First Western Financial Inc Reports Mixed Q4 Results Amid Economic Uncertainty

Net Income: Q4 net income available to common shareholders was $0.3 million, a significant decrease from $3.1 million in Q3 2023 and $5.5 million in Q4 2022.

Deposits: Total deposits grew to $2.53 billion, up 4.5% from Q3 2023, reflecting the company's focus on deposit relationships.

Loan to Deposit Ratio: Improved to 100.7% in Q4 2023 from 105.1% in Q3 2023, aligning with year-end goals.

Diluted EPS: Earnings per share dropped to $0.03 in Q4 2023 from $0.32 in the previous quarter.

Capital Ratios: Total capital to risk-weighted assets ratio increased to 12.82% in Q4 2023 from 12.45% in Q3 2023.

Asset Management: Assets Under Management (AUM) rose to $6.75 billion, a quarterly increase attributed to improved market values.

Credit Quality: Non-performing assets increased to 2.00% of total assets, up from 1.87% in Q3 2023.

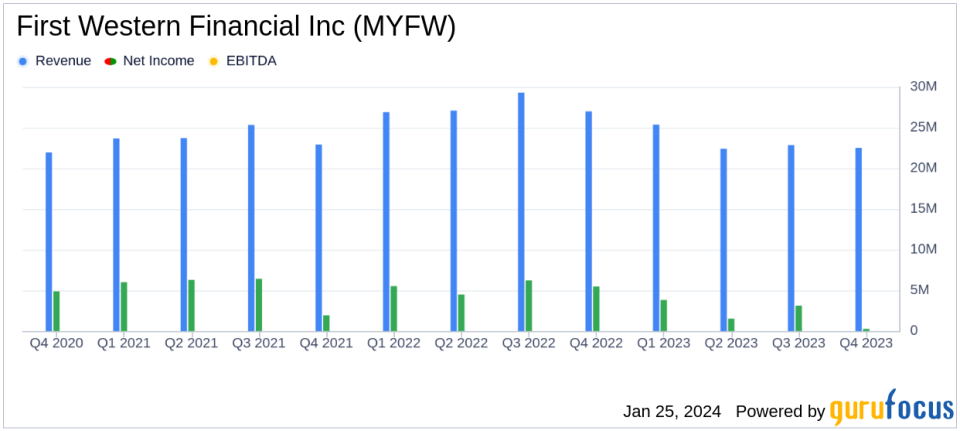

On January 25, 2024, First Western Financial Inc (NASDAQ:MYFW) released its 8-K filing, detailing the financial results for the fourth quarter ended December 31, 2023. The company, a financial holding entity providing wealth management services and operating primarily through its Wealth Management and Mortgage segments, reported a decrease in net income available to common shareholders to $0.3 million, or $0.03 per diluted share, compared to $3.1 million, or $0.32 per diluted share, in the third quarter of 2023, and $5.5 million, or $0.56 per diluted share, in the fourth quarter of 2022.

Performance and Challenges

First Western Financial Inc's performance in Q4 2023 was marked by a disciplined approach to expense control and a strategic focus on deposit growth. Despite these efforts, the company faced a significant reduction in profitability, primarily due to an increased provision for credit losses. CEO Scott C. Wylie expressed confidence in the company's ability to navigate economic uncertainties, emphasizing a strong balance sheet and conservative underwriting criteria.

Financial Highlights

The company's total deposits increased to $2.53 billion, reflecting an 18% annualized growth during the quarter. This deposit growth contributed to an improved loan-to-deposit ratio, which is a critical metric for banks as it indicates the balance between loan creation and deposit accumulation. The total capital to risk-weighted assets ratio, a measure of financial strength and stability, also saw an uptick, suggesting a solid capital position.

Income Statement and Balance Sheet Summary

First Western Financial Inc's net interest income for Q4 2023 was $16.3 million, a decrease from the previous quarter and year-over-year. The net interest margin also declined to 2.37% from 2.46% in Q3 2023 and 3.30% in Q4 2022. Non-interest income remained flat at $6.1 million compared to the previous quarter, while non-interest expense was consistent at $18.3 million. The efficiency ratio, which measures non-interest expense as a percentage of revenue, worsened to 80.77% from 78.76% in Q3 2023.

"While economic conditions remain uncertain, we will continue to prioritize prudent risk management and be conservative in new loan production while focusing on core deposit gathering, which should result in a modest level of asset growth until economic conditions improve," said CEO Scott C. Wylie.

Analysis of Company's Performance

The company's performance in the fourth quarter reflects the challenging economic environment, with increased credit loss provisions impacting profitability. However, the growth in total deposits and a stable loan-to-deposit ratio demonstrate First Western Financial Inc's strategic focus on maintaining liquidity and preparing for various economic scenarios. The company's conservative approach to loan production and emphasis on deposit relationships may position it for solid earnings growth when economic conditions improve.

For a more detailed analysis and the full earnings report, investors are encouraged to review the complete 8-K filing.

Explore the complete 8-K earnings release (here) from First Western Financial Inc for further details.

This article first appeared on GuruFocus.