Is Fleetcor Technologies (FLT) a Hidden Gem in the Software Industry?

Fleetcor Technologies Inc (NYSE:FLT) has been making waves in the market with a daily gain of 5.15% and a three-month gain of 11.61%. The company's Earnings Per Share (EPS) stand at a noteworthy 12.55. However, the question remains: Is the stock significantly undervalued? In this article, we will delve into the valuation analysis of Fleetcor Technologies Inc (NYSE:FLT) to answer this question. Let's get started!

A Brief Introduction to Fleetcor Technologies Inc (NYSE:FLT)

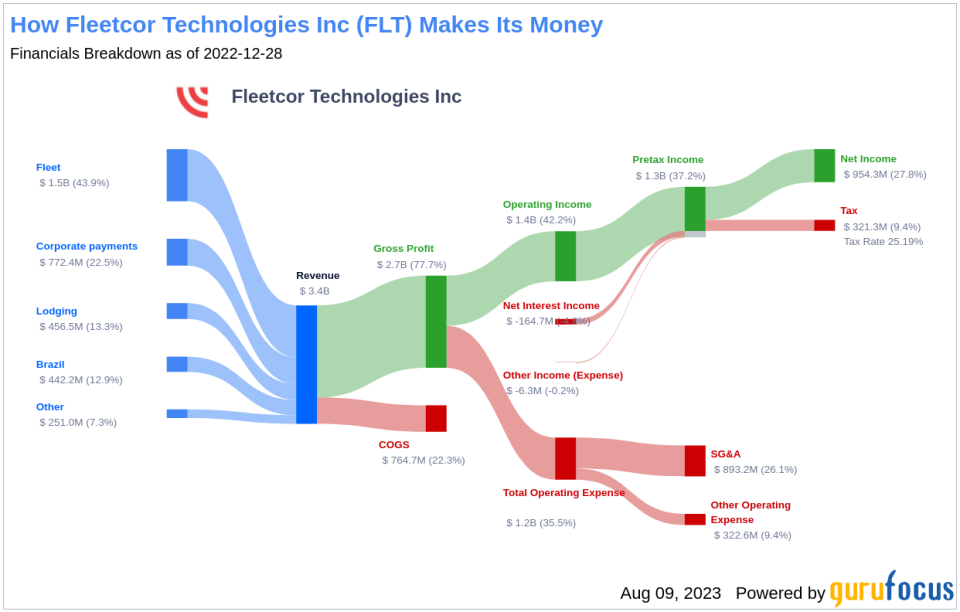

Fleetcor Technologies is a leading provider of specialized payment products. The company offers a range of services, including fleet cards, food cards, corporate lodging discount cards, and other specialized payment services. Fleetcor's systems are designed to help customers manage and control their commercial payments and loyalty-card programs. The company serves a diverse clientele, including commercial fleet operators, major oil companies, petroleum marketers, and government entities. Fleetcor also provides customized analysis solutions, offering business productivity tracking capabilities.

Understanding the GF Value

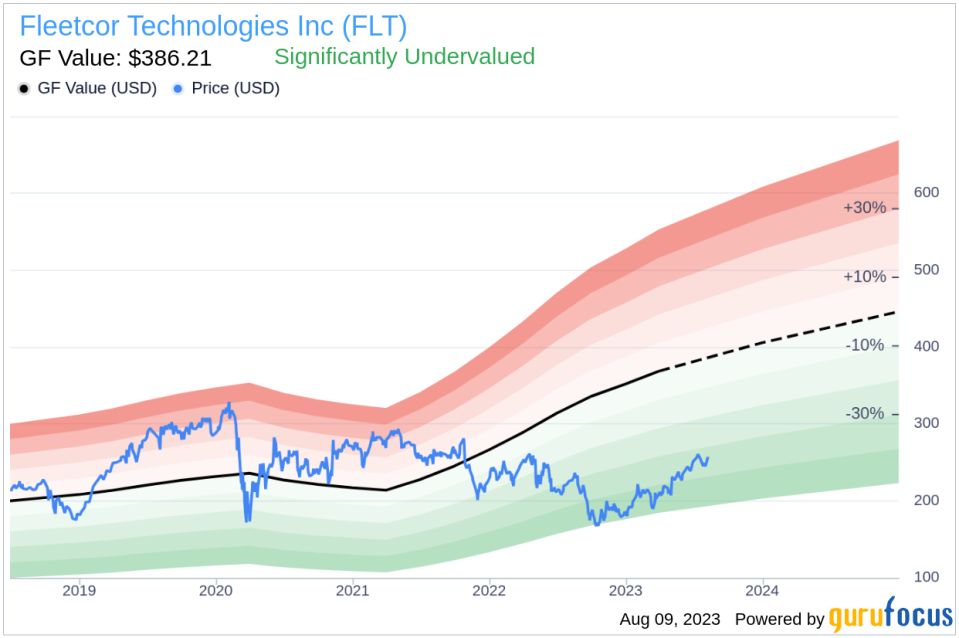

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line offers a visual representation of the stock's ideal trading value. If the stock price is significantly above the GF Value Line, it is considered overvalued and its future return is likely to be poor. Conversely, if the price is significantly below the GF Value Line, the stock is potentially undervalued and its future return may be higher.

