Flowers Foods (FLO) Strategic Priorities Aid Amid High Costs

Flowers Foods, Inc. FLO has been benefiting from its key strategic priorities, encompassing team development, brand emphasis, margin prioritization, and engagement in mergers and acquisitions. The focus on innovation in leading brands like Dave Killer Bread is worth noting.

However, high selling, distribution and administrative (SD&A) expenses have been a concern. Input cost inflation has also been a hurdle for the company, though the impact is showing signs of moderation.

Strategic Priorities on Track

Flowers Foods has been shifting focus toward becoming a more brand-focused company. The company expects its optimized portfolio to drive market share gains through innovation. Management is focused on undertaking innovation in its leading brands. To this end, the rollout of Dave’s Killer Bread Snack Bars is in full swing, and the company is prepping for countrywide launches of DKB protein bars and DKB snack bites in spring and the second half of 2024, respectively.

Moving to margins, the company is undertaking pricing and saving measures and efforts to enhance business efficiency. The company has been focused on transitioning a larger part of its sales to higher-margin branded retail products (which increased 3% year over year and formed 64.3% of sales in the third quarter of 2023).

Apart from this, the company is on track with digital transformation and supply-chain efforts. Flowers Foods is ahead of track with its savings plan and now expects to achieve savings of $30-$35 million in 2023, up from the earlier view of $20-$30 million.

Gains from acquisitions have been another driver. Flowers Foods has been undertaking acquisitions to strengthen its product portfolio and expand in untapped markets. In February 2023, the company acquired Papa Pita Bakery, which boosted sales by 1.3% in the third quarter of 2023. In December 2018, the company completed the acquisition of Canyon Bakehouse, which has helped Flowers Foods expand into the growing gluten-free bakery space.

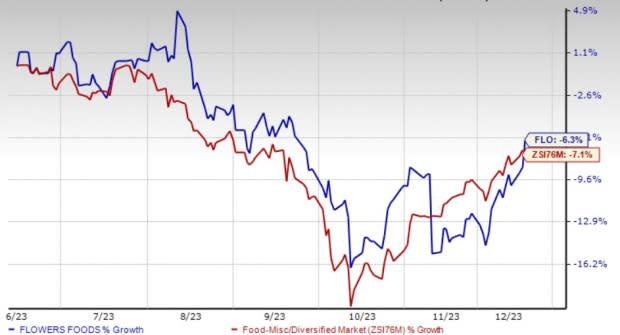

Image Source: Zacks Investment Research

High SD&A Costs & More

Flowers Foods’ SD&A expenses have been expanding as a percentage of sales on a year-over-year basis. In the third quarter, adjusted SD&A expenses expanded 200 bps to 38.4% of sales. Flowers Foods’ increased focus on marketing and innovation behind brands is likely to increase its cost burden in the near term, though it is expected to drive long-term growth.

The company expects costs related to upgrading its ERP system to be nearly $70-$80 million in 2023 (out of which $25-$35 million is anticipated to be capitalized).

Considering the third-quarter results, management now expects 2023 sales and adjusted EBITDA in the range of $5.085-$5.104 billion and $495-$515 million, respectively. Earlier, sales and adjusted EBITDA were expected to be $5.095-$5.141 billion and $503-$528 million bands, respectively.

Wrapping Up

Flowers Foods looks well placed on the back of its impressive pricing and portfolio strategies, along with enhanced efficiencies. These are likely to help the Zacks Rank #3 (Hold) company combat the inflationary challenges.

Shares of FLO have lost 6.3% in the past three months compared with the industry’s decline of 7.1%.

3 Appetizing Picks

The Kraft Heinz Company KHC, a food and beverage product company, currently carries a Zacks Rank #2 (Buy). KHC has a trailing four-quarter earnings surprise of 9.9%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Kraft Heinz’s current financial-year sales and earnings suggests growth of 1.1% and 6.5%, respectively, from the year-ago reported numbers.

Celsius Holdings, Inc. CELH, which develops, processes, markets, distributes and sells functional drinks and liquid supplements, holds a Zacks Rank #2. CELH has a trailing four-quarter earnings surprise of 110.9%, on average.

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and earnings suggests growth of 98.5% and 184.1%, respectively, from the year-ago reported numbers.

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently has a Zacks Rank #2. VITL has a trailing four-quarter earnings surprise of 145%, on average.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales suggests growth of 29.4% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Kraft Heinz Company (KHC) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report