Five Point Holdings LLC Reports Robust Earnings Amid Economic Challenges

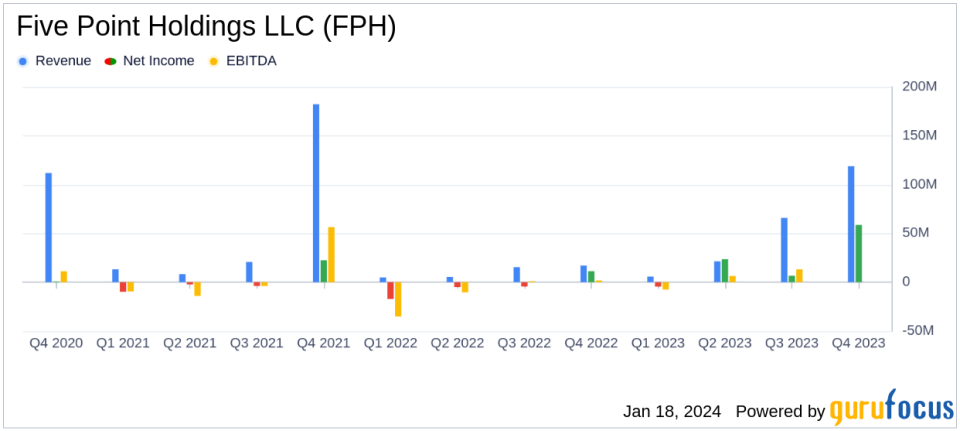

Consolidated Revenues: $211.7 million for 2023, with Q4 revenues at $118.8 million.

Net Income: $113.7 million for the year, with $58.7 million reported in Q4.

Land Sales: Valencia and Great Park segments closed significant land sales, contributing to revenue.

Liquidity: $478.8 million as of December 31, 2023, bolstered by cash and credit facility availability.

Debt Management: Debt to total capitalization ratio at 24.0%, showcasing prudent financial management.

Equity in Earnings: $76.6 million from unconsolidated entities for the year, reflecting profitable partnerships.

On January 18, 2024, Five Point Holdings LLC (NYSE:FPH) released its 8-K filing, detailing the fourth quarter and full-year earnings for 2023. The company, a prominent developer of mixed-use, master-planned communities in California, reported strong financial results despite a challenging economic landscape.

FPH's success is largely attributed to its strategic land sales in the Valencia and Great Park segments. In 2023, Valencia closed the sale of 729 homesites, while Great Park recognized revenue from the sale of commercial land and 798 homesites. These transactions underscore the company's ability to capitalize on the ongoing housing supply shortage, which CEO Dan Hedigan believes will sustain demand for FPH's land.

Financial Performance and Challenges

The company's consolidated net income for the quarter stood at $58.7 million, contributing to the annual net income of $113.7 million. This performance is significant as it reflects FPH's resilience and strategic execution in a period marked by economic uncertainty and fluctuating interest rates. The company's ability to generate substantial revenue and manage selling, general, and administrative expenses, which were $13.1 million for Q4 and $51.5 million for the year, played a crucial role in achieving profitability.

However, challenges such as the potential impact of inflation and interest rates on future home sales and builder sales remain. FPH's proactive measures, including the extension of its $125.0 million unsecured revolving credit facility and the exchange of senior notes to improve its debt profile, demonstrate its commitment to maintaining financial stability.

Key Financial Metrics

Five Point Holdings LLC's balance sheet reflects a solid financial position, with cash and cash equivalents totaling $353.8 million as of December 31, 2023. The company's debt to total capitalization ratio of 24.0% is indicative of a balanced approach to leveraging, which is further supported by a net debt to total capitalization ratio of 12.0%. These metrics are essential for investors as they provide insight into the company's financial health and risk management practices.

"Achieving these results in the face of a challenging economic and interest rate environment is a testament to our teams focus on executing our key operating priorities: generating revenue, right-sizing our SG&A, and managing our capital spend," said Dan Hedigan, Chief Executive Officer of Five Point Holdings LLC.

Analysis of Company's Performance

The earnings report indicates that FPH is navigating the complexities of the real estate market with strategic finesse. The company's focus on generating revenue through land sales, optimizing operational expenses, and carefully managing capital expenditures has yielded positive results. The extension of credit facilities and the restructuring of debt underscore a forward-looking approach to financial management.

As Five Point Holdings LLC continues to develop its master-planned communities, the company's ability to adapt to market conditions and leverage its assets will be critical in sustaining growth and delivering value to shareholders. The reported earnings reflect a company that is not only weathering economic headwinds but also positioning itself for future success.

For more detailed information and to listen to the conference call, investors and interested parties are directed to the Five Point website at ir.fivepoint.com.

Investors are encouraged to review the full 8-K filing for a comprehensive understanding of Five Point Holdings LLC's financial performance and strategic direction.

Explore the complete 8-K earnings release (here) from Five Point Holdings LLC for further details.

This article first appeared on GuruFocus.