Five Reasons to Invest in New York Community (NYCB) Stock Now

New York Community Bancorp, Inc.’s NYCB financials are expected to get continuous support from a strong balance sheet position, growth in net interest income (NII) and the company’s restructuring efforts. Hence, it seems to be a wise idea to invest in the NYCB stock now, given its solid fundamentals and decent growth prospects.

The Zacks Consensus Estimate for NYCBs' earnings has been revised 45% and 6.9% north for 2023 and 2024, respectively, over the past 60 days. This shows that analysts are optimistic regarding the company’s earnings prospects. It currently sports a Zacks Rank #1 (Strong Buy).

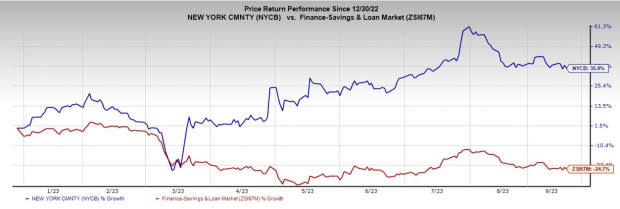

Year to date, shares of the company have rallied 35.9% against the industry's 24.7% decline.

Image Source: Zacks Investment Research

Mentioned below are a few factors that make NYCB a must-buy stock now.

Earnings Per Share (EPS) Growth: In the last three-five years, NYCB witnessed EPS growth of 14.73%, higher than the industry average of 9.98%. Further, the company’s earnings are projected to increase 41.46% this year.

Also, the company’s long-term (three-five years) estimated EPS growth rate of 12.26% promises rewards for shareholders.

Strong Balance Sheet Position: New York Community’s deposits and loan balances have been rising over the years. The acquisition of Signature Bank improved its deposit base, provided the benefits of loan diversification and the initiation of its commercial middle-market lending business.

Also, the merger deal with Flagstar offered the company national scale by enhancing its foothold in Northeast/Midwest regions and giving it exposure to high-growth markets. This, along with deposit growth opportunities in the banking as a service space, bode well for New York Community’s balance-sheet strength.

Growth in NII: NII at New York Community witnessed a compound annual growth rate of 43.3% over the last four years (ended 2022). The rising trend continued in first-half 2023. In fact, the addition of low-cost deposits from Signature Bank’s acquisition improved its overall funding cost and is expected to further increase its net interest margin (NIM). Moreover, the addition of variable rate loan portfolio from the merger of Flagstar has positively impacted the company’s NIM.

Sustainable Capital Distributions: New York Community’s capital distribution activities are decent. The company currently pays out 17 cents per share as quarterly. Also, it has a share repurchase program in place. In October 2018, the board of directors approved a $300 million share-buyback program and had approximately $9 million remaining under this authorization as of Jun 30,2023.

The interest earning cash and cash equivalents at the second-quarter 2023 end were $18.28 billion, whereas the company’s total borrowed funds were $18.2 billion. Hence, with decent cash levels and earnings strength, its capital distribution activities seem sustainable and might stoke investors’ confidence in the stock in the upcoming period.

Restructuring Efforts: The Federal Reserve’s rate hike has led to higher residential mortgage rates affecting the mortgage market. Hence, post the acquisition of Flagstar, New York Community made efforts to restructure its mortgage business to operate its distributed retail mortgage channel as an in-branch footprint model.

This resulted in a 69% reduction in the number of retail home lending offices. This downsizing does not impact New York Community’s position in the mortgage industry. Cost reduction achieved from this move, coupled with its diversified business model focusing on core businesses, are likely to improve profitability in the upcoming challenging mortgage market environment.

Other Key Picks

A couple of other top-ranked stocks from the finance space are BBVA USA Bancshares, Inc. BBVA and HSBC Holdings’ HSBC.

BBVA’s current-year earnings estimate has been revised 4.4% upward over the past 30 days. BBVA’s shares have gained 3% over the past three months. The stock currently sports a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for HSBC’s current-year earnings has been revised marginally upward over the past week. Over the past three months, HSBC’s share price has increased 0.2%. The stock currently sports a Zacks Rank of 1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Banco Bilbao Viscaya Argentaria S.A. (BBVA) : Free Stock Analysis Report

New York Community Bancorp, Inc. (NYCB) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report