FirstCash Holdings Inc's Meteoric Rise: Unpacking the 13% Surge in Just 3 Months

FirstCash Holdings Inc (NASDAQ:FCFS), a leading player in the Credit Services industry, has been making waves in the stock market with its impressive performance. The company's market cap stands at $4.89 billion, with its stock price currently at $108.33. Over the past week, the stock has seen a gain of 5.69%, and over the past three months, it has surged by 12.96%. The company's GF Value, a measure of intrinsic value defined by GuruFocus.com, is currently $111.48, up from $104.95 three months ago. This indicates that the stock is currently fairly valued, compared to being modestly undervalued three months ago.

Company Overview

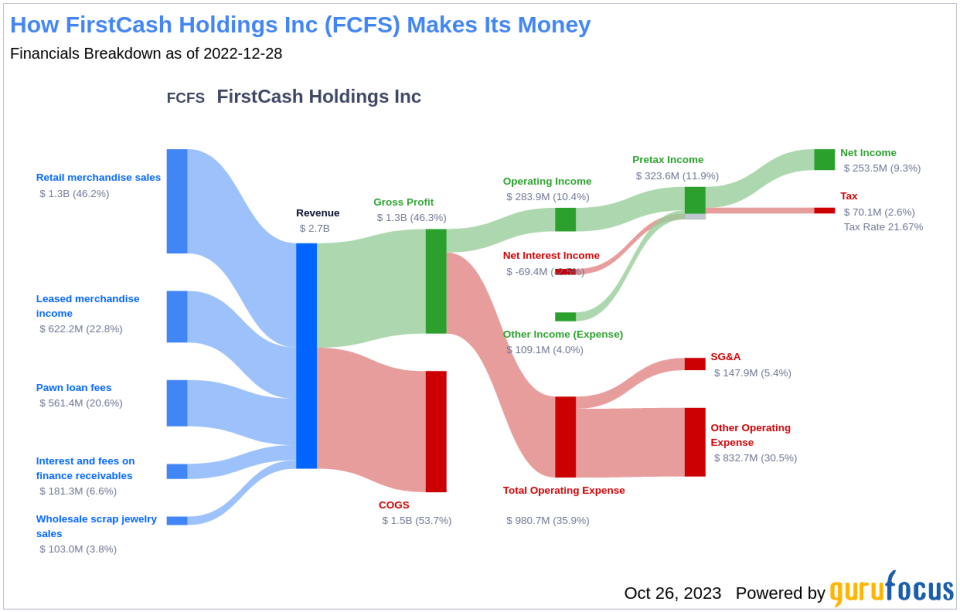

FirstCash Holdings Inc operates pawn stores in the United States and Latin America. Its primary business involves making small loans secured by personal property. These pawn loans give the borrower the option of either repaying the loans with interest or forfeiting the property without further penalty. Close to 30% of total company revenue comes from interest earned on the loans. Close to 70% of total revenue comes from reselling forfeited property in the company's retail stores. Revenue is split almost equally between loans made in the United States, where the company has more than 300 retail locations, and loans made in Latin America, where the company has over 700 locations in Mexico and several more in Guatemala.

