FMR LLC Acquires New Stake in Magenta Therapeutics Inc

Introduction to the Transaction

On September 29, 2023, FMR LLC (Trades, Portfolio), a prominent investment firm, made a significant move in the biotechnology sector by purchasing a new holding of 2,218,212 shares in Magenta Therapeutics Inc (NASDAQ:MGTA). This transaction was executed at a price of $0.6996 per share, marking a notable investment in the clinical-stage biotechnology company. The acquisition represents a 14.97% ownership stake in Magenta Therapeutics, indicating a strategic position taken by FMR LLC (Trades, Portfolio) in the company's equity.

Profile of the Investment Firm

FMR LLC (Trades, Portfolio), known for its flagship company Fidelity Investments, was founded in 1946 by Edward C. Johnson II. The firm has a rich history of focusing on growth potential and individual decision-making in its investment approach. Fidelity's innovative and research-driven strategy has led to the creation of groundbreaking technologies and services, including the first major financial institution to offer discount brokerage services. With a diverse range of products and a focus on talent investment, FMR LLC (Trades, Portfolio) has grown to manage assets in the trillions, with a significant presence in both the technology and healthcare sectors.

Magenta Therapeutics Inc at a Glance

Magenta Therapeutics Inc, based in the USA, went public on June 21, 2018. The company is at the forefront of developing innovative medicines aimed at enhancing the effectiveness of stem cell transplant, gene therapy, genome editing, and cell therapy. With a product pipeline that includes MGTA-117 and MGTA-145, among others, Magenta Therapeutics is actively working towards revolutionizing treatment options for various conditions.

Financial Snapshot of Magenta Therapeutics Inc

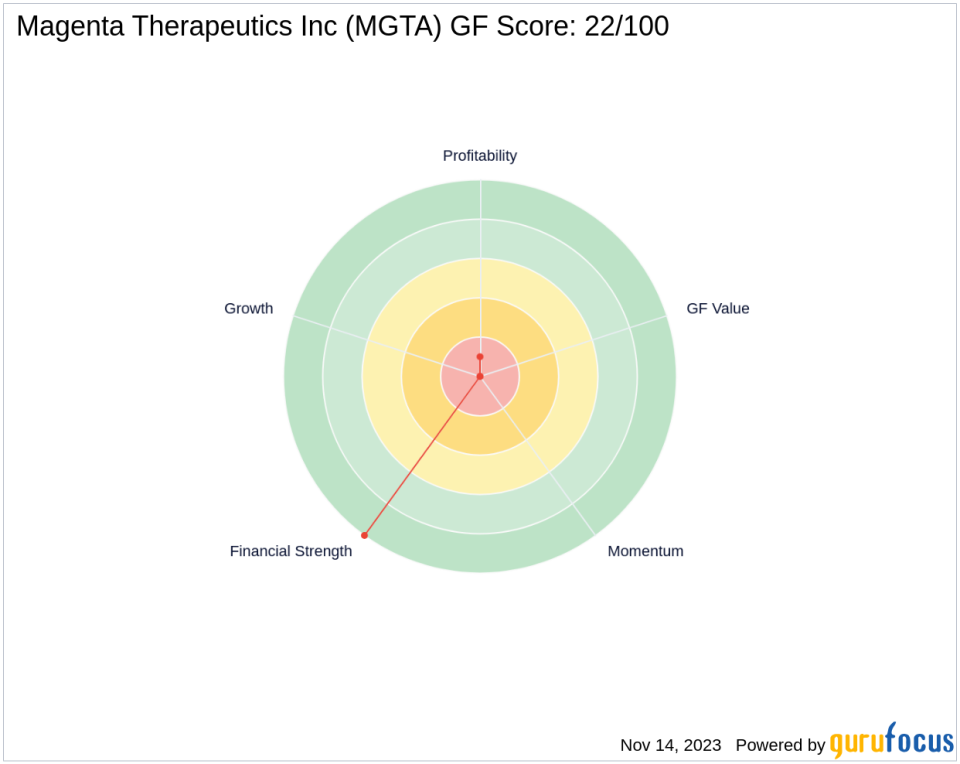

As of the latest data, Magenta Therapeutics Inc holds a market capitalization of approximately $42.441 million, with its stock price at $0.6996. The company's financial metrics, such as the PE Percentage, are not applicable as the company is currently operating at a loss. The GF Score of Magenta Therapeutics stands at 22 out of 100, indicating potential challenges in future performance.

FMR LLC (Trades, Portfolio)'s Position in Magenta Therapeutics Inc

The new holdings by FMR LLC (Trades, Portfolio) in Magenta Therapeutics Inc do not yet have a significant impact on the firm's overall portfolio due to the zero trade impact recorded. However, the 14.97% ownership stake is a substantial position within the company, suggesting that FMR LLC (Trades, Portfolio) sees long-term value or strategic importance in this investment.

Analysis of Magenta Therapeutics Inc's Market Performance

Since its IPO, Magenta Therapeutics Inc's stock has seen a decline of 95.49%, while the year-to-date performance shows a substantial increase of 70.63%. The current stock price does not have a GF Value Rank as the GF Value cannot be evaluated, indicating that the intrinsic value of the stock is not easily determined at this time.

FMR LLC (Trades, Portfolio)'s Top Holdings and Sectors

FMR LLC (Trades, Portfolio)'s top holdings include major players in the technology and healthcare sectors, such as Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), and NVIDIA Corp (NASDAQ:NVDA). The addition of Magenta Therapeutics Inc aligns with the firm's investment strategy, which heavily favors these sectors, and underscores the firm's commitment to investing in companies with transformative potential.

Market and Technical Indicators

Magenta Therapeutics Inc's stock momentum and RSI indicators suggest a mixed sentiment, with RSI values of 27.82, 33.15, and 36.83 over 5, 9, and 14 days, respectively. The company's financial strength is solid, with a perfect score of 10/10, while other metrics such as Profitability Rank and Growth Rank indicate areas for improvement.

Transaction Analysis

FMR LLC (Trades, Portfolio)'s acquisition of Magenta Therapeutics Inc shares is a strategic move that may influence the stock's performance and the firm's portfolio. While the immediate impact on FMR LLC (Trades, Portfolio)'s portfolio is minimal, the significant ownership stake could lead to more active involvement or influence in the company's strategic direction. Investors and market watchers will be keen to see how this investment unfolds in the context of FMR LLC (Trades, Portfolio)'s broader investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.