FMC Corp (FMC) Gains on Pricing & New Products Amid Demand Woes

FMC Corporation FMC is benefiting from pricing actions and new product launches amid headwinds from demand weakness due to inventory management by farmers.

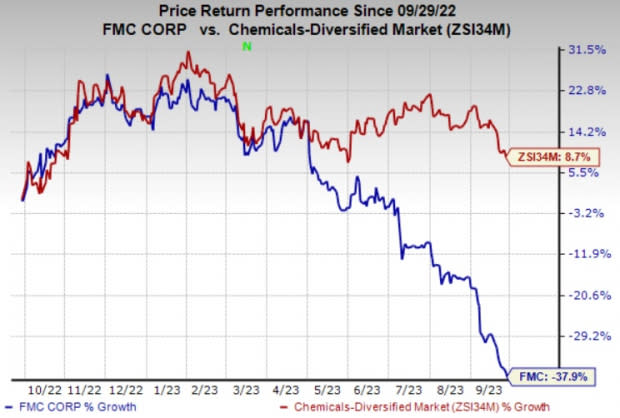

The company’s shares are down 37.9% in the past year compared with an 8.7% rise of the industry.

Image Source: Zacks Investment Research

FMC Corp, a Zacks Rank #3 (Hold) stock, remains focused on boosting its market position and strengthening its product portfolio. It is investing in technologies and products as well as new launches to enhance value to the farmers. New products launched in Europe, North America and Asia are gaining significant traction. Product introductions are expected to support the company’s results this year.

The acquisition of BioPhero ApS, a Denmark-based pheromone research and production company, also adds biologically produced state-of-the-art pheromone insect control technology to the company’s product portfolio and R&D pipeline, highlighting FMC's role as a leader in delivering innovative and sustainable crop protection solutions.

The company is actively taking price increase measures to mitigate the impact of cost inflation. FMC Corp saw pricing tailwind of 3% in the second quarter of 2023 with strongest price increases witnessed in EMEA. Higher prices are expected to continue to support the company’s results. The company is also expected to benefit from improved input costs and its cost-control actions.

FMC Corp also remains committed to return value to shareholders. The company returned around $123 million to its shareholders during the second quarter of 2023 including $73 million in dividends. The company, in its second-quarter call, said that it expects to return roughly $145 million to shareholders through dividends in the balance of 2023.

However, FMC faces headwinds from inventory de-stocking. The aggressive de-stocking by growers in the distribution channel is hurting its volumes as witnessed in the second quarter of 2023. The de-stocking is due to lower prices of fertilizers and certain non-selective herbicides and increased confidence in product availability driven by the easing of supply chain disruptions as well as higher interest rates, which have increased the carrying cost of inventory, per the company. Continued inventory management is expected to weigh on the company’s volumes in the third quarter.

The company also faces headwinds stemming from higher interest expenses in 2023. Higher U.S. interest rates are largely contributing to the spike in interest expenses. FMC now expects interest expenses for 2023 in the band of $220-$230 million, which indicates an increase of $15 million at the midpoint of the range compared with its previous guidance. Higher interest expenses are expected to weigh on margins in 2023.

Stocks to Consider

Better-ranked stocks worth a look in the basic materials space include Carpenter Technology Corporation CRS, Hawkins, Inc. HWKN and Alamos Gold Inc. AGI.

The Zacks Consensus Estimate for current fiscal-year earnings for CRS is currently pegged at $3.48, implying year-over-year growth of 205.3%. Carpenter Technology currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology has a trailing four-quarter earnings surprise of roughly 10%, on average. The stock has rallied around 115% over the past year.

Hawkins currently carrying a Zacks Rank #1. It has a projected earnings growth rate of 18.9% for the current year.

Hawkins has a trailing four-quarter earnings surprise of roughly 25.6%, on average. HWKN shares are up around 55% in a year.

Alamos Gold currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for AGI's current-year earnings has been revised 7.5% upward over the past 60 days.

The Zacks Consensus Estimate for current fiscal-year earnings for Alamos Gold is currently pegged at 43 cents, implying year-over-year growth of 53.6%. AGI shares have surged around 57% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

FMC Corporation (FMC) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report