First Watch (FWRG) Acquires Six Franchise Owned Restaurants

First Watch Restaurant Group, Inc. FWRG recently announced the acquisition of six franchise-owned restaurants and one restaurant (under construction) along with associated development rights in Georgia and South Carolina. The move boosts FWRG's presence in Daytime Dining.

Focus on Franchise Business

The company focuses on executing its strategy to enhance long-term value by acquiring franchise-owned restaurants and associated territories. In the second quarter, FWRG acquired six franchise restaurants within the Omaha market, followed by the recent addition of five more franchise restaurants in the Milwaukee Area. Year to date, the company has acquired 17 franchise restaurants.

During the second quarter of 2023, the company reported total franchise revenues of $3,713 million, up 34% from $2,771 million reported in the year-ago quarter. The upside was backed by increased sales from franchise-owned restaurants from 18 franchise-owned new restaurant openings.

For 2023, the company expects to open 45-51 new system-wide restaurants, including 38-42 new company-owned restaurants and 10 to 12 new franchise-owned restaurants.

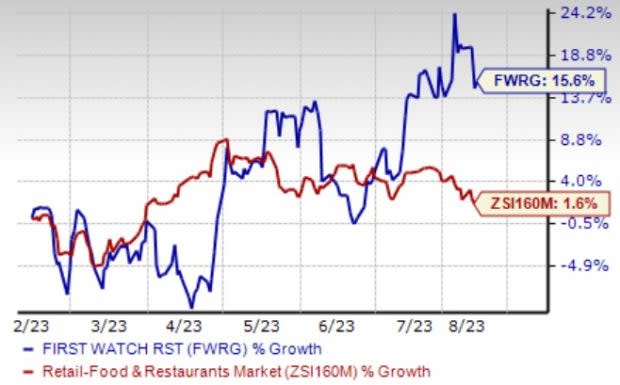

Price Performance

Image Source: Zacks Investment Research

Shares of FWRG have increased 15.6% in the past six months compared with the industry’s 1.6% rise. The upside was backed by robust same-restaurant sales growth driven by positive same-restaurant traffic growth in its dining rooms. Also, the focus on menu innovation and strategic pricing bodes well. The company intends to focus on franchise acquisitions and new restaurant openings to drive growth. Earnings estimates for 2023 have increased in the past 30 days, depicting analysts' optimism regarding the stock growth potential.

Zacks Rank & Other Key Picks

First Watch carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the Zacks Retail and Wholesale sector are:

BJ's Restaurants, Inc. BJRI sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 121.2%, on average. Shares of BJRI have increased 34.4% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for BJRI’s 2023 sales and EPS indicates 5.6% and 405.9% growth, respectively, from the year-ago period’s levels.

Chuy's Holdings, Inc. CHUY flaunts a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 26.6%, on average. Shares of CHUY have increased by 72.1% in the past year.

The Zacks Consensus Estimate for CHUY’s 2023 sales and EPS indicate an increase of 9.5% and 32.9%, respectively, from the year-ago period’s levels.

Jack in the Box Inc. JACK sports a Zacks Rank #2. JACK has a trailing four-quarter earnings surprise of 11.1%, on average. Shares of JACK have gained 2.5% in the past year.

The Zacks Consensus Estimate for JACK’s 2023 sales and EPS indicates a rise of 15.9% and 4.5%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Janus Henderson Sustainable & Impact Core Bond ETF (JACK) : Free Stock Analysis Report

Chuy's Holdings, Inc. (CHUY) : Free Stock Analysis Report

First Watch Restaurant Group, Inc. (FWRG) : Free Stock Analysis Report