FMC Corp Takes the Spotlight in Tweedy Browne's Latest 13F Filing with a 1.56% Portfolio Impact

Insight into Tweedy Browne (Trades, Portfolio)'s Q3 2023 Investment Moves and Top Holdings

Renowned for its adherence to the value investing principles of Benjamin Graham, Tweedy Browne (Trades, Portfolio) has a storied history in the investment world. The firm's Management Committee, with tenures ranging from 18 to 47 years, oversees operations with a focus on undervalued U.S. and foreign equity securities. Owned by its Managing Directors, employees, and a subsidiary of Affiliated Managers Group, Inc., Tweedy Browne (Trades, Portfolio) operates with autonomy, ensuring a stable succession and ownership transfer. The firm's investment approach is characterized by a long-term growth perspective and a prudent hedging strategy to mitigate currency risk.

New Additions to the Portfolio

Tweedy Browne (Trades, Portfolio)'s recent 13F filing reveals the addition of three new stocks to its portfolio:

Vertex Pharmaceuticals Inc (NASDAQ:VRTX) stands out as the most significant new holding, with 75,004 shares valued at $26.08 million, making up 1.4% of the portfolio.

Kenvue Inc (NYSE:KVUE) follows, with 447,426 shares worth approximately $8.98 million, accounting for 0.48% of the portfolio.

Atmus Filtration Technologies Inc (NYSE:ATMU) rounds out the new additions with 132,195 shares valued at $2.76 million, representing 0.15% of the portfolio.

Key Position Increases

In addition to new acquisitions, Tweedy Browne (Trades, Portfolio) bolstered its stakes in two existing holdings:

FMC Corp (NYSE:FMC) saw a substantial increase of 435,404 shares, bringing the total to 1,443,804 shares. This 43.18% increase in share count had a 1.56% impact on the portfolio, with a total value of $96.69 million.

Sealed Air Corp (NYSE:SEE) also experienced growth with an additional 269,610 shares, resulting in a 49.44% increase in share count and a total value of $26.78 million.

Complete Exits

The third quarter also saw Tweedy Browne (Trades, Portfolio) exit two positions entirely:

The firm sold all 339,637 shares of Fresenius Medical Care AG & Co. KGaA (NYSE:FMS), impacting the portfolio by -0.43%.

All 10,600 shares of CKX Lands Inc (CKX) were liquidated, causing a negligible -0.01% impact on the portfolio.

Significant Reductions

Tweedy Browne (Trades, Portfolio) reduced its positions in 38 stocks, with the most notable changes being:

A 570,169 share reduction in Cisco Systems Inc (NASDAQ:CSCO), equating to a -68.04% decrease and a -1.55% portfolio impact. The stock's average trading price was $53.95 during the quarter, with a -2.01% return over the past three months and a 13.21% year-to-date return.

Coca-Cola Femsa SAB de CV (NYSE:KOF) shares were cut by 239,466, a -13.12% reduction, impacting the portfolio by -1.05%. The stock traded at an average price of $82.7 during the quarter, returning 3.21% over the past three months and 28.13% year-to-date.

Portfolio Overview

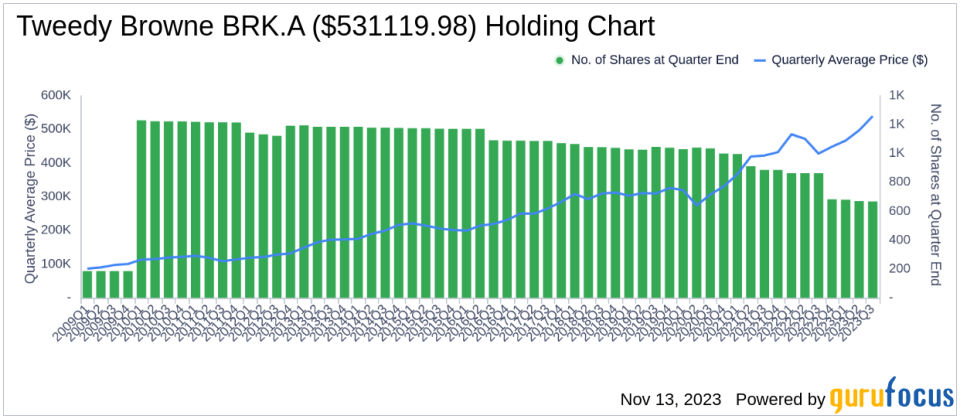

As of the third quarter of 2023, Tweedy Browne (Trades, Portfolio)'s portfolio comprised 48 stocks, with top holdings including 18.97% in Berkshire Hathaway Inc (NYSE:BRK.A), 14.06% in Alphabet Inc (NASDAQ:GOOGL), 9.5% in Johnson & Johnson (NYSE:JNJ), 8.52% in Ionis Pharmaceuticals Inc (NASDAQ:IONS), and 6.65% in Coca-Cola Femsa SAB de CV (NYSE:KOF). The investments are primarily concentrated across nine industries, including Financial Services, Healthcare, Communication Services, Consumer Cyclical, Consumer Defensive, Basic Materials, Industrials, Technology, and Energy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.