First Pacific Advisors Trims Microsoft, Howmet Aerospace

First Pacific Advisors (Trades, Portfolio) sold shares of the following stocks during the first quarter of 2020.

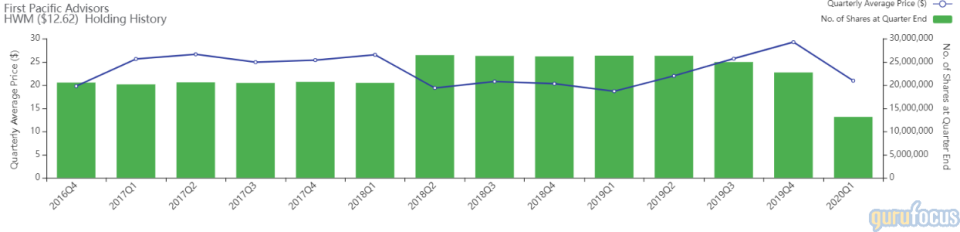

Howmet Aerospace

The firm cut the Howmet Aerospace Inc. (HWM) position by 42.23%. The portfolio was impacted by -2.81%.

The supplier of specialty metals to the aerospace market has a market cap of $5.15 billion and an enterprise value of $9.74 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of 10.31% and return on assets of 2.77% are outperforming 51% of companies in the industrial products industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.36 is below the industry median of 0.91.

The largest guru shareholder of the company is Paul Singer (Trades, Portfolio)'s Elliott Management with 9.54% of outstanding shares, followed by First Pacific Advisors (Trades, Portfolio) with 3.01% and Steven Romick (Trades, Portfolio) with 2.17%.

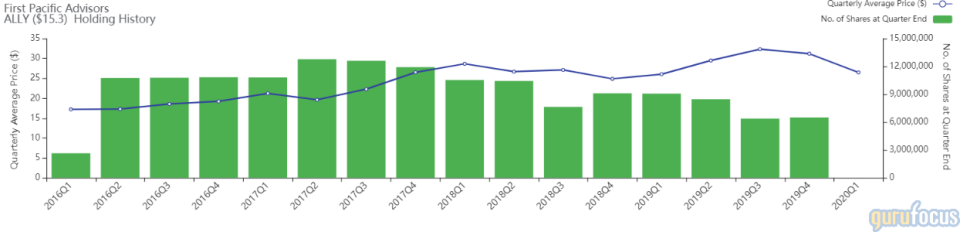

Ally Financial

The firm closed its Ally Financial Inc. (ALLY) holding. The portfolio was impacted by -1.89%.

The diversified financial services firm has a market cap of $5.89 billion and an enterprise value of $39.80 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. While the return on equity of 7.26% is outperforming the sector, return on assets of 0.56% is underperforming 56% of companies in the credit services industry. Its financial strength is rated 2 out of 10. The cash-debt ratio of 0.15 is below the industry median of 0.26.

The largest guru shareholder of the company is Bill Nygren (Trades, Portfolio)'s Oakmark Fund with 4.25% of outstanding shares, followed by Howard Marks (Trades, Portfolio)' Oaktree Capital Management with 2.92% and Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 0.46%.

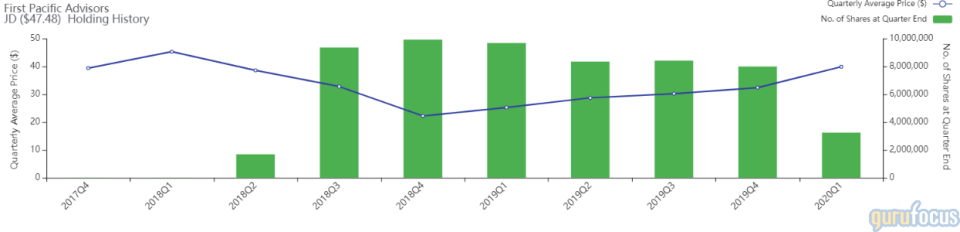

JD.com

The firm cut its position of JD.com Inc. (JD) by 59.4%, impacting the portfolio -1.59%.

The Chinese e-commerce company has a market cap of $69.55 billion and an enterprise value of $63.85 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of 17.47% and return on assets of 5.27% are outperforming 73% of companies in the retail, cyclical industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 3.28 is above the industry median of 0.42.

The largest guru shareholder of the company is Chase Coleman (Trades, Portfolio)'s Tiger Global Management with 3.61% of outstanding shares, followed by Andreas Halvorsen (Trades, Portfolio)'s Viking Global Investors with 1.52% and Dodge & Cox with 1.43%.

