Fiverr Set to Gain Support From a Growing Freelance Market

- By

We're in a tough market, there's no doubt about it. For the long term, however, I think it is an excellent time to buy the dip. One stock I am currently bullish on in this environment is Fiverr International Ltd. (NYSE:FVRR), an Israel-based freelance platform with a presence predominantly in the United States.

According to Statista, the U.S.'s freelance market will make up 51% of its labor force by 2027. There are two main reasons for this. First, companies are reducing headcount due to the development of artificial intelligence. The second is the reduction of headcount because of job division, meaning that professions and occupations are becoming increasingly more specialized than they were in the past. Thus, companies would rather contract a freelancer for a specific task rather than have an in-house generalist.

Fiverr earnings and growth

Fiverr's started off like a house on fire when it listed in 2020, and it's still gaining speed. The company again beat its estimates for the second quarter, posting revenue of $75.26 million (up 59.77% year over year) and earnings of 19 cents per share.

Behind the company's stellar revenue growth was a 43% year-over-year increase in active users. Spend per user (buy-side) also increased to $226 from $184 in the prior-year quarter.

Valuation and pricing metrics

From a growth perspective, Fiverr is flourishing. The company's levered free cash flow has increased 454.68% year over year, while its capital expenditure has risen 106.31% over the past year. Fiverr also presents exciting gross profit margins; the company trades at a gross margin of 83.13%, signifying its prospects for parallel growth in bottom and top line earnings.

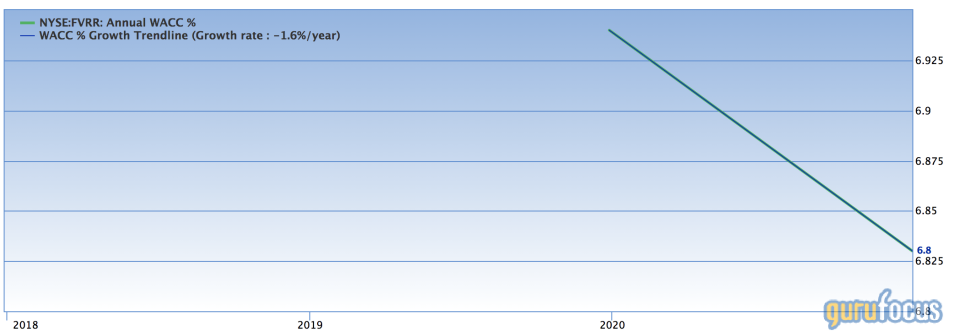

A pricing metric I'd like to outline is the company's weighted average cost of capital. As seen in the chart above, the WACC has decreased at an accelerating rate since the company started trading publicly. The lower the WACC, the higher the prospect of future intrinsic value. Thus, if this trend continues, we could experience a higher stock price for Fiverr.

Final word

Fiverr is a bright spark in a tough market. I expect the company to be handed support from a growing freelance market as well as its impressive valuation and pricing metrics. The stock is a buy and hold.

This article first appeared on GuruFocus.