FirstEnergy Corp (FE) Surpasses Earnings Expectations and Unveils $26 Billion Investment Plan

GAAP Earnings: Reported full year 2023 GAAP earnings from continuing operations of $1.96 per share.

Operating Earnings: Delivered 2023 Operating (non-GAAP) earnings of $2.56 per share, above the midpoint of guidance.

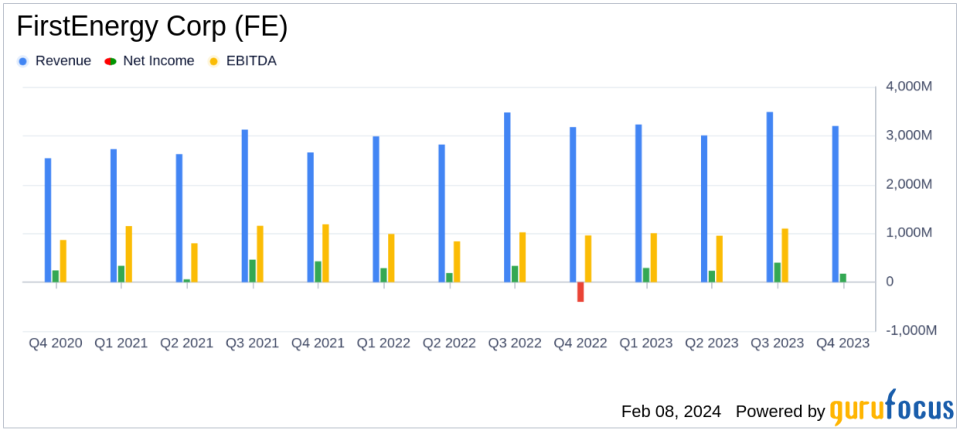

Revenue: Achieved revenue of $12.9 billion in 2023, an increase from $12.5 billion in 2022.

2024 Guidance: Provides 2024 operating guidance of $2.61 to $2.81 per share, a 7% increase over the 2023 guidance mid-point.

Capital Investment Plan: Introduces Energize365, a $26 billion capital investment plan from 2024 to 2028 to enhance customer experience and support the energy transition.

Long-Term Growth: Targets 6-8% long-term annual operating earnings per share growth with improved earnings quality.

On February 8, 2024, FirstEnergy Corp (NYSE:FE) released its 8-K filing, announcing its fourth quarter and full year 2023 financial results. The company, a leading investor-owned utility, operates one of the nation's largest electric transmission systems and serves over six million customers across six states.

FirstEnergy reported full year 2023 GAAP earnings from continuing operations of $1.123 billion, or $1.96 per share, on revenue of $12.9 billion, compared to $406 million, or $0.71 per share, on revenue of $12.5 billion in 2022. The company's operating (non-GAAP) earnings for 2023 were $2.56 per share, exceeding the midpoint of the company's guidance range and surpassing 2022's operating earnings of $2.41 per share.

Performance Highlights and Challenges

FirstEnergy's performance in 2023 was driven by solid execution on capital deployment, cost discipline, and operating performance. Despite challenges such as lower weather-related demand and higher financing costs, the company managed to deliver strong financial results. The mild temperatures in December 2023 led to a 1.3% decrease in total distribution deliveries compared to the fourth quarter of 2022. However, on a weather-adjusted basis, distribution deliveries increased by just over 1% for the year.

FirstEnergy's President and CEO, Brian X. Tierney, highlighted the company's innovation and financial discipline, which were pivotal in overcoming challenges and accelerating progress towards becoming a premier utility. The company's strategic actions have set a stronger, sustainable financial foundation that supports a comprehensive long-term capital plan.

Strategic Investments and Future Outlook

The company's 2024 earnings guidance range of $2.61 to $2.81 per share represents robust growth in its regulated businesses. This is supported by the Energize365 capital investment program, which focuses on enhancing the transmission and distribution systems to support a cleaner energy future. The program is expected to reduce power outages, increase resiliency, and enable a smarter energy grid without compromising affordability.

FirstEnergy deployed $3.7 billion in capital investments in 2023, exceeding its original plan by $300 million, despite supply chain challenges. These investments were aimed at modernizing and improving the reliability and resiliency of the transmission and distribution systems, which is crucial for the utility industry.

Financial Metrics and Importance

Key financial metrics from the income statement, balance sheet, and cash flow statement underscore the importance of FirstEnergy's strategic investments and financial management. The company's capital investment and cost control measures have contributed to the growth in revenue and operating earnings per share, which are vital indicators of the company's financial health and operational efficiency.

"Throughout 2023, FirstEnergy employees demonstrated innovation, operational excellence and financial discipline to overcome challenges, drive our strategy and deliver on our financial commitments. It was pivotal year for FirstEnergy, in which we strengthened our foundation and greatly accelerated our progress toward our goal of becoming a premier utility," said Brian X. Tierney, President and Chief Executive Officer.

FirstEnergy's financial achievements, including the increase in revenue and operating earnings per share, are significant for a company in the regulated utilities industry, which is known for its capital-intensive nature and the need for continuous investment in infrastructure.

Analysis of Company's Performance

FirstEnergy's performance in 2023 reflects a company that is effectively navigating the complexities of the utility sector, balancing the need for investment with financial discipline. The company's future outlook, bolstered by the Energize365 investment plan, positions it for continued growth and adaptation to the evolving energy landscape. The targeted 6-8% long-term annual operating earnings per share growth indicates confidence in the company's strategic direction and its ability to deliver value to shareholders.

Investors and stakeholders can access FirstEnergy's Strategic and Financial Highlights presentation on the company's Investor Information website and are invited to listen to a live webcast of the financial analysts' teleconference.

FirstEnergy's commitment to integrity, safety, reliability, and operational excellence, along with its strategic investments and financial guidance, signal a strong path forward for the company and its stakeholders.

For a detailed analysis and more information, readers are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from FirstEnergy Corp for further details.

This article first appeared on GuruFocus.