Fluence Energy Inc (FLNC) Reports Strong Quarterly Performance with Record Order Intake

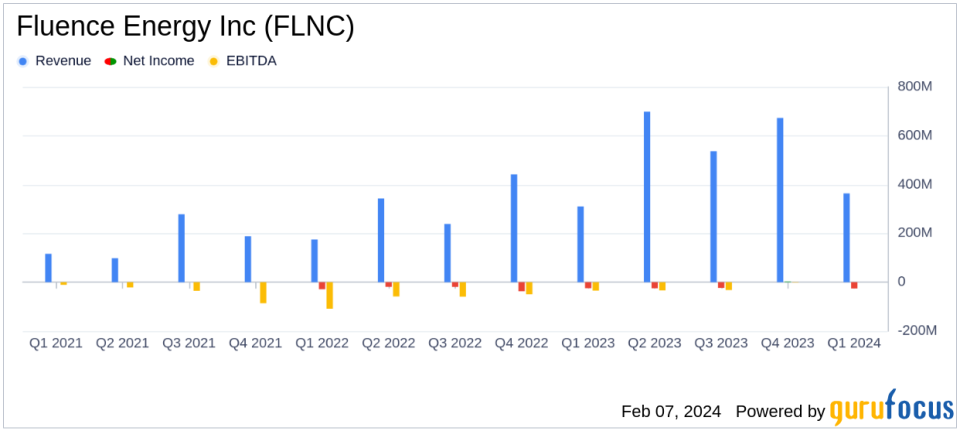

Revenue Growth: Quarterly revenue increased by 17% year-over-year to $364 million.

Improved Profitability: GAAP gross profit margin rose to 10%, and adjusted gross profit margin reached 10.5%.

Reduced Net Loss: Net loss narrowed to $25.6 million from $37.2 million in the same quarter last year.

Backlog Expansion: Contracted backlog surged to a record $3.7 billion, a significant increase from the previous quarter.

Liquidity Strength: Total Cash grew to $477 million, marking the third consecutive quarter of increase.

On February 7, 2024, Fluence Energy Inc (NASDAQ:FLNC) released its 8-K filing, announcing financial results for the first fiscal quarter ended December 31, 2023. The company, a leader in energy storage products and services, as well as digital applications for renewables and storage, reported a robust start to the fiscal year with a record $1.1 billion quarterly order intake, leading to its highest ever backlog. The majority of FLNC's revenue is derived from the Americas, reflecting its strong presence in the region.

Financial Performance and Strategic Progress

FLNC's revenue for the quarter stood at approximately $364 million, a 17% increase from the same quarter last year. This growth is attributed to the company's strategic focus on delivering profitable growth and developing products that meet customer needs. The GAAP gross profit margin improved significantly to 10%, up from 3.9% in the previous year's quarter, while the adjusted gross profit margin saw a similar improvement, reaching 10.5%. The net loss for the quarter was reduced to approximately $25.6 million, down from $37.2 million for the same quarter last year. Adjusted EBITDA also improved, with a loss of approximately $18.3 million compared to a loss of $26.1 million in the prior year.

The company's contracted backlog, a critical indicator of future revenue, increased to approximately $3.7 billion as of December 31, 2023, from $2.9 billion as of September 30, 2023. This growth in backlog underscores the robust market demand for FLNC's energy storage solutions. Total Cash, which includes cash and cash equivalents plus restricted cash, grew to approximately $477 million, representing an increase of approximately $14 million from the previous quarter.

Strategic Objectives and Market Positioning

FLNC's President and CEO, Julian Nebreda, highlighted the company's strategic objectives, including the anticipated start of battery module production at their Utah manufacturing facility in the summer of 2024. This move is expected to improve FLNC's competitive position and allow the company and its customers to benefit from incentives under the Inflation Reduction Act of 2022.

"We are off to a strong start for 2024 with a record quarterly order intake," said Julian Nebreda. "By manufacturing our own battery modules with domestic content, we expect this will further improve our competitive position and allow us and our customers to benefit from incentives under the Inflation Reduction Act of 2022."

FLNC's CFO, Ahmed Pasha, expressed confidence in the company's financial position and its ability to capitalize on the growing energy storage market. The company reaffirmed its fiscal year 2024 guidance, expecting total revenue in the range of $2.7 billion to $3.3 billion and Adjusted EBITDA between $50 million and $80 million.

"This quarter, we reported another solid set of financial results. This reflects our disciplined focus to drive sustainable growth and profitability. We remain on track to deliver on our financial commitments for fiscal 2024," said Ahmed Pasha.

Conclusion

Fluence Energy Inc (NASDAQ:FLNC) has demonstrated a strong start to fiscal 2024, with significant improvements in revenue, gross profit margins, and a reduced net loss. The company's strategic initiatives, including the expansion of its product offerings and the strengthening of its supply chain, position it well to capitalize on the growing demand for energy storage solutions. With a record backlog and a reaffirmed guidance, FLNC is poised for continued growth in the clean energy sector.

For more detailed financial analysis and the latest updates on Fluence Energy Inc (NASDAQ:FLNC), visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Fluence Energy Inc for further details.

This article first appeared on GuruFocus.