Fiserv (FI) Rises 11% in the Past Month: Let's Check How

Fiserv, Inc. FI has gained 10.9% in the last month, outperforming its industry’s 6.3% growth and the 5.4% increase of the S&P 500 composite.

Fiserv is gaining from its shareholder-friendly behavior, along with strategic partnerships and collaborations. The company’s increasing current ratio bodes well.

Factors in Favor

Fiserv, a global leader in payments and financial services technology, is gaining through its partnerships and collaborations. It has partnered with Melio, a prominent B2B payments platform. This collaboration introduces CashFlow CentralSM, an innovative solution that combines Melio's user-friendly accounts payable and receivable workflows with Fiserv's leading biller and merchant network.

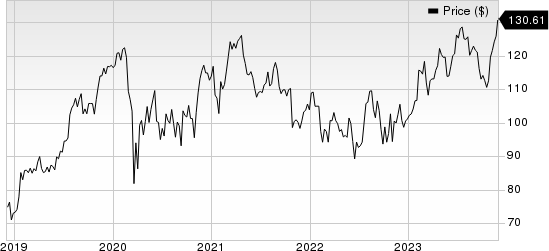

Fiserv, Inc. Price

Fiserv, Inc. price | Fiserv, Inc. Quote

In another development, Fiserv has enhanced industry innovation by streamlining access to its core banking APIs through Banking Hub, thus facilitating collaboration for more than 500 developers. Additionally, the ompany has joined forces with Plaid to enable secure data sharing via APIs, thereby meeting consumer demand for flexible financial information access. Furthermore, it has collaborated with Akoya to facilitate secure data sharing among financial institutions, customers and third parties.

Fiserv's current ratio at the end of third-quarter 2023 was pegged at 1.07, higher than the current ratio of 1.06 reported at the end of the year-ago quarter. An improving current ratio is desirable as it indicates that the company might not have problems in meeting its short-term obligations.

Fiserv has been consistent with share repurchases. During 2022, 2021 and 2020, it repurchased $25.4 million, $23.3 million and $16.1 million shares for $2.50 billion, $2.57 billion and $1.64 billion, respectively. Such moves instill investors’ confidence and positively impact earnings per share.

Fiserv's financial stability is underscored by its consistent upward trajectory in Return on Assets (ROA), a key indicator of profitability and financial efficiency. In the second quarter, the company recorded an impressive ROA of 5.6%, surpassing both the previous quarter's 5.5% and the year-ago figure of 5.2%. This sustained increase in ROA reflects its success in enhancing earnings for each dollar invested over time.

FI currently has a Zacks Rank #3 (Hold).

Stocks to Consider

Here are a few better-ranked stocks from the Business Services sector that may be considered:

Gartner IT: The Zacks Consensus Estimate for Gartner’s 2023 revenues indicates 7.9% growth from the year-ago figure while earnings are expected to decline 1.9%. The company beat the consensus estimate in all the trailing four quarters, with an average surprise of 34.4%.

IT sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

FTI Consulting FCN: The Zacks Consensus Estimate for FCN’s 2023 revenues indicates 12.1% growth from the year-ago figure while earnings are expected to grow 3.4%. The company beat the consensus estimate in three of the four quarters and missed on one instance, the average surprise being 8.5%.

FCN carries a Zacks Rank #2 (Buy).

Broadridge Financial Solutions BR: The Zacks Consensus Estimate for Broadridge’s 2023 revenues indicates 7.7% growth from the year-ago figure while earnings are expected to grow 10.1%. The company beat the consensus estimate in three of the past four quarters and matched on one instance, the average surprise being 5.4%.

BR carries a Zacks Rank of 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

Fiserv, Inc. (FI) : Free Stock Analysis Report