FMR LLC Acquires Significant Stake in RH

On July 31, 2023, FMR LLC, a renowned investment firm, added 264,651 shares of RH (NYSE:RH), a luxury retailer in the furniture and home furnishing industry. This acquisition has brought FMR LLC's total holdings in RH to 2,246,391 shares, representing a 12.21% stake in the company. The transaction, executed at a trade price of $388.17 per share, has a minor impact of 0.01% on FMR LLC's portfolio, increasing its position in RH to 0.08%.

About FMR LLC

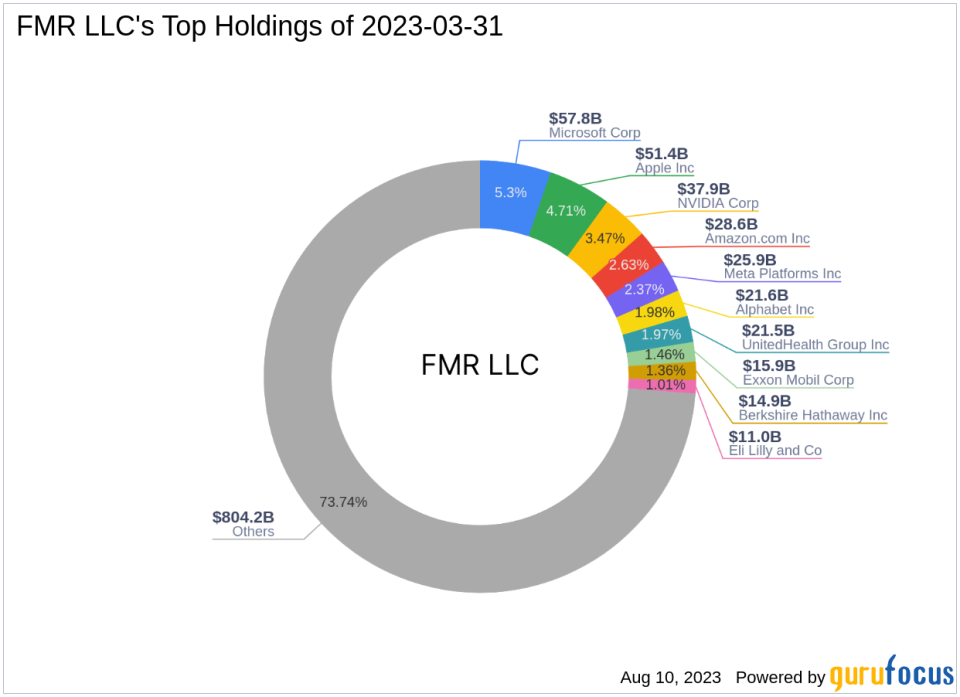

FMR LLC, also known as Fidelity, was founded in 1946 by Edward C. Johnson II. The firm has a rich history of taking risks and buying stocks with growth potential. Fidelity's investment philosophy is based on individual decision-making and constant innovation. The firm's top holdings include Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), Meta Platforms Inc (NASDAQ:META), Microsoft Corp (NASDAQ:MSFT), and NVIDIA Corp (NASDAQ:NVDA).

Fidelity manages a massive equity of $1,090.64 trillion, with a diversified portfolio spread across various sectors. The firm's top sectors are Technology and Healthcare. As of the date of this article, Fidelity holds 5049 stocks in its portfolio.

Overview of RH

RH, formerly known as Restoration Hardware, operates in the $143 billion domestic furniture and home furnishing industry. The company offers a wide range of products across various categories, including furniture, lighting, textiles, bath, decor, and children's items. RH also has a growing presence in the hospitality business, with 15 restaurant locations. The company's market capitalization stands at $7.08 billion, with a current stock price of $385.08.

Analysis of RH's Stock

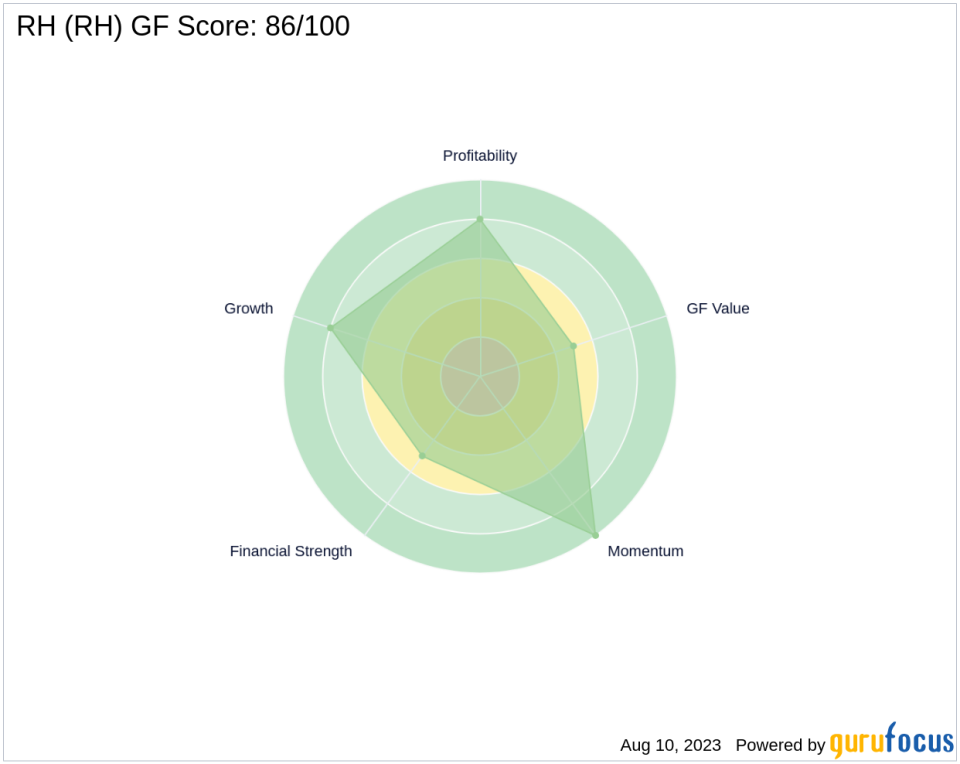

RH's stock has a PE percentage of 26.95, indicating that the company is profitable. According to GuruFocus, the stock is fairly valued with a GF Value of $404.90. The stock's price to GF Value ratio stands at 0.95, suggesting that it is slightly undervalued. Since its IPO in 2012, RH's stock has gained 1101.5%, and it has seen a year-to-date increase of 52.04%. The stock's GF Score is 86/100, indicating good outperformance potential.

Financial Health of RH

RH's financial strength is reflected in its balance sheet rank of 5/10, profitability rank of 8/10, and growth rank of 8/10. The company's interest coverage ratio is 2.99, and its Altman Z score is 2.55. RH's profitability rank is 8/10, and its Piotroski F-Score is 5, indicating a stable financial situation.

Other Gurus' Investment in RH

Other notable gurus who hold shares in RH include Ron Baron (Trades, Portfolio), First Eagle Investment (Trades, Portfolio), and Chris Davis (Trades, Portfolio). The largest guru holding RH's shares is Lone Pine Capital.

Conclusion

The recent acquisition by FMR LLC signifies the firm's confidence in RH's growth potential. The transaction has a minor impact on FMR LLC's portfolio, but it significantly increases its stake in RH. With RH's strong financial health and promising stock performance, this investment could yield substantial returns for FMR LLC in the future. As always, value investors should conduct their own research before making investment decisions.

This article first appeared on GuruFocus.