Flotek Industries Inc (FTK) Reports Significant Turnaround with $67 Million Improvement in Net ...

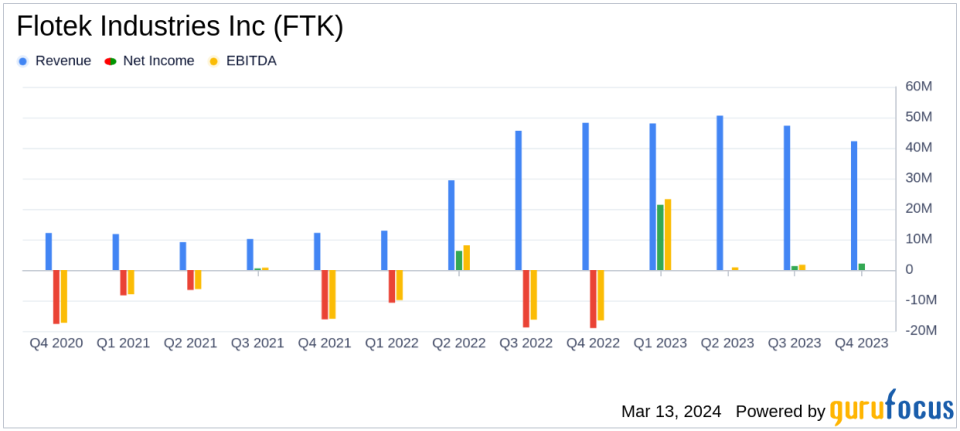

Net Income: Flotek Industries Inc (NYSE:FTK) reported a remarkable year-over-year improvement in net income, turning a $42.3 million loss in 2022 into a $24.7 million profit in 2023.

Gross Profit: The company saw a $31 million increase in annual gross profit, marking a significant recovery from the previous year's loss.

Revenue: Full-year revenue surged by 38% to $188.1 million in 2023, up from $136.1 million in 2022.

Adjusted EBITDA: FTK achieved a positive adjusted EBITDA of $1.5 million for the full year, a substantial shift from a negative $26.2 million in 2022.

Data Analytics Growth: The Data Analytics segment, led by JP3 revenues, grew by 47% to $8.1 million, indicating strong growth potential.

On March 12, 2024, Flotek Industries Inc (NYSE:FTK) released its 8-K filing, detailing a transformative year with significant improvements across all profitability metrics. The company, known for delivering chemistry-based technology solutions for energy, industrial, and consumer applications, has reported a substantial turnaround in its financial performance for the year ended December 31, 2023.

Financial Performance and Challenges

FTK's journey to profitability in 2023 was marked by a $67.0 million year-over-year improvement in net income, with the company posting a profit of $24.7 million compared to the previous year's loss. This turnaround was driven by a 38% increase in full-year revenue, which rose to $188.1 million, and a significant improvement in gross profit, which went from a loss of $6.7 million in 2022 to a profit of $24.3 million in 2023. The company's adjusted gross profit also saw a remarkable rise, from a loss of $1.9 million to a gain of $28.7 million.

Despite the backdrop of a slowing upstream completion environment, FTK's chemistry revenue from external customers increased by 21% over 2022. The company also generated strong growth in its Data Analytics segment, with JP3 revenues growing by 47%. However, the company faced challenges such as lower North American land completion activity, which impacted fourth-quarter revenues. Additionally, Flotek strengthened its liquidity position through an up to $13.8 million Asset Based Loan (ABL) and solidified its senior leadership team, which is expected to resolve material weakness and going concern issues identified in the 2022 audit.

Key Financial Metrics and Importance

FTK's financial achievements are particularly important in the oil and gas industry, where fluctuations in commodity prices and operational efficiency play critical roles in a company's success. The improved net income and positive adjusted EBITDA underscore the company's ability to navigate market challenges and enhance shareholder value. The growth in revenue, particularly from the Data Analytics segment, highlights the company's diversification and innovation in providing real-time data solutions to the energy sector.

Key financial details from the Income Statement and Balance Sheet include:

Financial Metric | 2023 | 2022 |

|---|---|---|

Total Revenues | $188,058K | $136,092K |

Gross Profit | $24,263K | $(6,700)K |

Net Income | $24,713K | $(42,305)K |

Adjusted EBITDA | $1,488K | $(26,169)K |

Management Commentary

"2023 was a transformative year as we restored profitability and delivered significant improvement in all key financial metrics, strengthened our leadership team with the addition of several key members, enhanced our liquidity through an ABL, and positioned Flotek to be the collaborative partner of choice for sustainable chemistry and data solutions that maximize our customers value," said Chief Executive Officer Dr. Ryan Ezell.

Dr. Ezell also expressed excitement about the next generation of the JP3 Verax Near InfraRed measurement system, which is expected to scale the Data Analytics segment more quickly and deliver associated revenue growth of greater than 50% in 2024. The company anticipates sustained growth in reservoir-centric and international chemistry revenues as it expands its global footprint.

Analysis and Outlook

The company's performance in 2023 indicates a strong recovery and a strategic pivot towards sustainable and optimized chemistry and data solutions. The positive adjusted EBITDA, after several years, signals operational efficiency and a more stable financial footing. With the anticipated growth in the Data Analytics segment and expansion into global markets, Flotek Industries Inc (NYSE:FTK) is positioning itself for continued improvement and market share gains.

FTK plans to issue 2024 guidance in conjunction with the release of its first quarter 2024 financial and operating results, providing investors with a clearer picture of the company's trajectory. The upcoming 36th Annual Roth Conference will also offer further insights into the company's strategy and outlook.

For more detailed information about Flotek Industries Inc (NYSE:FTK)'s financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Flotek Industries Inc for further details.

This article first appeared on GuruFocus.