Fleetcor Technologies Inc (FLT) Posts Record Annual Revenues and Earnings for 2023

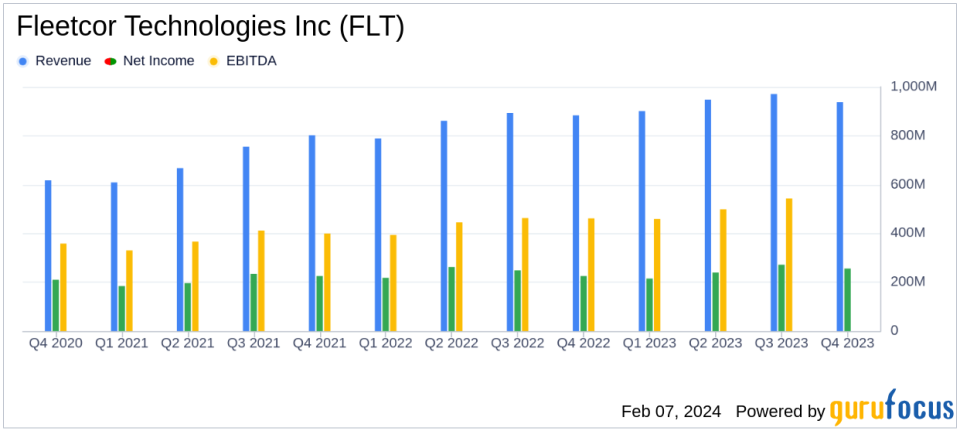

Revenue Growth: FLT's annual revenues hit an all-time high, increasing by 10% to $3.76 billion in 2023.

Net Income Growth: Full-year net income rose by 3% to $981.9 million, with a 6% increase in net income per diluted share.

Adjusted Earnings: Adjusted net income per diluted share grew by 5% to $16.92 in 2023.

Share Repurchase: FLT plans to repurchase $800 million of shares in 2024, with an increased share repurchase authorization of $1.0 billion.

2024 Outlook: FLT projects 20% sales growth, 8-10% organic revenue growth, and mid-teens growth in adjusted net income.

On February 7, 2024, Fleetcor Technologies Inc (NYSE:FLT), a leading global business payments company, released its 8-K filing, announcing financial results for the fourth quarter and full year ended December 31, 2023. FLT specializes in providing specialized payment products, including fleet cards, food cards, corporate lodging discount cards, and other specialized payment services. The company's systems enable customers to manage and control their commercial payments and loyalty-card programs, with a strong presence in the United States as its largest geographic operating segment.

Financial Performance and Challenges

Fleetcor Technologies Inc (NYSE:FLT) reported a successful 2023 with significant growth in revenues and net income. The company's full-year organic revenue growth of 10% and EBITDA growth of 13% align with its long-term targets. The Corporate Payments segment grew by 19% for the year, now representing over 25% of total revenue. FLT also made strides in expanding its electric vehicle (EV) capabilities, boasting the best charge point network in the UK and Western Europe after adding Tesla in the fourth quarter.

However, the fourth quarter saw a slight lag in revenue and adjusted earnings per share due to softness in some U.S. businesses. Despite this, FLT managed operating expenses effectively, achieving an EBITDA margin of 54.2%, which is 220 basis points better than the prior year quarter. The company ended the year with over $2.2 billion in liquidity and plans to repurchase $800 million of shares in 2024.

Financial Achievements and Importance

The financial achievements of FLT in 2023 are critical indicators of the company's ability to grow and deliver value to shareholders. The record revenues and earnings reflect the company's robust business model and strategic initiatives, particularly in expanding its payment solutions and enhancing its EV charging network. These achievements are significant in the software and payments industry, where innovation and market expansion are key drivers of success.

Key Financial Metrics

FLT's financial strength is further underscored by its balance sheet and cash flow statements. The company's total assets increased to $15.15 billion as of December 31, 2023, from $14.09 billion the previous year. Net cash provided by operating activities was a robust $1.78 billion for the year. FLT's commitment to shareholder returns is evident in its share repurchase activities, having repurchased approximately 2.6 million shares for $687 million for the year.

"Our fourth quarter revenue and adjusted earnings per share came in slightly behind our expectations due to pockets of softness in some of our U.S. businesses," said Tom Panther, chief financial officer, FLEETCOR Technologies, Inc. "We tightly managed operating expenses, exiting the year with an EBITDA margin of 54.2%, which was 220 basis points better than the prior year quarter."

FLT's outlook for 2024 is optimistic, with expectations for 20% sales growth, organic revenue growth of 8% to 10%, and adjusted net income growth in the mid-teens. The company's balance sheet remains strong with low leverage and significant liquidity, positioning it well for continued growth and shareholder value creation.

Analysis of Performance

Fleetcor Technologies Inc (NYSE:FLT)'s performance in 2023 demonstrates its resilience and adaptability in a dynamic market. The company's focus on expanding its payment solutions, particularly in the EV space, aligns with current trends and positions it for future growth. FLT's disciplined approach to expense management and its strategic share repurchases reflect a commitment to operational efficiency and shareholder value. As FLT moves into 2024, its strong financial position and optimistic outlook suggest a continued trajectory of growth and profitability.

For more detailed information and analysis, investors and interested parties are encouraged to visit the company's investor relations website and review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Fleetcor Technologies Inc for further details.

This article first appeared on GuruFocus.