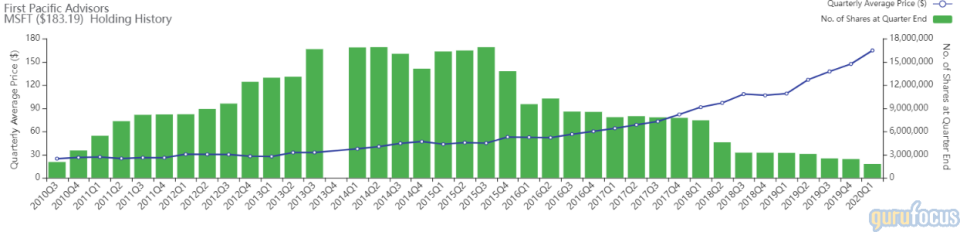

Microsoft

The investment firm cut its position in Microsoft Corp. (MSFT) by 26.2%. The trade had an impact of -0.96% on the portfolio.

The developer of consumer and enterprise software and hardware has a market cap of $1.40 trillion and an enterprise value of $1.34 trillion.

GuruFocus gives the company a profitability and growth rating of 10 out of 10. The return on equity of 43.82% and return on assets of 16.56% are outperforming 93% of companies in the software industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 1.86 is below the industry median of 2.24.

The largest guru shareholder of the company is PRIMECAP Management (Trades, Portfolio) with 0.41% of outstanding shares, followed by Dodge & Cox with 0.34% and Pioneer Investments (Trades, Portfolio) with 0.29%.

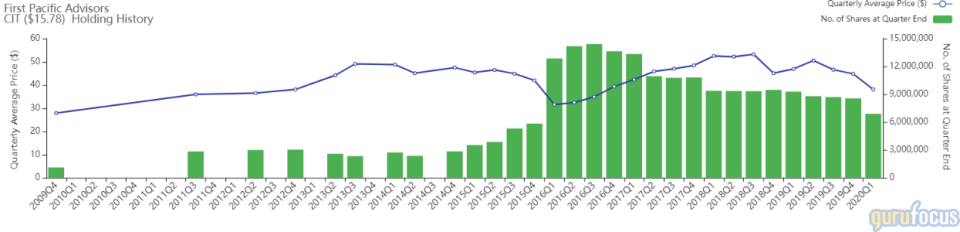

CIT Group

The firm cut its CIT Group Inc. (CIT) position by 19.5%. The trade had an impact of -0.73% on the portfolio.

The banking holding company has a market cap of $1.51 billion and an enterprise value of $6.70 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of -3.93% and return on assets of -0.41% are underperforming 94% of companies in the banks industry. Its financial strength is rated 2 out of 10. The cash-debt ratio of 0.44 is below the industry median of 1.26.

First Pacific Advisors (Trades, Portfolio) is the largest guru shareholder of the company with 7.01% of outstanding shares. Other notable shareholders include Romick with 5.71% and HOTCHKIS & WILEY with 2.44%.

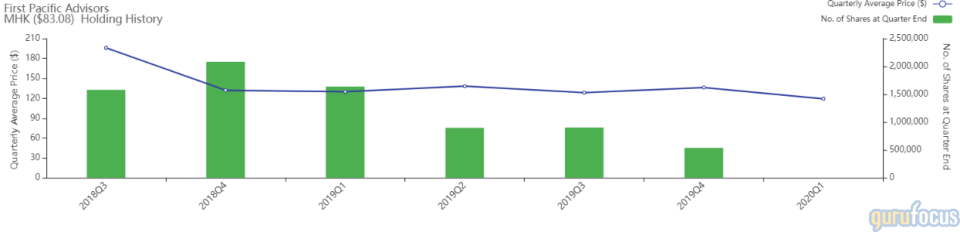

Mohawk Industries

The firm exited its holding in Mohawk Industries Inc. (MHK). The trade had an impact of -0.70% on the portfolio.

The manufacturer of flooring products has a market cap of $5.69 billion and an enterprise value of $8.51 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 9.37% and return on assets of 5.43% outperform 59% of other companies in the furnishings, fixtures and appliances industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.09 is below the industry median of 0.65.

The largest guru shareholder of the company is Richard Pzena (Trades, Portfolio) with 2.91% of outstanding shares, followed by John Rogers (Trades, Portfolio) with 0.92% and Tom Gayner (Trades, Portfolio) with 0.41%.

Disclosure: I do not own any stocks mentioned.

Read more here:

8 Stocks Ken Fisher Continues to Buy

The Yacktman Fund Cuts Samsung, PepsiCo

T Rowe Price Equity Income Fund Buys 8 Stocks

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.