inc's financial performance. The company strategically sold additional bonds, repositioning its balance sheet and driving a strong net interest margin of 3.33%. This move also allowed for the reduction of brokered CDs and wholesale borrowings, improving the company's interest income and expense dynamics.

First Mid Bancshares Inc's net interest income for the fourth quarter increased by $7.0 million, or 13.9%, compared to the third quarter of 2023, primarily driven by the addition of Blackhawk, loan growth, and the repricing of loans with higher interest rates. Year-over-year, the net interest income saw a significant increase of $11.8 million, or 25.8%, with interest income rising by $29.2 million, while interest expense increased by $17.4 million.

Loan Portfolio and Asset Quality

The company's total loans ended the quarter at $5.58 billion, representing an increase of $40.5 million, with the largest growth observed in Ag operating loans. The loan demand showed slight improvement, with most new originations and renewed loans being at rates in the 8.00% to 8.50% range. Asset quality remained robust, with the allowance for credit losses (ACL) increasing by $0.4 million to $68.7 million, and the ACL to total loans ratio standing at 1.23%. The fourth quarter also saw minimal net charge-offs, further evidencing the company's strong asset quality performance.

Deposits and Noninterest Income

Total deposits ended the quarter at $6.12 billion, a decrease of $222.7 million from the previous quarter, mainly due to seasonal cash flow operating needs of commercial customers. Noninterest income, which represented 31% of total net revenues for the year, was $21.8 million for the fourth quarter, compared to $23.1 million in the third quarter. Excluding securities gains, noninterest income increased by $2.1 million, benefiting from the full quarter inclusion of Blackhawk and higher insurance revenues.

Operational Efficiency and Capital Strength

Noninterest expense for the fourth quarter totaled $57.0 million, with the increase primarily driven by the full quarter impact of Blackhawk and approximately $5.6 million in nonrecurring acquisition-related costs. The company's efficiency ratio, as adjusted, was 58.9% for the fourth quarter. The capital levels of First Mid Bancshares Inc remained strong, with a tangible book value per share increasing to $22.20, reflecting both earnings growth and improvement in the unrealized loss position in the bond portfolio.

The Board of Directors approved a regular quarterly dividend of $0.23 payable on March 1, 2024, for shareholders of record on February 16, 2024. The effective tax rate for the fourth quarter was 16.6%, with the lower rate primarily due to $0.8 million of refunds for amendments filed on Wisconsin state taxes.

Conclusion and Outlook

First Mid Bancshares Inc's fourth quarter results demonstrate the company's strategic growth and operational efficiency. The successful integration of Blackhawk Bank has contributed positively to the company's financial metrics, and the strong asset quality suggests a stable foundation for future growth. The company's focus on maintaining robust capital levels and delivering shareholder value through dividends is indicative of its commitment to financial prudence and long-term sustainability.

For more detailed financial information and performance metrics, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from First Mid Bancshares Inc for further details.

This article first appeared on GuruFocus.