Is First United (FUNC) Worth a Watch on 5.8% Dividend Yield?

Given the ongoing turmoil in the banking industry and recession fears in the near term, investors are on the lookout for stocks with solid dividend yields. One such stock is First United Corporation FUNC.

This Oakland, MD-based bank offers a range of services, such as commercial and retail banking facilities, trust services and wealth management services through 26 branches across the country.

First United has been increasing its quarterly dividend on a regular basis, with the last hike of 11.1% to 20 cents per share announced in March 2023. Over the past five years, the company increased its dividend four times, with an annualized dividend growth rate of 21.04%.

Considering the last day’s closing price of $13.86, First United’s dividend yield currently stands at 5.77%. This is impressive compared with the industry average of 3.26% and attractive for income investors as it represents a steady income stream.

First United Corporation Dividend Yield (TTM)

First United Corporation dividend-yield-ttm | First United Corporation Quote

Additionally, on Jun 28, the company announced a cash dividend of 20 cents per share. The dividend will be paid on Aug 1 to shareholders of record as of Jul 18.

Should you keep an eye on First United’s stock to earn a high dividend yield? Let’s check out the company fundamentals to understand the risks and rewards. This will help us make a proper investment decision.

FUNC is witnessing a steady improvement in revenues, which recorded a compound annual growth rate (CAGR) of 6.2% over the last three years (2019-2022). The uptrend continued in the first quarter of 2023. The improvement was backed by a strong loan and deposit balance and higher interest rates.

While its revenues are expected to improve marginally this year, the same is expected to fall 1.9% in 2024.

First United remains focused on bolstering its loan and deposit balance. Over the last three years (ended 2022), loans and deposits recorded a CAGR of 6.7% and 11.2%, respectively. Driven by modest loan demand and high rates, the company is expected to witness an uptrend in loans and deposit balances going forward.

First United’s trailing 12-month return on equity (ROE) indicates its growth potential. Its ROE of 16.65% compares favorably with the 12.24% for the industry. This reflects that the company is more efficient in using shareholder funds.

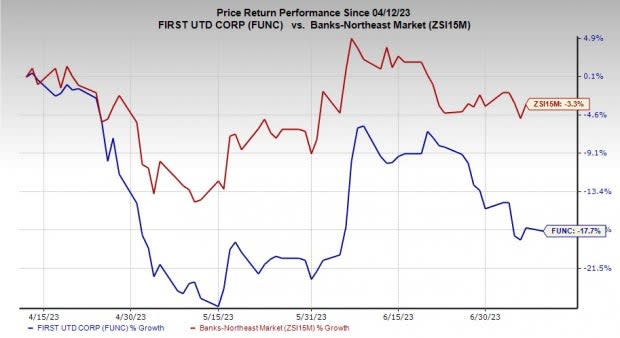

Despite near-term headwinds that include rising expenses and a tough operating environment, FUNC is fundamentally solid. In the past three months, the company’s shares have declined 17.7% compared with the industry's fall of 3.3%.

Image Source: Zacks Investment Research

Therefore, income investors should keep this Zacks Rank #3 (Hold) stock on their radar as it will help generate robust returns over time. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Bank Stocks With Solid Dividends

Banking stocks like Truist Financial Corporation TFC and U.S. Bancorp USB are worth a look as these too have robust dividend yields.

Considering the last day’s closing price, Truist Financial’s dividend yield currently stands at 6.9%. In the past three months, shares of TFC have declined 3.1%.

Based on the last day’s closing price, U.S. Bancorp’s dividend yield currently stands at 5.8%. In the past three months, shares of USB have declined 4.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

U.S. Bancorp (USB) : Free Stock Analysis Report

First United Corporation (FUNC) : Free Stock Analysis Report

Truist Financial Corporation (TFC) : Free Stock Analysis Report