First Pacific Advisors Cuts Back on American International Group in Q4 2023

Insight into First Pacific Advisors (Trades, Portfolio)' Latest 13F Filing and Investment Adjustments

First Pacific Advisors (Trades, Portfolio), a renowned Los Angeles-based investment management firm, is known for its value investing approach and research-intensive process. The firm, led by CFO J. Richard Atwood, manages a suite of funds including the FPA Capital Fund (Trades, Portfolio) and the FPA Crescent Fund. With a preference for small- and mid-cap stocks, First Pacific Advisors (Trades, Portfolio) maintains concentrated portfolios to capitalize on their most compelling investment ideas, independent of market consensus.

Summary of New Buys

First Pacific Advisors (Trades, Portfolio) introduced a new position in the fourth quarter of 2023:

The most significant addition was Bio-Rad Laboratories Inc (NYSE:BIO), purchasing 4,866 shares. This stake represents 0.02% of the portfolio, with a total value of $1.57 million.

Key Position Increases

The firm also bolstered its holdings in several companies:

Citigroup Inc (NYSE:C) saw an additional 1,247,548 shares, bringing the total to 6,690,639 shares. This represents a 22.92% increase in share count and a 0.98% impact on the current portfolio, valued at $344.17 million.

NCR Atleos Corp (NYSE:NATL) had an increase of 1,012,073 shares, resulting in a total of 1,564,398 shares. This adjustment marks a 183.24% increase in shares, with a total value of $37.99 million.

Summary of Sold Out Positions

First Pacific Advisors (Trades, Portfolio) exited several positions entirely:

The firm sold all 118,617 shares of Ares Acquisition Corp (NYSE:AAC.WS), which had a negligible impact on the portfolio.

All 49,656 shares of Apollo Strategic Growth Capital II (NYSE:APGB.WS) were liquidated, also with a negligible impact on the portfolio.

Key Position Reductions

Significant reductions were made in the following stocks:

American International Group Inc (NYSE:AIG) was reduced by 5,345,416 shares, resulting in an 84.84% decrease in shares and a 5.18% impact on the portfolio. The stock traded at an average price of $63.72 during the quarter and has returned 9.85% over the past three months and 2.92% year-to-date.

Meta Platforms Inc (NASDAQ:META) saw a reduction of 135,941 shares, a 11.11% decrease, impacting the portfolio by 0.65%. The stock's average trading price was $325.65 during the quarter, with returns of 42.62% over the past three months and 32.47% year-to-date.

Portfolio Overview

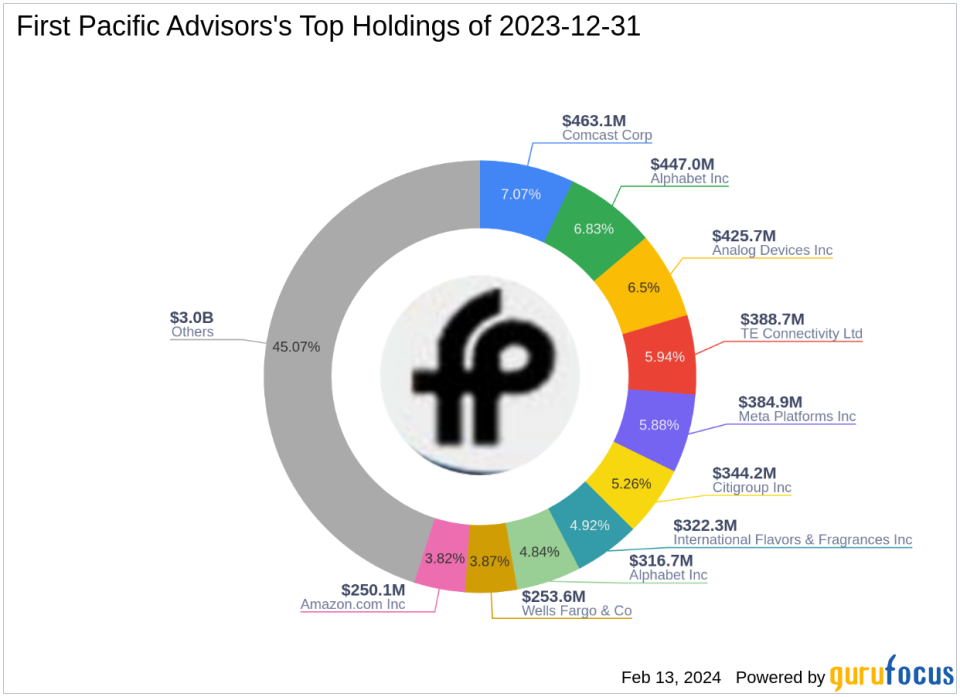

As of the fourth quarter of 2023, First Pacific Advisors (Trades, Portfolio)' portfolio consisted of 77 stocks. The top holdings were 7.07% in Comcast Corp (NASDAQ:CMCSA), 6.83% in Alphabet Inc (NASDAQ:GOOGL), 6.5% in Analog Devices Inc (NASDAQ:ADI), 5.94% in TE Connectivity Ltd (NYSE:TEL), and 5.88% in Meta Platforms Inc (NASDAQ:META). The firm's investments are primarily concentrated across 11 industries, reflecting a diverse range of sectors including Communication Services, Technology, and Financial Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.