FirstEnergy's (FE) Units Win Transmission Projects Worth $800M

FirstEnergy Corporation FE announced that its subsidiaries Potomac Edison and Mid-Atlantic Interstate Transmission (“MAIT”) have been awarded three transmission projects by regional transmission organization PJM Interconnection. These transmission projects are worth almost $800 million and spread across Maryland, Pennsylvania, Virginia and West Virginia.

The projects were filed by Potomac Edison and MAIT earlier this year in response to PJM's request for bids, which was made in response to the data centers across its territory, particularly in Northern Virginia.

Details of the Projects

The projects are aimed at upgrading a 24-mile power transmission line from Adams County, PA, to Carroll County, MD. A new set of 230 kilovolt (kV) electrical wires, officially called a circuit, is inserted into the upgraded line as part of its complement to the current 115/138 kV wire in the corridor. In addition, as part of the $135 million project, MAIT will replace a nearby 115 kV transmission line and complete all necessary upgrades to the existing equipment.

In the Frederick and Montgomery counties, MD, the existing 500 kV and double-circuit 230 kV lines will be converted into adjacent transmission structures, each with 500 kV line sets over 230 kV lines for a total of four circuits.

One 500/230-kV double circuit will extend 8 miles from Potomac Edison's existing Doubs Substation in Frederick to a substation in Montgomery, owned by Exelon Corp. EXC. The other circuit will continue south another 7 miles to the Virginia state line. The $235-million project includes associated upgrades at the Doubs Substation.

The projects also include the conversion of 36 miles of existing 138 kV transmission lines in Virginia and West Virginia to a double-circuit line with 500 kV conductors installed over 138 kV lines. Located in Frederick and Clark counties, VA, and Jefferson County, WV, the $392-million project includes substation upgrades and is part of a larger 160-mile transmission line project.

Benefits of Upgrades

A rise in temperature not only increases the demand for electricity but also poses a threat to electric infrastructure. These upgrades and maintenance tasks are crucial to maintaining service reliability and ensuring customer satisfaction.

The projects will increase reliability, meet the rising demand for power from commercial and residential customers, and make it easier to link renewable energy sources like solar and wind. The U.S. Department of Energy states that the effort will also help improve the system's overall electrical flow and address the effects of power plant retirements, which produced 11 gigawatts of energy, enough to run 1.1 billion LED lightbulbs at a time.

Utilities’ Focus on Infrastructure

In order to provide reliable services to customers, utilities make systematic investments to upgrade transmission and distribution lines and develop new substations. The objective is to warrant a proper supply of electricity to millions of customers across the United States.

Electric power companies like Xcel Energy, Inc. XEL and Duke Energy DUK are also adopting measures to strengthen their existing infrastructure.

Xcel Energy aims to spend $34 billion during 2024-2028, out of which the company plans to invest nearly $21.8 billion in strengthening its electric distribution and transmission operations.

XEL’s long-term (three to five years) earnings growth rate is 6.12%. The Zacks Consensus Estimate for 2023 earnings per share (EPS) implies a year-over-year improvement of 5.4%.

Duke Energy remains focused on expanding its scale of operations and implementing modern technologies at its facilities. Almost 85% of the company’s planned investment funds its generation fleet transition and grid modernization. This includes approximately $75 billion to modernize and strengthen its transmission and distribution infrastructure.

DUK’s long-term earnings growth rate is 6.09%. The Zacks Consensus Estimate for 2023 EPS implies a year-over-year increase of 6.1%.

Price Performance

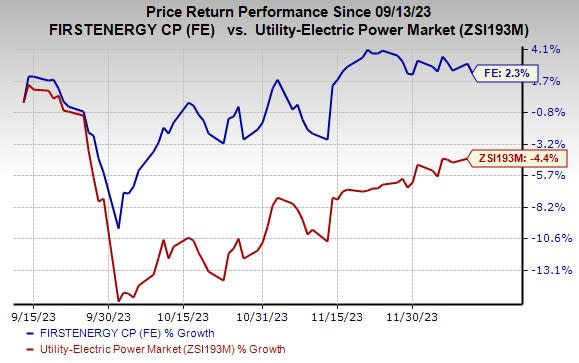

In the past three months, shares of FirstEnergy have risen 2.3% against the industry’s 4.4% decline.

Image Source: Zacks Investment Research

Zacks Rank

FirstEnergy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exelon Corporation (EXC) : Free Stock Analysis Report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report