FMR LLC Adjusts Stake in Olink Holding AB

Overview of FMR LLC (Trades, Portfolio)'s Recent Transaction

On October 31, 2023, FMR LLC (Trades, Portfolio), a prominent investment firm, made a significant adjustment to its investment portfolio by reducing its stake in Olink Holding AB (NASDAQ:OLK). The transaction involved the sale of 11,019,033 shares, resulting in an 88.79% decrease in FMR LLC (Trades, Portfolio)'s holdings in the company. This move had a minor impact of -0.02% on the firm's portfolio, with the shares being traded at a price of $24.92 each. Following the transaction, FMR LLC (Trades, Portfolio)'s remaining stake in Olink Holding AB stands at 1,391,795 shares, which corresponds to a 1.12% ownership in the traded company.

Insight into FMR LLC (Trades, Portfolio)

FMR LLC (Trades, Portfolio), known for its Fidelity brand, was established in 1946 by Edward C. Johnson II. The firm has a rich history of taking calculated risks and seeking stocks with high growth potential. Fidelity's investment philosophy is deeply rooted in individual decision-making and innovation, a legacy carried on from the early days when Gerry Tsai managed the Fidelity Capital Fund. Under the leadership of Edward C. Johnson III, Fidelity experienced significant growth and diversification, including the launch of the Magellan Fund and the pioneering Fidelity Daily Income Trust. Today, Fidelity continues to be a leader in the financial industry, with a keen focus on technology and healthcare sectors, boasting an equity portfolio of $1,154.67 trillion.

About Olink Holding AB

Olink Holding AB, based in Sweden, is a company specializing in medical diagnostics and research. Since its IPO on March 25, 2021, Olink has been leveraging its proprietary Proximity Extension Assay technology across various segments, including Kit and Services. The company's innovative approach allows for a seamless transition from discovery to clinical trials and diagnostic applications. Despite a challenging market, Olink Holding AB maintains a market capitalization of $3.09 billion, with a current stock price of $24.83.

Trade Impact on FMR LLC (Trades, Portfolio)'s Portfolio

The recent trade by FMR LLC (Trades, Portfolio) marks a notable reduction in its investment in Olink Holding AB, which now represents a 1.12% position in the company. The trade price of $24.92 reflects a slight decrease from the current stock price, indicating a potential strategic move by FMR LLC (Trades, Portfolio) to optimize its portfolio performance. Despite this reduction, Olink Holding AB remains a part of FMR LLC (Trades, Portfolio)'s diverse investment landscape, particularly within the technology and healthcare sectors.

Market Context and Olink's Stock Performance

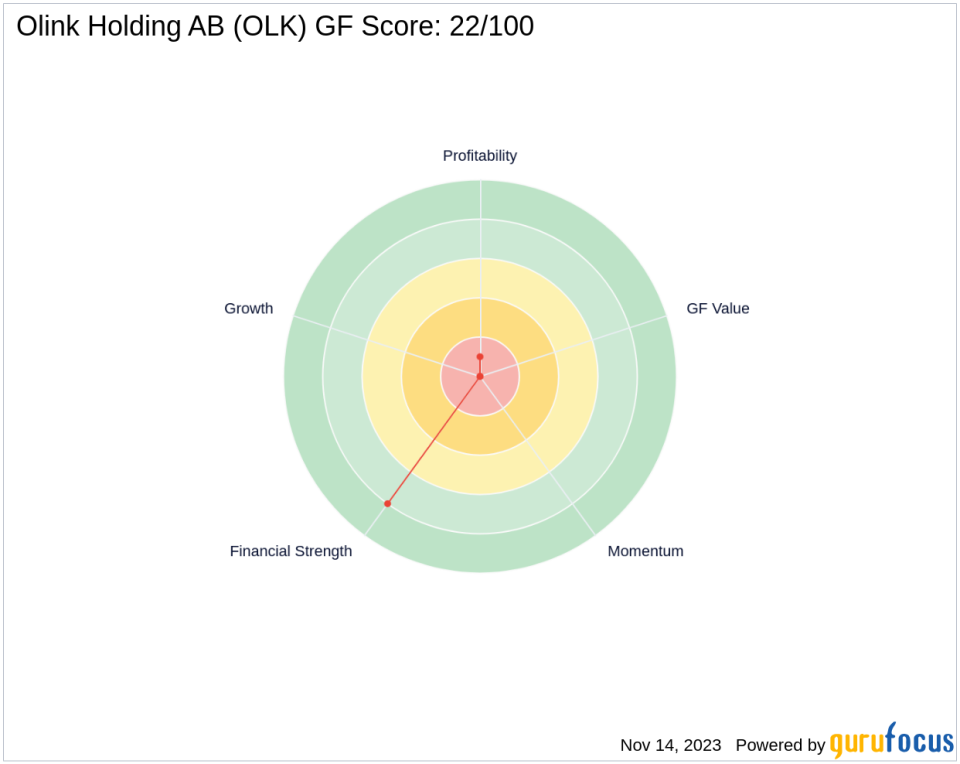

Olink Holding AB's stock has experienced a year-to-date increase of 10.4%, although it has seen a decline of 17.51% since its IPO. The company's stock performance is further characterized by a GF Score of 22/100, indicating potential challenges in future performance. Additionally, the stock's Relative Strength Index (RSI) over 14 days stands at 76.57, suggesting a recent uptrend in investor sentiment.

Assessing Olink's Sector and Financial Health

FMR LLC (Trades, Portfolio)'s top sectors include technology and healthcare, aligning with Olink Holding AB's industry of Medical Diagnostics & Research. Olink's financial health is reflected in its Financial Strength with a Balance Sheet Rank of 8/10, and a Piotroski F-Score of 4, indicating a moderate financial position. However, the company's Growth Rank and Profitability Rank are areas of concern, standing at 0/10 and 1/10, respectively.

Investment Considerations for Olink Holding AB

Investors considering Olink Holding AB must weigh the company's growth prospects against its market valuation. With a three-year revenue growth rate of 49.70%, Olink shows promise in its ability to expand. However, the lack of data for GF Value Rank and Momentum Rank makes it challenging to evaluate the stock's intrinsic value and momentum accurately.

Conclusion

FMR LLC (Trades, Portfolio)'s recent transaction involving Olink Holding AB signifies a strategic adjustment within its portfolio. While Olink's position in the market and its potential outlook present a mixed picture, FMR LLC (Trades, Portfolio)'s decision to reduce its stake may reflect a broader investment strategy. Investors should closely monitor Olink's financial health and market performance to make informed decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.