FLEETCOR (FLT) Surges 40% Year to Date: Here's How

FLEETCOR Technologies, Inc. FLT has had an impressive run in the year-to-date period, gaining 39.5% compared with the 10.3% increase of the industry and 15.6% rise of the Zacks S&P 500 composite.

What’s Aiding the Stock?

FLEETCOR's consistent organic revenue growth is due to the strong performance in fuel, corporate payments, tolls and lodging. The company achieved notable growth rates of 13%, 12%, 11%, 10% and 9% in 2022, 2021, 2019, 2018 and 2017, respectively.

FLT is strategically acquiring to enhance its top line. Acquisitions expand its customer base, operations and service offerings globally. The acquisition of Global Reach Group in Jan 2023 strengthens its non-bank cross-border position while the acquisition of Levarti in Mar 2022 enhances its airline-lodging business.

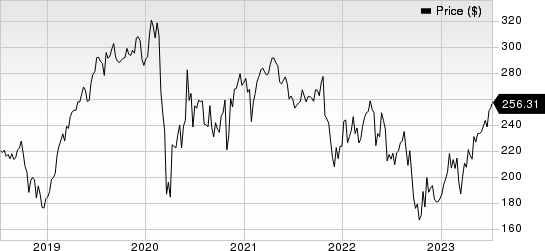

FleetCor Technologies, Inc. Price

FleetCor Technologies, Inc. price | FleetCor Technologies, Inc. Quote

FLEETCOR's shareholder-friendly share repurchases, totaling $1.41 billion, $1.36 billion, $849.9 million and $694.9 million, in 2022, 2021, 2020 and 2019, respectively, reflect its commitment to creating value and boosting investors’ confidence. This in turn positively impacts earnings per share.

Zacks Rank and Stocks to Consider

FLT currently carries a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Business Services can consider the following stocks:

Avis Budget CAR: For second-quarter 2023, the Zacks Consensus Estimate of Avis Budget’s revenues suggests a decline of 1.6% year over year to $3.19 billion and the same for earnings indicates a 38.4% plunge to $9.82 per share. The company has an impressive earning surprise history, beating the consensus mark in all four trailing quarters, the average surprise being 65.2%.

CAR has a Value Score of A and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Maximus MMS: For second-quarter 2023, the Zacks Consensus Estimate of Maximus’ revenues suggests an increase of 6.9% year over year to $1.2 billion and the same for earnings indicates a 46.2% rise to $1.14 per share. The company has an impressive earning surprise history, beating the consensus mark in three instances and missing on one instance, the average surprise being 9.6%.

MMS has a VGM Score of B along with a Zacks Rank of 1.

Interpublic Group IPG: For second-quarter 2023, the Zacks Consensus Estimate of IPG’s revenues suggests an increase of 0.6% year over year to $2.39 billion and the same for earnings indicates a 3.2% decline to 61 cents per share. The company has an impressive earning surprise history, beating the consensus mark in all four trailing quarters, with an average surprise of 9.5%.

IPG has a Value Score of A along with a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

FleetCor Technologies, Inc. (FLT) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report