First Mid Bancshares (NASDAQ:FMBH) Has Announced A Dividend Of $0.23

First Mid Bancshares, Inc. (NASDAQ:FMBH) has announced that it will pay a dividend of $0.23 per share on the 1st of March. This means that the annual payment will be 2.8% of the current stock price, which is in line with the average for the industry.

See our latest analysis for First Mid Bancshares

First Mid Bancshares' Payment Expected To Have Solid Earnings Coverage

Unless the payments are sustainable, the dividend yield doesn't mean too much.

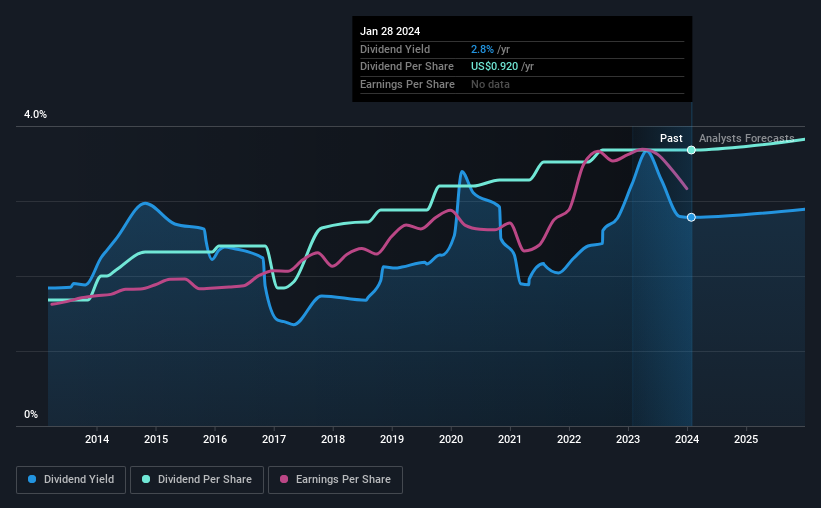

Having distributed dividends for at least 10 years, First Mid Bancshares has a long history of paying out a part of its earnings to shareholders. Past distributions do not necessarily guarantee future ones, but First Mid Bancshares' payout ratio of 29% is a good sign as this means that earnings decently cover dividends.

Looking forward, EPS is forecast to rise by 18.1% over the next 3 years. Analysts estimate the future payout ratio will be 27% over the same time period, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The annual payment during the last 10 years was $0.42 in 2014, and the most recent fiscal year payment was $0.92. This means that it has been growing its distributions at 8.2% per annum over that time. We like to see dividends have grown at a reasonable rate, but with at least one substantial cut in the payments, we're not certain this dividend stock would be ideal for someone intending to live on the income.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Earnings have grown at around 2.7% a year for the past five years, which isn't massive but still better than seeing them shrink. If First Mid Bancshares is struggling to find viable investments, it always has the option to increase its payout ratio to pay more to shareholders.

We should note that First Mid Bancshares has issued stock equal to 17% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Our Thoughts On First Mid Bancshares' Dividend

Overall, a consistent dividend is a good thing, and we think that First Mid Bancshares has the ability to continue this into the future. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 3 warning signs for First Mid Bancshares that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.