Can-Fite (CANF) Up on Liver Cancer Study Update of Namodenoson

Can-Fite BioPharma Ltd. CANF announced that the continued treatment of a patient, previously enrolled and treated with namodenoson in its phase II liver cancer study, observed a complete response and overall survival (OS) of 6.9 years (82.8 months).

The patient, at the time of enrollment in the phase II study, was suffering from advanced hepatocellular carcinoma (HCC). The patient continues to receive treatment with namodenoson, to date. Several observations were made in the condition of the patient, such as the disappearance of ascites, normal liver function and good quality of life, collectively defined as a complete response, along with the OS of 6.9 years.

Liver Cancer, designated as HCC, is caused by tumor growth on the liver with a high mortality rate. HCC is a major global health problem due to the lack of effective treatment modes, particularly for patients with advanced hepatic dysfunction known as disease stage Child Pugh B.

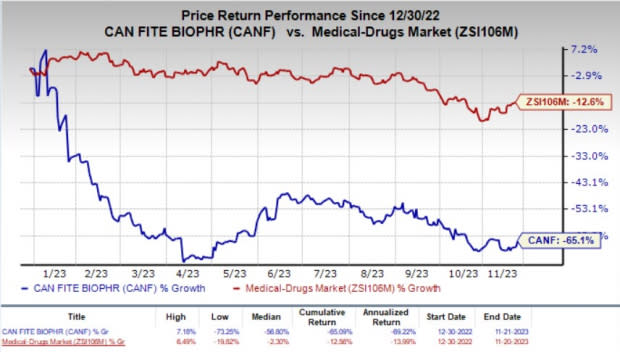

Can-Fite’s stock gained 6.7% on Tuesday as investors cheered the encouraging response observed in the liver cancer patient upon continued treatment with namodenoson. Year to date, shares of CANF have plunged 65.1% compared with the industry’s 12.6% decline.

Image Source: Zacks Investment Research

Namodenoson is the company’s small and orally bioavailable drug that binds with high affinity and selectivity to the A3 adenosine receptor.

Currently, Can-Fite is enrolling patients in its pivotal phase III study of namodenoson for the treatment of advanced HCC, following agreements with regulatory bodies in the United States and EU. The investigational candidate enjoys Orphan Drug status in the United States and EU. Furthermore, the FDA has also granted Fast Track status to namodenoson.

The pivotal phase III study of namodenoson is expected to enroll 450 HCC patients with underlying Child Pugh B7 (CPB7). The enrolled patients will be randomized to receive either an oral and twice-daily 25 mg dose of namodenoson or placebo.

The primary endpoint of the pivotal late-stage study of namodenoson in HCC is that of OS. Other efficacy outcomes, such as tumor radiographic response rates and median progression-free survival, as well as standard safety parameters, will also be assessed.

After treating 50% of enrolled patients in the pivotal study with namodenoson, an independent committee will conduct an interim analysis. The candidate will be evaluated as a second or third-line treatment for CPB7 patients who have not benefitted from other approved therapies.

Can-Fite believes that namodenoson has the potential to get conditional approval, subject to positive results from the interim analysis of the phase III HCC study.

Besides the HCC indication, Can-Fite has also evaluated namodenoson in another phase II study for the treatment of non-alcoholic fatty liver disease and non-alcoholic steatohepatitis.

Can-Fite Biopharma Ltd Price and Consensus

Can-Fite Biopharma Ltd price-consensus-chart | Can-Fite Biopharma Ltd Quote

Zacks Rank and Other Stocks to Consider

Can-Fite currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks worth mentioning are Ligand Pharmaceuticals LGND, Acadia Pharmaceuticals ACAD and Agenus AGEN. While LGND sports a Zacks Rank #1 (Strong Buy), ACAD and AGEN carry a Zacks Rank #2 each at present.

You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for Ligand’s 2023 earnings per share has remained constant at $5.10. During the same time frame, the estimate for Ligand’s 2024 earnings per share has remained constant at $4.59. Year to date, shares of LGND have lost 12.5%.

LGND’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 67.19%.

In the past 30 days, the Zacks Consensus Estimate for Acadia’s 2023 loss per share has narrowed from 37 cents to 34 cents. The estimate for Acadia’s 2024 earnings per share is pegged at 90 cents. Year to date, shares of ACAD have shot up 41%.

ACAD beat estimates in two of the trailing four quarters, missing the mark on the other two occasions, delivering an average earnings surprise of 20.69%.

In the past 30 days, the Zacks Consensus Estimate for Agenus’ 2023 loss per share has narrowed from 77 cents to 63 cents. During the same time frame, the estimate for Agenus’ 2024 loss per share has narrowed from 70 cents to 45 cents. Year to date, shares of AGEN have declined 71.6%.

AGEN beat estimates in one of the trailing four quarters, matching in one and missing the mark on the other two occasions, delivering an average earnings surprise of 0.49%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Agenus Inc. (AGEN) : Free Stock Analysis Report

Can-Fite Biopharma Ltd (CANF) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report