Fixed Income ETFs Take Center Stage After Jackson Hole

The Federal Reserve’s hawkish messaging has renewed focus on fixed income ETFs, while gyrating stock markets push investors away from equity-focused products.

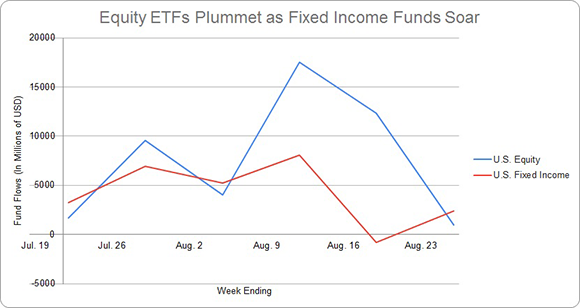

ETF flows plummeted 84% last week from the week prior, according to data from ETF.com, as investors responded to central bankers’ warnings at the annual Jackson Hole conference about higher interest rates for the foreseeable future.

Among the sectors most hit were equity ETFs, which picked up a modest $981.2 million in total inflows last week, compared with more than $12 billion from the week prior. Meanwhile, U.S. fixed income ETFs brought in more than double that amount, almost $2.4 billion, rebounding from $773 million in outflows in the week ending Aug. 19.

(For a larger view, click on the image above)

“The bull market was propellled by Powell’s comments around neutrality several months ago,” Phillip Toews, chief executive officer at Toews Asset Management, said. “No one really believed what he was saying, but it gave fuel to the bull market in a way that was really impressive.”

“The Fed is determined to see asset prices fall,” he said, adding that the trend may continue for almost two years.

Potential Reprieve

While equity markets continue to see headwinds as both the S&P and Nasdaq indices drop for a fourth day, fixed income ETFs may provide some reprieve from the storm.

The top-performing ETFs of last week included short-term, fixed income vehicles, with a particular focus on lower duration Treasury bills and bonds. Top funds included the Vanguard Short-Term Bond ETF (BSV), the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) and the Vanguard Short-Term Treasury Index ETF (VGSH). Fixed income ETFs in the top 10 funds from last week raked in over $3 billion alone.

For Kevin Flanagan, head of fixed income strategy of WisdomTree, the high inflows into fixed income vehicles can be attributed to high yield levels not seen for some time. He went on to add that the U.S.-based fund has seen $6 billion in inflows within their low-duration, Treasury floating products.

“Floating rate Treasuries help you invest with the Fed because they reset with weekly T-bills, which are going to be tied very closely to funds with what the Fed does, so they provide some duration protection for your portfolio,” he said.

“If the Fed is going to continue to raise rates into restrictive territory—which I think Powell made it very loud and clear [on Friday] that was the intent—this trend should be sustained going forward,” Flanagan noted, referring to the focus on fixed income, Treasury and high yield funds.

Contact Shubham Saharan at shubham.saharan@etf.com

Recommended Stories