Flowers Foods (FLO) Banks on Core Priorities Amid Cost Woes

Flowers Foods, Inc. FLO is navigating challenges effectively and positioning itself for growth. This leading packaged bakery product company has been gaining from its polished core priorities and the benefits of pricing strategies and strategic acquisitions.

Core Priorities

Flowers Foods has been committed to its core priorities, focusing on team development, brand concentration, margin enhancement, and strategic mergers and acquisitions. The company's transformation into a more brand-centric organization has shown progress, and its optimized product portfolio is set to drive market share expansion through innovation.

Flowers Foods has been actively innovating in its flagship brands, demonstrated by the nationwide launch of Dave's Killer Bread Snack Bars.

In the realm of margins, Flowers Foods is meticulously implementing pricing strategies and cost-saving measures to enhance business efficiency. The company is successfully shifting a significant portion of its sales to higher-margin branded retail products, which constituted 64.1% of its sales in the second quarter of 2023. Digital transformation and supply-chain initiatives are also progressing well, with FLO targeting savings of $20 to $30 million in 2023.

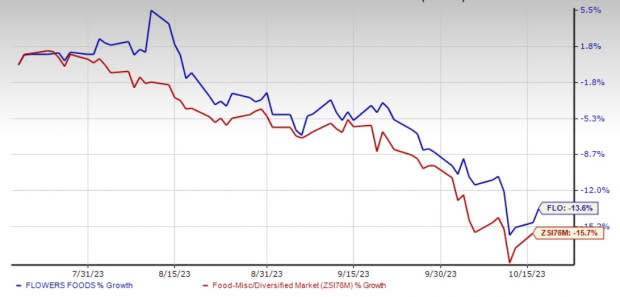

Image Source: Zacks Investment Research

Buyouts Solidify Portfolio

Flowers Foods has strategically pursued acquisitions to reinforce its product portfolio and expand into untapped markets. The acquisition of Papa Pita Bakery in February 2023 contributed to a 1.6% sales increase in the second quarter of 2023.

In addition, the acquisition of Dave's Killer Bread and Alpine Valley Bread Company in 2015 provided the company with access to the Pacific Northwest market. The 2018 acquisition of Canyon Bakehouse opened doors for Flowers Foods in the growing gluten-free bakery segment.

Gains From Pricing Aid Amid Cost Challenges

While grappling with cost inflation challenges, Flowers Foods has effectively utilized pricing strategies to support its margins. Pricing/mix increased 13.3% in the second quarter and boosted sales in branded retail and other channels. For fiscal 2023, the Zacks Rank #3 (Hold) company expects sales in the range of $5.095-5.141 billion, suggesting a 6-7% increase year over year.

However, materials, supplies, labor and other production costs (excluding depreciation and amortization) were impacted by input cost inflation, reduced production volumes, higher product returns and elevated maintenance costs in the second quarter. Also, Flowers Foods witnessed a rise in marketing expenses in the quarter. The company’s increased focus on marketing and innovation behind brands is likely to increase its cost burden in the near term, though it is expected to drive long-term growth.

For fiscal 2023, Flowers Foods’ adjusted EPS is envisioned in the band of $1.18-$1.25 compared with $1.27 recorded in fiscal 2022. The company’s shares have tumbled 13.6% in the past three months compared with the industry’s decline of 15.7%.

3 Appetizing Picks

Lamb Weston LW, which offers frozen potato products, currently sports a Zacks Rank #1 (Strong Buy). LW delivered an earnings surprise of 46.2% in the last reported quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lamb Weston’s current financial-year sales and earnings suggests growth of 27.4% and 20.1%, respectively, from the year-ago reported numbers.

The Kraft Heinz Company KHC, a food and beverage product company, currently carries a Zacks Rank #2 (Buy). KHC has a trailing four-quarter earnings surprise of 11.3%, on average.

The Zacks Consensus Estimate for Kraft Heinz’s current fiscal-year sales suggests growth of 2.2% from the corresponding year-ago reported figure.

The J. M. Smucker Company SJM, a branded food and beverage products company, currently carries a Zacks Rank #2. SJM has a trailing four-quarter earnings surprise of 7.3%, on average.

The Zacks Consensus Estimate for J. M. Smucker’s current fiscal-year earnings suggests growth of 8.9% from the corresponding year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Kraft Heinz Company (KHC) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report