Flexsteel Industries Inc (FLXS) Reports Notable Q2 Fiscal 2024 Results and Manufacturing ...

Net Sales: Increased by 7.5% to $100.1 million compared to the prior year quarter.

Gross Margin: Improved significantly to 21.9% from 17.0% in the prior year quarter.

Operating Income: GAAP operating income rose to $4.6 million, or 4.6% of net sales.

Net Income: GAAP net income per diluted share increased to $0.57, up from $0.53 in the prior year quarter.

Cash Flow: Strong cash flow from operations at $18.9 million, aided by a $15.6 million reduction in inventories.

Balance Sheet: Debt repayments of $15.1 million, marking a 46% reduction in borrowings under the line of credit.

Manufacturing Network: Announced closure of Dublin, Georgia plant to optimize operations, expecting annualized savings of $4.0 to $4.5 million.

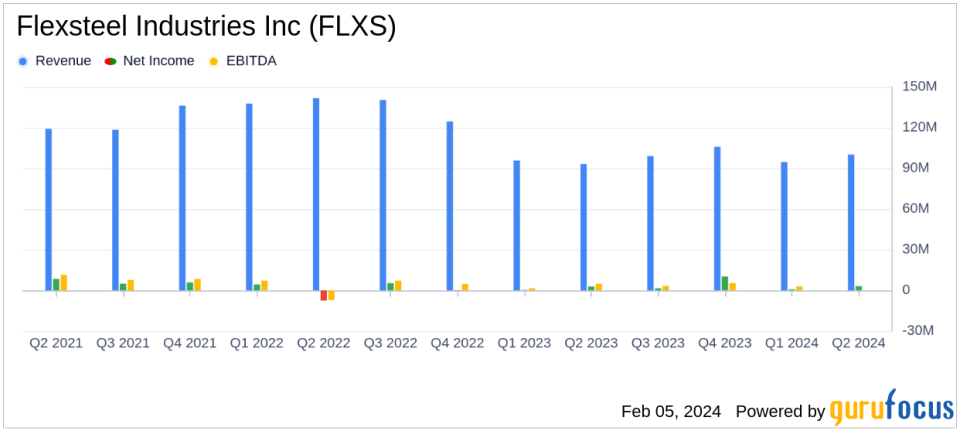

On February 5, 2024, Flexsteel Industries Inc (NASDAQ:FLXS) released its 8-K filing, announcing its financial results for the second quarter ended December 31, 2023. The company, a prominent player in the manufacture, import, and marketing of residential furniture in the United States, showcased a healthy sales growth and a significant improvement in gross margin. These results are particularly noteworthy given the current economic headwinds and shifts in consumer spending.

Company Overview

Flexsteel Industries Inc is known for its diverse range of furniture products, including sofas, chairs, desks, and bedroom furniture, which cater to various applications from home to office and healthcare settings. The company's commitment to quality is exemplified by its patented Blue Steel Spring technology, a hallmark of its upholstered furniture. Operating primarily in the residential market, Flexsteel has established a strong presence through both e-commerce and direct sales channels.

Financial Performance and Challenges

The company's performance this quarter reflects a robust 7.5% growth in net sales, reaching $100.1 million, and a 13.9% increase in sales orders, indicating strong demand for Flexsteel's products. The gross margin saw an impressive rise to 21.9%, attributed to effective cost control and material cost savings initiatives. GAAP operating income also improved, standing at 4.6% of net sales, up from 4.0% in the prior year quarter. These achievements are significant as they demonstrate Flexsteel's ability to navigate industry headwinds, such as shifts in consumer spending, and still deliver financial growth.

Despite these positive results, the company faces challenges, including a decrease in e-commerce sales due to softer consumer demand and a strategic reduction in promotional activity to bolster profitability. Additionally, the company is navigating the complexities of optimizing its manufacturing network, which includes the closure of its Dublin, Georgia plant. This move is expected to streamline operations and generate cost savings, but it will also incur one-time restructuring expenses.

Financial Statements Highlights

Flexsteel's balance sheet remains strong with a cash balance of $3.3 million and working capital of $100.5 million. The company has also demonstrated prudent financial management by reducing its line of credit borrowings significantly. The cash flow from operations was particularly strong, driven by higher profits and a substantial reduction in inventories.

Our strategies are working, and were seeing the outcomes in our improved financial performance. Im encouraged by these second quarter results and excited about the direction we are headed, said Jerry Dittmer, CEO of Flexsteel Industries, Inc.

The company's financial outlook remains positive, with Flexsteel reiterating its full-year fiscal 2025 guidance and expecting to achieve its third and fourth-quarter fiscal 2024 guidance on an adjusted non-GAAP basis, despite the one-time costs associated with the Dublin plant closure.

Conclusion

Flexsteel Industries Inc (NASDAQ:FLXS) has demonstrated a strong fiscal performance in its second quarter of 2024, with significant sales growth and gross margin improvement. The company's proactive steps to optimize its manufacturing network and improve working capital efficiency are expected to yield long-term benefits. As Flexsteel continues to navigate industry challenges and execute its strategic initiatives, it remains a company to watch for investors interested in the Furnishings, Fixtures & Appliances industry.

For more detailed information, investors are encouraged to review the full 8-K filing and join the earnings conference call scheduled for February 6, 2024.

Explore the complete 8-K earnings release (here) from Flexsteel Industries Inc for further details.

This article first appeared on GuruFocus.