Fluor (FLR) Wins $5.87B Nuclear Cleanup Contract With Amentum

Fluor Corporation FLR, in partnership with Amentum Environment and Energy Inc. and Cavendish Nuclear Inc., has been awarded a contract by the U.S. Department of Energy (“DOE”) to manage the decontamination and decommissioning of the Portsmouth Gaseous Diffusion Plant in Piketon, Ohio.

The share price of FLR gained 1% during the trading session on Jul 17.

With an estimated value of $5.87 billion, this 10-year contract presents a significant opportunity for Fluor to showcase its expertise in environmental remediation and nuclear facility decommissioning.

The contract encompasses various tasks, such as demolition, disposal of facilities and the remediation of contaminated soils and groundwater. With this latest contract win, Fluor continues to solidify its presence in the nuclear energy industry and reinforces its reputation as a trusted partner for complex environmental projects.

Fluor will book its initial annual portion of the contract in the third quarter of 2023. The end-state contracting model allows for task orders to be issued under a single-award indefinite delivery/indefinite quantity contract, providing flexibility and efficiency throughout the project's lifecycle. Furthermore, the contract allows for up to five additional years for the performance of task orders, indicating potential long-term revenue streams for FLR.

Fluor's successful management of the Portsmouth Gaseous Diffusion Plant since 2011 has positioned the company as a trusted partner in the DOE's efforts to clean up and decommission nuclear weapon facilities.

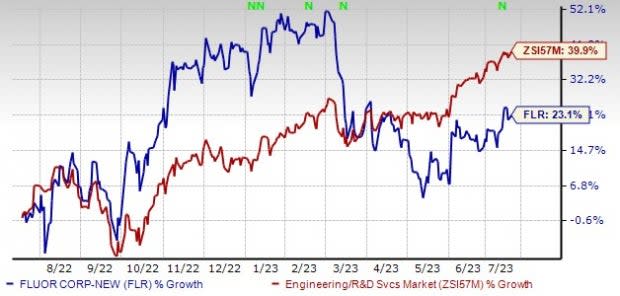

Price Performance

Image Source: Zacks Investment Research

Shares of FLR have increased 23.1% in the past year compared with the Zacks Engineering - R and D Services industry’s growth of 39.9%. The company’s underlying performance continues to be impacted by a few remaining legacy projects.

However, Fluor benefits from its diverse presence in various markets, which allows it to reduce the impact of market fluctuations. The company adopts a strategic approach by maintaining a well-balanced business portfolio, enabling it to prioritize stable markets while taking advantage of opportunities in cyclical markets when the timing is appropriate.

The company's long-term outlook remains promising, given the potential for growth in areas such as renewable energy, gas-fired combined cycle generation and projects focused on air emissions compliance for existing coal-fired power plants.

Fluor's total new awards in the first quarter of 2023 came in at $3.23 billion compared with $1.93 billion in the year-ago period. The consolidated backlog at the first-quarter end came in at $25.62 billion, up from $19.3 billion a year ago.

In the first quarter of 2023, consolidated revenues of FLR increased 20% year over year to $3,752 million. The upside was primarily attributable to solid contributions from all its segments.

Fluor's prior involvement in managing the decontamination and decommissioning work at the former Portsmouth Gaseous Diffusion Plant since 2011 showcases its exceptional track record in this sector. This expertise played a key role in the company’s selection for this latest contract, highlighting its commitment to delivering high-quality work.

Zacks Rank & Key Picks

FLR currently carries a Zacks Rank #3 (Hold). Here are some better-ranked stocks that investors may consider from the Zacks Construction sector:

Dycom Industries, Inc. DY sports a Zacks Rank #1 (Strong Buy). DY has a trailing four-quarter earnings surprise of 153.7%, on average. Shares of Dycom Industries have risen 9% year to date (YTD). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for DY’s 2024 sales and earnings per share (EPS) indicates a rise of 8.3% and 41%, respectively, from the year-ago period’s levels.

Eagle Materials Inc. EXP sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 6.5%, on average. Shares of Eagle Materials have rallied 44.2% YTD.

The Zacks Consensus Estimate for EXP’s 2024 sales and EPS calls for a rise of 2% and 8.3%, respectively, from the year-ago period’s levels.

Martin Marietta Materials, Inc. MLM carries a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 31%, on average. Shares of Martin Marietta Materials have increased 35.6% YTD.

The Zacks Consensus Estimate for MLM’s 2023 sales and EPS indicates a rise of 18.4% and 31.7%, respectively, from the year-ago period’s levels.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

Martin Marietta Materials, Inc. (MLM) : Free Stock Analysis Report

Eagle Materials Inc (EXP) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report