FMR LLC Adjusts Stake in Blueprint Medicines Corp

On October 31, 2023, FMR LLC (Trades, Portfolio), a prominent investment firm, made a significant adjustment to its holdings in Blueprint Medicines Corp (NASDAQ:BPMC), a biopharmaceutical company. The firm reduced its stake by 1,412,144 shares, resulting in a -23.21% change in its position. This transaction had a minor impact of -0.01% on FMR LLC (Trades, Portfolio)'s portfolio, with the trade executed at a price of $58.86 per share. Post-transaction, FMR LLC (Trades, Portfolio) holds a total of 4,673,111 shares in Blueprint Medicines, representing a 7.69% ownership and a 0.02% position size within the firm's portfolio.

Insight into FMR LLC (Trades, Portfolio)

FMR LLC (Trades, Portfolio), known as Fidelity, was established in 1946 by Edward C. Johnson II. The firm has a rich history of taking calculated risks and seeking stocks with growth potential. Fidelity's investment philosophy is rooted in individual decision-making and innovation, a legacy carried on by Edward C. Johnson III and later by CEO Abigail Johnson. With a focus on technology and healthcare sectors, Fidelity has grown to manage an equity portfolio worth $1,154.67 trillion, with top holdings in major companies like Apple Inc (NASDAQ:AAPL) and Amazon.com Inc (NASDAQ:AMZN).

Blueprint Medicines Corp at a Glance

Blueprint Medicines Corp, founded in the USA, went public on April 30, 2015. The company is dedicated to developing innovative treatments for diseases caused by abnormal kinase activation. Its pipeline includes small molecule drugs for cancer and rare genetic diseases, with notable candidates like BLU-285 and BLU-554 targeting specific cancer-causing mutations. Blueprint Medicines operates within various segments, including collaboration and license revenue, and has a market capitalization of $3.93 billion.

Detailed Transaction Specifics

The trade specifics reveal that FMR LLC (Trades, Portfolio)'s transaction on October 31, 2023, was executed at a price of $58.86, with the firm's total shares in Blueprint Medicines Corp post-transaction standing at 4,673,111. This represents a 7.69% stake in the company and a 0.02% position in FMR LLC (Trades, Portfolio)'s portfolio. The trade change percentage is significant, indicating a strategic move by the firm.

Blueprint Medicines Corp's Market Performance

Currently, Blueprint Medicines Corp's stock is priced at $64.73, reflecting a 9.97% gain since the transaction date. The stock is deemed "Modestly Overvalued" with a GF Value of $49.94 and a price to GF Value ratio of 1.30. The company's stock has experienced a 176.15% increase since its IPO and a 49.49% rise year-to-date.

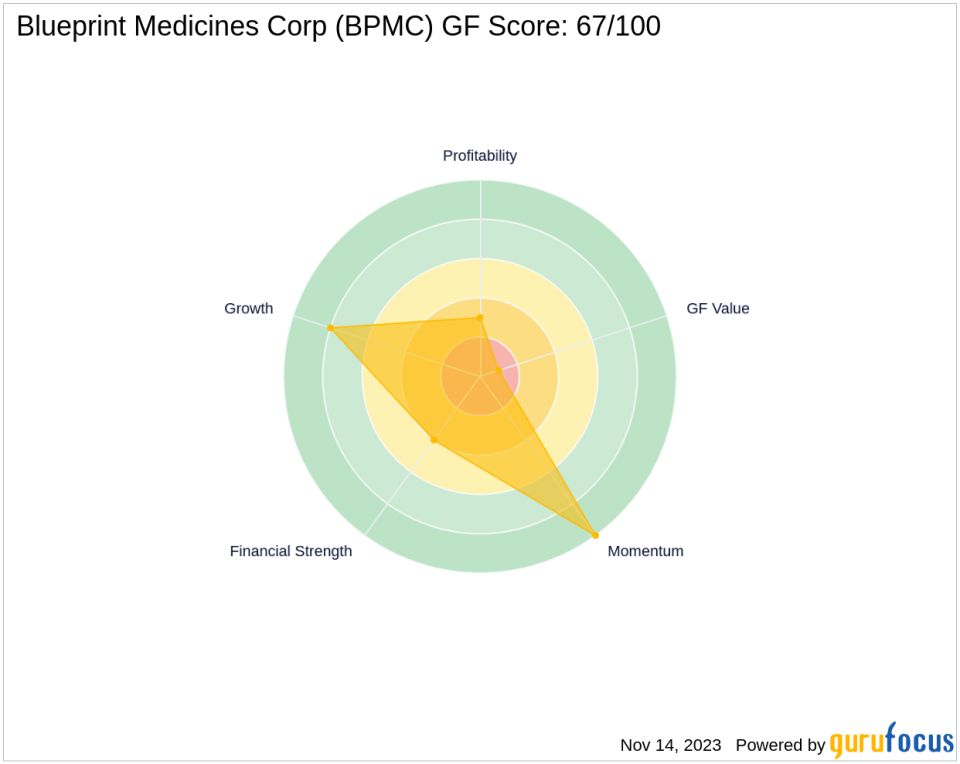

Financial Health and Growth Prospects

Blueprint Medicines Corp's financial health is characterized by a cash to debt ratio of 2.13, with a Financial Strength rank of 4/10. The company's Profitability Rank is 3/10, while its Growth Rank stands at 8/10. Despite a negative ROE of -133.15% and ROA of -44.45%, the company has shown a revenue growth of 35.00% over the past three years.

Comparative Analysis with Other Gurus

Other notable investors, such as Ken Fisher (Trades, Portfolio) and Jefferies Group (Trades, Portfolio), also hold positions in Blueprint Medicines Corp. The Vanguard Health Care Fund (Trades, Portfolio) is the largest guru shareholder, although the specific share percentage is not provided. This context highlights the diverse interest in Blueprint Medicines within the investment community.

Concluding Thoughts on FMR LLC (Trades, Portfolio)'s Portfolio Adjustment

FMR LLC (Trades, Portfolio)'s recent reduction in Blueprint Medicines Corp shares suggests a strategic portfolio realignment. While the transaction's impact on the firm's portfolio was minimal, it could reflect a response to the company's current valuation, financial health, or growth prospects. As Blueprint Medicines continues to innovate within the biotechnology industry, FMR LLC (Trades, Portfolio) and other investors will likely monitor its performance closely, adjusting their positions as necessary to align with their investment strategies and market movements.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.