According to our valuation method, Fleetcor Technologies (NYSE:FLT) appears to be significantly undervalued. With a current share price of $257.13, a market cap of $19 billion, and a GF Value of $386.21, the stock is poised for potentially high future returns. Given that Fleetcor Technologies is significantly undervalued, the long-term return of its stock is likely to be much higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Fleetcor Technologies' Financial Strength

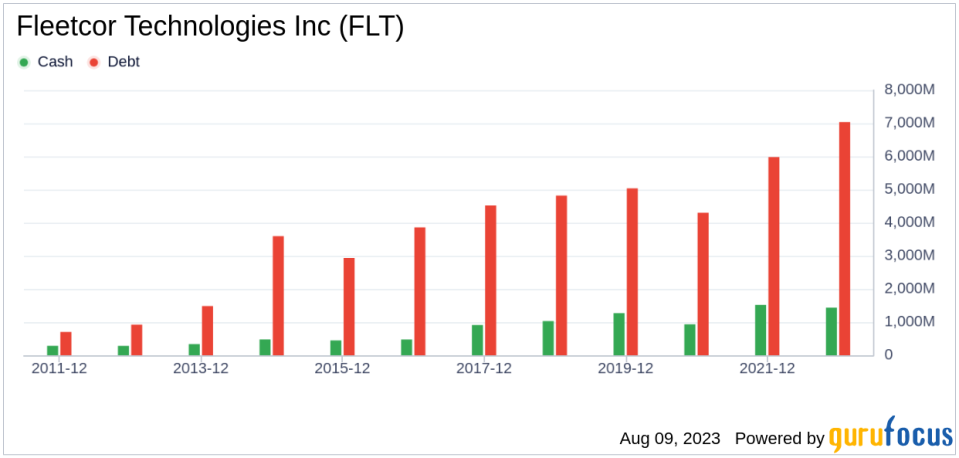

Before investing in a company, it's crucial to assess its financial strength. Investing in companies with poor financial strength poses a higher risk of permanent loss. A great way to understand the financial strength of a company is by looking at the cash-to-debt ratio and interest coverage. Unfortunately, Fleetcor Technologies' cash-to-debt ratio of 0.19 is worse than 88.27% of companies in the Software industry. However, the company's overall financial strength is rated 5 out of 10, indicating fair financial health.

Profitability and Growth of Fleetcor Technologies

Investing in profitable companies, especially those with consistent profitability over the long term, poses less risk. Fleetcor Technologies has been profitable 10 over the past 10 years. The company's operating margin of 42.5% ranks better than 98.27% of companies in the Software industry, indicating strong profitability. Furthermore, the 3-year average annual revenue growth rate of Fleetcor Technologies is 14.9%, outperforming 65.07% of companies in the Software industry. The 3-year average EBITDA growth rate is 11.2%, ranking better than 52.99% of companies in the Software industry.

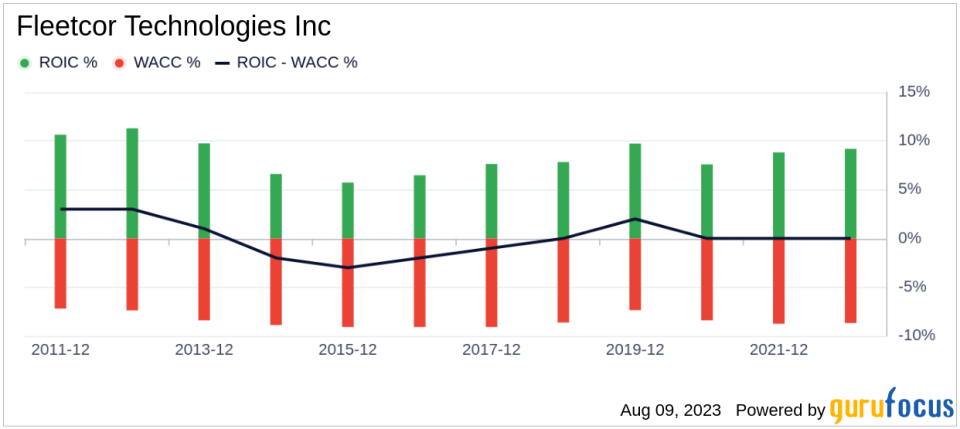

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to the weighted average cost of capital (WACC) can also provide insights into its profitability. When the ROIC is higher than the WACC, it suggests the company is creating value for shareholders. For the past 12 months, Fleetcor Technologies' ROIC has been 9.28, and its WACC has been 7.7.

Conclusion

In conclusion, Fleetcor Technologies (NYSE:FLT) is estimated to be significantly undervalued. The company's financial condition is fair, and its profitability is strong. Its growth ranks better than 52.99% of companies in the Software industry. For more information about Fleetcor Technologies stock, check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.