Floor & Decor (FND) Q4 Earnings & Sales Beat Estimates, Stock Up

Floor & Decor Holdings, Inc. FND reported better-than-expected results for the fourth quarter of fiscal 2023. The company exceeded the Zacks Consensus Estimate for both earnings and revenues, driven by stronger-than-expected comparable store sales despite challenges associated with record-low existing homes for sales and diminishing flooring industry sales.

Shares of this multi-channel specialty retailer of hard surface flooring and related accessories gained 3.9% during the trading session and 3.1% in the after-hour trading session on Feb 22.

Looking ahead to 2024, the company is committed to expanding its market share by leveraging everyday low prices, value-driven options, trend-right product assortments, ample in-stock quantities, and outstanding customer service delivered by store associates.

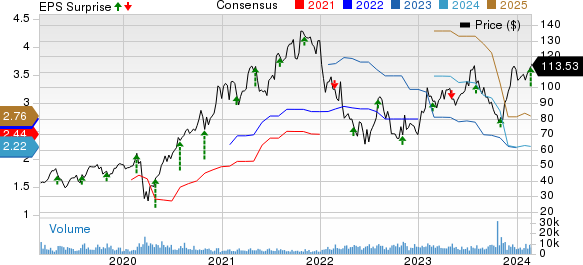

Floor & Decor Holdings, Inc. Price, Consensus and EPS Surprise

Floor & Decor Holdings, Inc. price-consensus-eps-surprise-chart | Floor & Decor Holdings, Inc. Quote

Earnings & Revenue Discussion

Floor & Decor reported earnings per share (EPS) of 34 cents in the quarter, beating the consensus estimate of 27 cents by 25.9% but decreased 46.9% from the year-ago quarter’s 64 cents.

Net sales of $1.05 billion in the quarter topped the consensus mark of $1 billion by 3.9%. The reported figure was flat compared to the year-ago level. Comparable store sales decreased by a better-than-anticipated 9.4%, mainly due to the effective implementation of strategies to boost sales and the comparison with previous periods of lower sales.

In the fourth quarter of fiscal 2023, operating income amounted to $46.2 million, marking a 51.3% decline from the $94.7 million recorded in the same period of fiscal 2022. The operating margin stood at 4.4%, dropping 460 basis points (bps) compared with the fourth quarter of fiscal 2022.

Gross margin improved 60 bps year over year to 42.2% in the quarter, attributed to favorable product margins from lower supply-chain costs.

General and administrative expenses, as a percentage of sales, experienced a deleverage of 160 basis points, reaching 6.5%. This was primarily attributed to the deleverage resulting from the decline in comparable store sales.

Selling and store operating expenses, as a percentage of sales, experienced a deleverage of 340 bps, dropping to 30.1% from a year ago. This increase primarily stems from the operation of 30 additional warehouse stores, leading to deleverage in occupancy and other fixed costs, as well as in-store labor costs, all influenced by a decline in comparable store sales.

In the quarter, pre-opening expenses amounted to $12.8 million, marking a 30.8% increase compared with the corresponding period last year, leading to a year-over-year deleverage of 30 bps. This rise was mainly attributed to the higher number of future store openings that the company was preparing for, as well as expenses related to rent and labor incurred due to delays in store openings compared with the same period last year.

Adjusted EBITDA for the fiscal fourth quarter amounted to $107.8 million, marking a 24.7% decrease from the $143.1 million reported in the same period of fiscal 2022.

Fiscal 2023 Highlights

Earnings came in at $2.28 per share, a decrease of 18% from $2.78 in fiscal 2022. In fiscal 2023, total sales rose 3.5% to achieve a record high of $4.41 billion, driven chiefly by the inauguration of 31 new warehouse-format stores and expansion in the commercial sector. Despite this growth, comparable store sales experienced a 7.1% decline from fiscal 2022, which modestly outperformed the company's projections of a 7.8% to 8.5% decline in comparable store sales. In fiscal 2022, comparable store sales growth was 9.2%, a period when monthly annualized existing home sales averaged 5.1 million units and 30-year mortgage rates were at 5.5%.

Adjusted EBITDA for fiscal 2023 amounted to $551.1 million, marking a 4.5% decrease from the $577.1 million reported in fiscal 2022.

Other Financials

As of Dec 28, 2023, Floor & Decor had cash and cash equivalents of $34.4 million, up from $9.8 million at the fiscal 2022-end.

During the fiscal fourth quarter, the company opened 14 new warehouse-format stores, and throughout fiscal 2023, it opened a total of 31 new warehouse stores. This expansion brought the year-end count to 221 warehouse-format stores and five design studios across 36 states.

Additionally, after the conclusion of fiscal 2023, a new warehouse store opened in Mansfield, TX, on Dec 29, 2023, increasing the total number of warehouse stores to 222. Looking ahead, FND remains committed to opening 30 to 35 new warehouse stores in fiscal 2024 as part of its long-term goal to operate 500 warehouse stores across the United States.

Fiscal 2024 Guidance

For fiscal 2024, the company expects net sales to range from approximately $4.6 million to $4.77 billion, with comparable store sales anticipated to fall within the band of 5.5%-2.0%. The EPS is estimated to be between $1.75 and $2.05, while adjusted EBITDA is projected to be between $520 million and $560 million.

Zacks Rank & Recent Construction Releases

Floor & Decor currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Owens Corning OC reported better-than-expected results for fourth-quarter 2023. Both earnings and net sales surpassed the Zacks Consensus Estimate and increased on a year-over-year basis.

Chair and chief executive officer of OC, Brian Chambers, said, “Looking ahead, we will continue to focus on delivering outstanding results in the near-term as we execute the strategic moves announced last week which will further strengthen our leadership in building and construction materials and position the company for long-term success.”

Martin Marietta Materials, Inc. MLM reported mixed fourth-quarter 2023 results, with earnings surpassing the Zacks Consensus Estimate and increasing on a year-over-year basis. Revenues missed the consensus mark but rose year over year.

Going forward, MLM anticipates strong demand for infrastructure, large-scale energy and domestic manufacturing projects. This will largely offset weaker residential demand and the anticipated softening in light non-residential activity. With mortgage rates stabilizing and affordability headwinds receding, MLM fully expects single-family residential construction to recover as demand still exceeds supply, particularly in its key markets.

Louisiana-Pacific Corporation LPX, or LP, reported impressive fourth-quarter 2023 results. Earnings and net sales beat their respective Zacks Consensus Estimate.

On a year-over-year basis, LPX’s earnings increased on reduced costs and inflationary pressure despite lower net sales.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Louisiana-Pacific Corporation (LPX) : Free Stock Analysis Report

Martin Marietta Materials, Inc. (MLM) : Free Stock Analysis Report

Owens Corning Inc (OC) : Free Stock Analysis Report

Floor & Decor Holdings, Inc. (FND) : Free Stock Analysis Report