Flex Ltd (FLEX) Reports Solid Q3 Fiscal 2024 Results; Completes Nextracker Spin-off

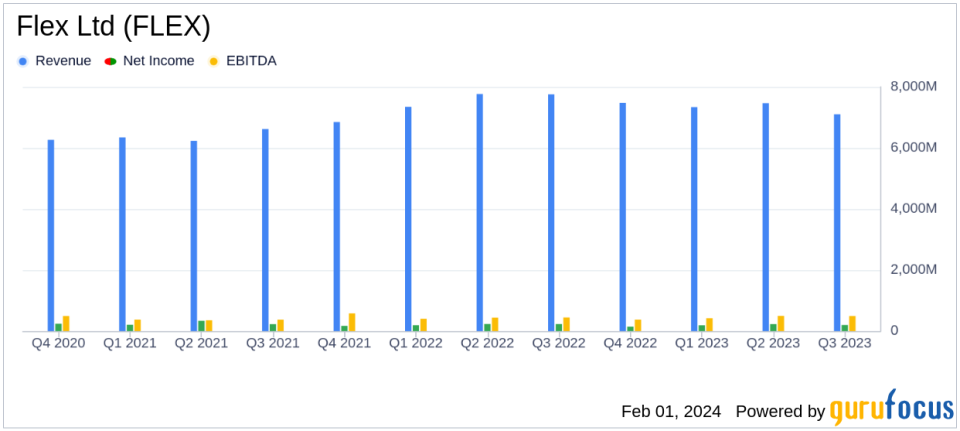

Net Sales: Reported $7.1 billion in the third quarter, a decrease compared to $7.8 billion in the same period last year.

GAAP Operating Income: Increased to $348 million from $321 million year-over-year.

Adjusted Operating Income: Rose to $477 million, up from $372 million in the prior-year period.

GAAP Net Income Attributable to Flex Ltd: Totaled $197 million, with a GAAP EPS of $0.45.

Adjusted Net Income Attributable to Flex Ltd: Reached $309 million, with an Adjusted EPS of $0.71.

Guidance: Provided Q4 FY24 revenue guidance of $5.8 billion to $6.4 billion and updated full-year FY24 guidance with revenue expectations of $27.7 billion to $28.3 billion.

Strategic Moves: Completed the spin-off of Nextracker, enhancing focus on core Flex business.

On January 31, 2024, Flex Ltd (NASDAQ:FLEX) released its third-quarter fiscal year 2024 results, showcasing a mix of robust operational performance and strategic repositioning. The company announced its 8-K filing which detailed financial metrics and corporate developments, including the completion of the Nextracker spin-off.

Flex Ltd is a leading contract manufacturing company that provides a wide range of design, manufacturing, and product management services to global electronics and technology companies. The company operates through segments such as Flex Agility Solutions (FAS), Flex Reliability Solutions (FRS), and Nextracker, serving diverse markets from automotive to cloud computing.

Financial Performance Overview

The company reported net sales of $7.1 billion for the third quarter, a slight decrease from the $7.8 billion reported in the same quarter of the previous year. Despite this, Flex Ltd saw an increase in both GAAP and Adjusted Operating Income, indicating effective cost management and operational efficiency. GAAP Operating Income rose to $348 million, while Adjusted Operating Income climbed to $477 million.

GAAP Net Income attributable to Flex Ltd was $197 million, with a GAAP Earnings Per Share (EPS) of $0.45. Adjusted Net Income attributable to Flex Ltd was significantly higher at $309 million, with an Adjusted EPS of $0.71. These figures underscore the company's ability to maintain profitability in a challenging market environment.

Balance Sheet and Cash Flow Highlights

The balance sheet of Flex Ltd remained robust, with cash and cash equivalents totaling $2.76 billion as of December 31, 2023. The company's inventories stood at $6.81 billion, reflecting the management of supply chain and inventory in response to market demand. Total assets were reported at $20.36 billion.

From a cash flow perspective, Flex Ltd generated $647 million in net cash from operating activities over the nine-month period ended December 31, 2023. However, the company used $414 million in investing activities and $768 million in financing activities, leading to a net decrease in cash and cash equivalents of $530 million for the same period.

Strategic Developments and Forward Outlook

Flex Ltd completed the strategic spin-off of Nextracker, which became a fully independent public company. This move is expected to allow Flex to concentrate more on its core competencies and streamline its operations.

Looking ahead, the company provided fourth-quarter fiscal 2024 guidance, projecting revenues between $5.8 billion and $6.4 billion. For the full fiscal year 2024, Flex updated its revenue guidance to a range of $27.7 billion to $28.3 billion, reflecting confidence in its business strategy and market position.

Flex's CEO, Revathi Advaithi, commented on the results, stating,

Overall, fiscal Q3 was another quarter of strong execution. We continue to deliver on our commitments, and we are very well positioned in markets with strong, long-term secular drivers."

The company's financial health and strategic initiatives position it well for continued success in the dynamic electronics manufacturing sector. Investors and analysts are encouraged to review the detailed financial statements and accompanying notes to gain a deeper understanding of Flex Ltd's performance and future prospects.

For more detailed information and analysis on Flex Ltd's financial results, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Flex Ltd for further details.

This article first appeared on GuruFocus.