Fleetcor Technologies Inc: A High-Performance Contender in the Software Industry

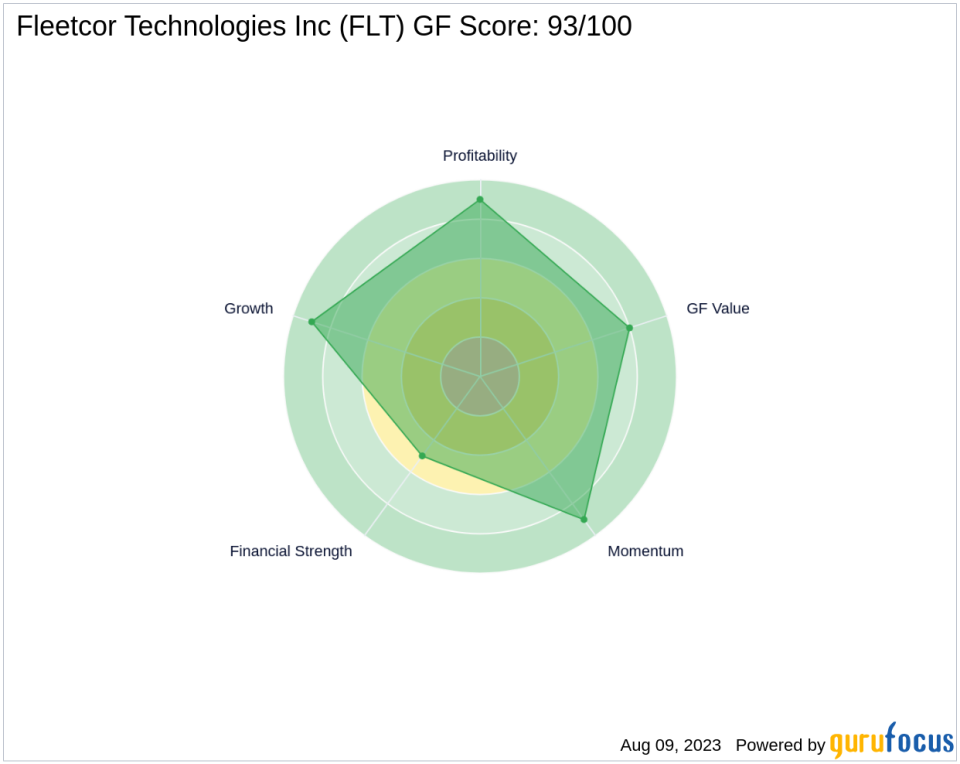

Fleetcor Technologies Inc (NYSE:FLT), a leading player in the software industry, is currently trading at $256.61 with a market capitalization of $18.95 billion. The company's stock price has seen a gain of 4.94% today and a modest increase of 1.37% over the past four weeks. In this article, we will delve into FLT's impressive GF Score of 93/100, which indicates the highest outperformance potential, and analyze its financial strength, profitability, growth, GF value, and momentum ranks.

Fleetcor Technologies Inc's GF Score

The GF Score is a comprehensive stock performance ranking system developed by GuruFocus. It evaluates a company's valuation across five key aspects: Financial Strength, Profitability Rank, Growth Rank, GF Value Rank, and Momentum Rank. FLT's GF Score of 93/100 suggests that the company has the highest outperformance potential, making it an attractive investment option.

Financial Strength Analysis

FLT's Financial Strength rank stands at 5/10. This rank evaluates the company's financial situation based on its debt burden, debt to revenue ratio, and Altman Z-Score. FLT's interest coverage is 6.76, indicating its ability to cover interest expenses with operating profits. The company's debt to revenue ratio is 1.92, and its Altman Z-Score is 2.23, suggesting moderate financial strength.

Profitability Rank Analysis

FLT's Profitability Rank is an impressive 9/10. The company's operating margin stands at 42.50%, and its Piotroski F-Score is 6, indicating a healthy financial situation. The trend of the operating margin over the past five years shows an uptrend, and the company has consistently been profitable over the past decade.

Growth Rank Analysis

FLT's Growth Rank is 9/10, reflecting strong revenue and profitability growth. The company's 5-year revenue growth rate is 11.30%, and its 3-year revenue growth rate is 14.90%. The 5-year EBITDA growth rate is 8.30%, indicating consistent growth in the company's business operations.

GF Value Rank Analysis

FLT's GF Value Rank is 8/10, suggesting that the company is fairly valued. This rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth.

Momentum Rank Analysis

FLT's Momentum Rank is 9/10, indicating strong stock price performance. This rank is determined using the standardized momentum ratio and other momentum indicators.

Competitive Analysis

FLT's main competitors in the software industry are Cloudflare Inc (NYSE:NET), VeriSign Inc (NASDAQ:VRSN), and Palantir Technologies Inc (NYSE:PLTR). Compared to its competitors, FLT's GF Score of 93 is higher than NET's 71, VRSN's 89, and PLTR's 37, indicating superior performance potential.

Conclusion

In conclusion, Fleetcor Technologies Inc's high GF Score and strong ranks in Financial Strength, Profitability, Growth, GF Value, and Momentum suggest that the company has a promising future. Investors seeking high returns should consider FLT as a potential investment option.

This article first appeared on GuruFocus.