FLEX Q1 Earnings Surpass Estimates, Revenues Decrease Y/Y

Flex Ltd FLEX reported first-quarter fiscal 2024 adjusted earnings per share (EPS) of 57 cents, beating the Zacks Consensus Estimate by 11.8%. The bottom line grew 5.6% year over year.

Revenues decreased 0.2% year over year to $7.3 billion. However, it surpassed the consensus mark by 1.3%. The downtick was caused by weakness across the Agility Solutions segment.

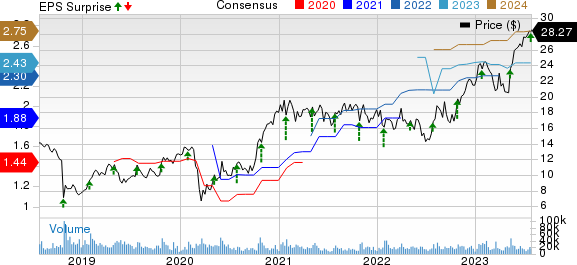

Flex Ltd. Price, Consensus and EPS Surprise

Flex Ltd. price-consensus-eps-surprise-chart | Flex Ltd. Quote

Segment Details

The Flex Reliability Solutions Group comprises Health Solutions, Automotive and Industrial businesses. Revenues improved 11% year over year to $3.3 billion. Demand remained healthy across the business segment, partly offset by supply-chain constraints.

The Flex Agility Solutions Group comprises Communications & Enterprise Compute and Lifestyle and Consumer Devices businesses. Revenues were down 10% year over year to $3.6 billion. The downtick was caused due to the softness in consumer end markets and enterprise IT.

The Nextracker Group’s revenues rose 21% year over year to $0.5 billion.

Operating Details

Non-GAAP gross margin increased 100 basis points (bps) on a year-over-year basis to 8.4% in the reported quarter.

Non-GAAP selling, general & administrative expenses, as a percentage of revenues, were 3.2%, which increased 20 bps from the prior-year period.

Non-GAAP operating margin expanded 60 bps year over year to 5.1%.

Adjusted operating margins of the Flex Reliability Solutions Group remained at 5% year over year. The Nextracker Group’s adjusted operating margin was 17.2%, up 960 bps year over year. The Flex Agility Solutions Group’s adjusted operating margin was 4.1%, down 20 bps.

Balance Sheet & Cash Flow

As of Jun 30, 2023, cash & cash equivalents totaled $2.66 billion compared with $3.29 billion as of Mar 31, 2023.

As of Jun 30, total debt (net of current portion) was $3.44 billion compared with $3.69 billion as of Mar 31, 2023.

In first-quarter fiscal 2024, the company generated cash flow from operating activities of $6 million and an adjusted free cash outflow of $150 million.

In the quarter under review, FLEX repurchased shares worth $197 million.

Guidance

For second-quarter fiscal 2024, Flex expects revenues between $7.3 billion and $7.7 billion.

Management expects adjusted EPS in the range of 55-60 cents. Adjusted operating income is projected to be between $370 million and $400 million.

For fiscal 2024, Flex expects revenues between $30.5 billion and $31.5 billion. It anticipates adjusted EPS in the range of $2.35-$2.55. Adjusted operating margin is projected to be in the range of 5-5.2%.

Zacks Rank & Stocks to Consider

Flex currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology space are InterDigital IDCC, Badger Meter BMI and Woodward WWD. InterDigital and Badger Meter presently sport a Zacks Rank #1 (Strong Buy), while Woodward currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for InterDigital’s 2023 EPS has increased 0.1% in the past 60 days to $8.08. The company’s long-term earnings growth rate is 13.9%.

InterDigital’s earnings beat estimates in all the trailing four quarters, delivering an average surprise of 170.9%. Shares of IDCC have rallied 53.9% in the past year.

The Zacks Consensus Estimate for Badger Meter’s 2023 EPS has increased 4.8% in the past 60 days to $2.82.

Badger Meter’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 6.7%. Shares of BMI have surged 80.5% in the past year.

The Zacks Consensus Estimate for Woodward’s fiscal 2023 EPS has increased 0.8% in the past 60 days to $3.61.

WWD’s long-term earnings growth rate is 13.5%. Shares of WWD have gained 20.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Flex Ltd. (FLEX) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report