Profitability Analysis

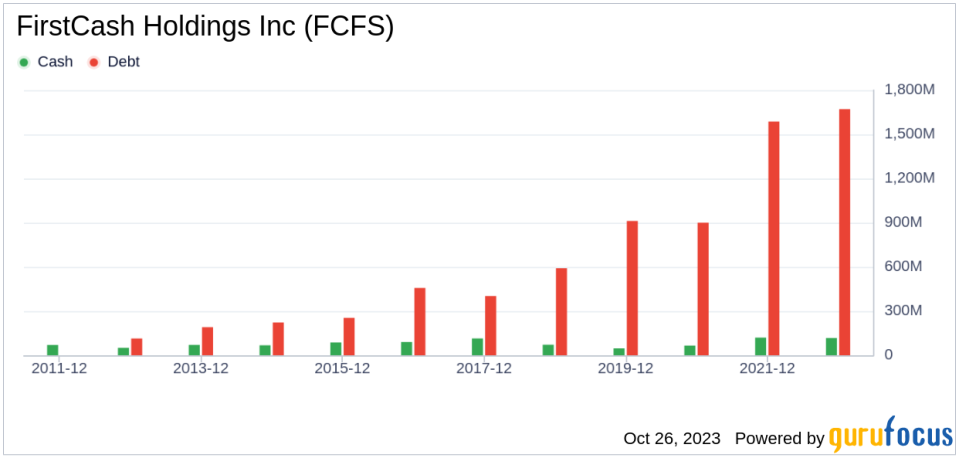

FirstCash Holdings Inc boasts a Profitability Rank of 8/10, indicating a high level of profitability. The company's Operating Margin stands at 11.40%, better than 39.47% of companies in the industry. Its ROE is 12.51%, better than 71.18% of companies, while its ROA is 5.98%, better than 81.24% of companies. The company's ROIC is 7.13%, better than 80.31% of companies. Furthermore, the company has consistently been profitable over the past 10 years, better than 99.8% of companies.

Growth Prospects

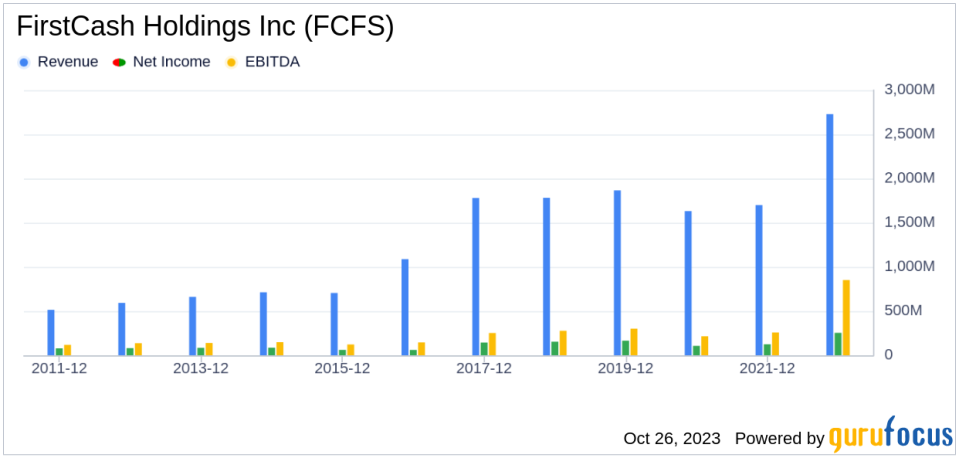

The company's Growth Rank is 7/10, indicating strong growth. Its 3-year and 5-year revenue growth rates per share are 10.10% and 6.60% respectively, better than over half of the companies in the industry. The company's future total revenue growth rate estimate is 16.65%, better than 79.1% of companies. Its 3-year and 5-year EPS without NRI growth rates are 12.10% and 6.40% respectively, better than a significant percentage of companies in the industry.

Top Holders

The top three holders of the stock are Jim Simons (Trades, Portfolio), Steven Cohen (Trades, Portfolio), and Ken Fisher (Trades, Portfolio). Jim Simons (Trades, Portfolio) holds 81,641 shares, accounting for 0.18% of the total shares. Steven Cohen (Trades, Portfolio) holds 575 shares, while Ken Fisher (Trades, Portfolio) holds 21 shares.

Competitive Landscape

FirstCash Holdings Inc faces competition from OneMain Holdings Inc(NYSE:OMF) with a market cap of $4.34 billion, The Western Union Co(NYSE:WU) with a market cap of $4.28 billion, and Blue Owl Capital Corp(NYSE:OBDC) with a market cap of $5.21 billion.

Conclusion

In conclusion, FirstCash Holdings Inc has demonstrated impressive performance in the stock market, with a significant surge in its stock price over the past three months. The company's profitability and growth ranks indicate a high level of profitability and strong growth prospects. Despite facing competition from other companies in the industry, FirstCash Holdings Inc's consistent profitability and strong growth make it a compelling choice for investors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.