FLEETCOR (FLT) Stock Gains 31% in Six Months: Here's How

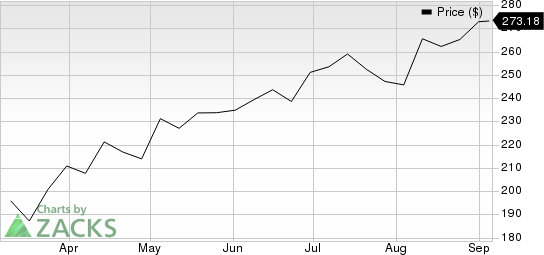

FLEETCOR Technologies, Inc. FLT shares have had an impressive run over the past six months.

The stock has rallied 30.6% compared with the 7.9% rise of the industry it belongs to and the 13.7% increase of the Zacks S&P 500 composite.

FleetCor Technologies, Inc. Price

FleetCor Technologies, Inc. price | FleetCor Technologies, Inc. Quote

What’s Behind the Rally

FLEETCOR’s top line remains healthy, driven by both organic and inorganic growth. Revenues grew 10% organically in the second quarter of 2023, driven by an increase in transaction volumes and new sales growth. Acquisitions completed in 2022 and 2023 contributed around $19 million to the top line in the quarter.

The recent acquisition of U.K.-based cross-border payments provider, Global Reach Group, has strengthened FLEETCOR’s global position as a non-bank cross-border provider by increasing its scale of payments. Another acquisition, Mina, a cloud-based electric vehicle charging software platform, provided FLEETCOR a home-charging software solution for commercial fleets in the U.K.

FLEETCOR has a consistent track record of share repurchases. In 2022, 2021, 2020 and 2019, the company repurchased shares worth $1.41 billion, $1.36 billion, $849.9 million and $694.9 million, respectively. Such moves not only instill investors’ confidence but also positively impact earnings per share.

Zacks Rank and Stocks to Consider

FLEETCOR currently carries a Zacks Rank #3 (Hold).

Here are two better-ranked stocks from the Business Services sector:

DocuSign DOCU beat the Zacks Consensus Estimate in all the four trailing quarters, with an earnings surprise of 25.6%. The consensus estimate for 2023 earnings is pegged at $2.52 per share, indicating 24.1% year-over-year growth. The consensus mark for 2023 revenues indicates an 8.1% increase from the year-ago reported figure. DOCU currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

CRA International CRAI beat the Zacks Consensus Estimate in two of the four trailing quarters and missed on two instances, the average earnings surprise being 5.1%. The Zacks Consensus Estimate for 2023 revenues indicates a 6.6% increase from the year-ago reported figure. The consensus mark for earnings is pegged at $5.49 per share, indicating a 7.6% year-over-year decline. CRAI carries a Zacks Rank #2 (Buy) at present.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

FleetCor Technologies, Inc. (FLT) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report