FLEETCOR (FLT) Benefits From Organic Growth Amid Seasonality

FLEETCOR Technologies, Inc’s. FLT revenues are gaining from organic growth and strategic acquisitions but remain prone to seasonality and foreign exchange exposure risk. The company has beaten the Zacks Consensus Estimate in all four preceding quarters, the average surprise being 3.7%. Partly due to these positives, shares of FLT have grown 4.5%, compared with its industry’s 5.7% increase.

FLEETCOR reported impressive first-quarter 2023 results wherein both earnings and revenues surpassed the respective Zacks Consensus Estimate. Adjusted earnings (excluding 92 cents from non-recurring items) of $3.8 per share outpaced the consensus estimate by 3%. Earnings grew 4.1% year over year. Revenues of $901.3 million beat the consensus estimate and increased 14.2% year over year on a reported basis and 12% on an organic basis.

Current Situation of FLEETCOR

FLEETCOR’s revenues continue to grow organically, driven by volume and revenues per transaction in some of its payment programs. Organic revenue growth was 13%, 12%, 11%, 10% and 9% respectively in 2022, 2021, 2019, 2018 and 2017.

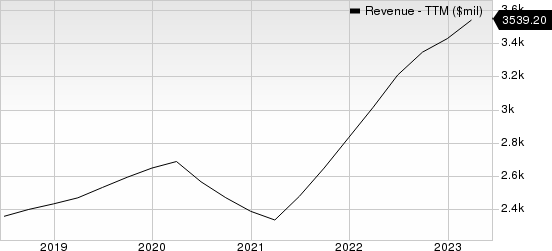

FleetCor Technologies, Inc. Revenue (TTM)

FleetCor Technologies, Inc. revenue-ttm | FleetCor Technologies, Inc. Quote

FLEETCOR has been active on the acquisition front, acquiring and investing in companies both in the United States as well as internationally. The company aims to expand its customer base, headcount and operations, and diversify its service offerings across industries by virtue of these acquisitions. The January 2023 acquisition of Global Reach Group is aimed at strengthening its scale of payments.

The company’s efforts to reward its shareholders are praiseworthy. In 2022, 2021, 2020 and 2019, the company repurchased shares worth $1.41 billion, $1.36 billion, $849.9 million and $694.9 million, respectively. These efforts instill shareholders’ confidence in the company.

FLEETCOR’s current ratio (a measure of liquidity) at the end of first-quarter 2023 was pegged at 1.16, higher than the current ratio of 1.11 reported in the prior-year quarter. This indicates that the company is less likely to face difficulty meeting its short-term debt obligations.

Some Concerning Points

FLEETCOR’s global presence is tolled with foreign currency exchange risk which pressurizes its bottom line. Notably, foreign exchange rates had unfavorably impacted the company’s revenues by $47 million in 2022, $112 million in 2020, $61 million in 2019 and $49 million in 2018.

Certain businesses of the company are faced with seasonality. FLEETCOR’s fuel card, workforce payment solutions and gift card are hampered seasonally which affects the company’s top line, thus making forecasting difficult.

Zacks Rank and Stocks to Consider

FLT currently carries a Zacks Rank #3 (Hold).

Investors interested in the Zacks Business Services sector can consider the following stocks:

Green Dot GDOT: For second-quarter 2023, the Zacks Consensus Estimate of Green Dot’s revenues suggests a decline of 4.5% year over year to $339.2 million and the same for earnings indicates a 59.5% plunge to 30 cents per share. The company has an impressive earning surprise history, beating the consensus mark in all four trailing quarters, the average surprise being 37.3%.

GDOT has a Value score of A and currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Maximus MMS: For second-quarter 2023, the Zacks Consensus Estimate of Maximus’ revenues suggests an increase of 6.9% year over year to $1.2 billion and the same for earnings indicates a 46.2% rise to $1.14 per share. The company has an impressive earning surprise history, beating the consensus mark in three instances and missing on one instance, the average surprise being 9.6%.

MMS has a VGM score of B along with a Zacks Rank of 1.

Rollins ROL: For second-quarter 2023, the Zacks Consensus Estimate of Rollins’ revenues suggests growth of 12.6% year over year to $803.6 million and the same for earnings indicates a 15% increase to 23 cents per share. The company has an impressive earning surprise history, beating the consensus mark in three of the four trailing quarters and missing on one instance, the average surprise being 5.53%.

ROL currently sports a Zacks Rank of 1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

FleetCor Technologies, Inc. (FLT) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report