FMR LLC Bolsters Portfolio with DHT Holdings Inc Acquisition

On October 31, 2023, FMR LLC (Trades, Portfolio), a prominent investment firm, expanded its portfolio by adding shares of DHT Holdings Inc (NYSE:DHT). The transaction saw FMR LLC (Trades, Portfolio) acquiring 2,192,013 shares of the Bermuda-based crude oil tanker company, at a trade price of $11.12 per share. This addition has increased FMR LLC (Trades, Portfolio)'s total shareholding in DHT Holdings to 18,314,334, marking a significant investment move by the firm.

FMR LLC (Trades, Portfolio): A Legacy of Innovative Investment

FMR LLC (Trades, Portfolio), known widely as Fidelity, has a storied history dating back to its founding in 1946. With a business strategy that emphasizes risk-taking and growth potential, Fidelity has grown into a powerhouse in the investment world. The firm's approach to mutual funds and its pioneering efforts in technology and research have set it apart in the industry. Fidelity's notable mutual funds and ETFs, such as the Magellan Fund and iShares MSCI Japan, underscore its diverse and forward-thinking investment philosophy. With assets totaling $1,154.67 trillion and a strong presence in the technology and healthcare sectors, FMR LLC (Trades, Portfolio) continues to be a leader in the financial services sector.

Understanding DHT Holdings Inc

DHT Holdings Inc, with its fleet of VLCCs, operates internationally in the crude oil tanker market. The company, which went public on October 13, 2005, has a market capitalization of $1.68 billion and specializes in time charter and spot market operations. Despite being labeled as modestly overvalued with a GF Value of $9.04 and a stock price to GF Value ratio of 1.15, DHT Holdings has maintained a PE percentage of 9.08, indicating profitability. The stock's current price stands at $10.44, reflecting a 6.12% decrease since the trade date and a 23.55% increase year-to-date.

Impact of FMR LLC (Trades, Portfolio)'s Trade on Portfolio

The recent acquisition by FMR LLC (Trades, Portfolio) has a modest impact on its portfolio, with the position in DHT Holdings representing a 0.02% ratio. However, the firm now holds an 11.28% stake in the tanker company, indicating a bullish outlook on DHT's market performance and future prospects.

Market and Sector Analysis of DHT Holdings

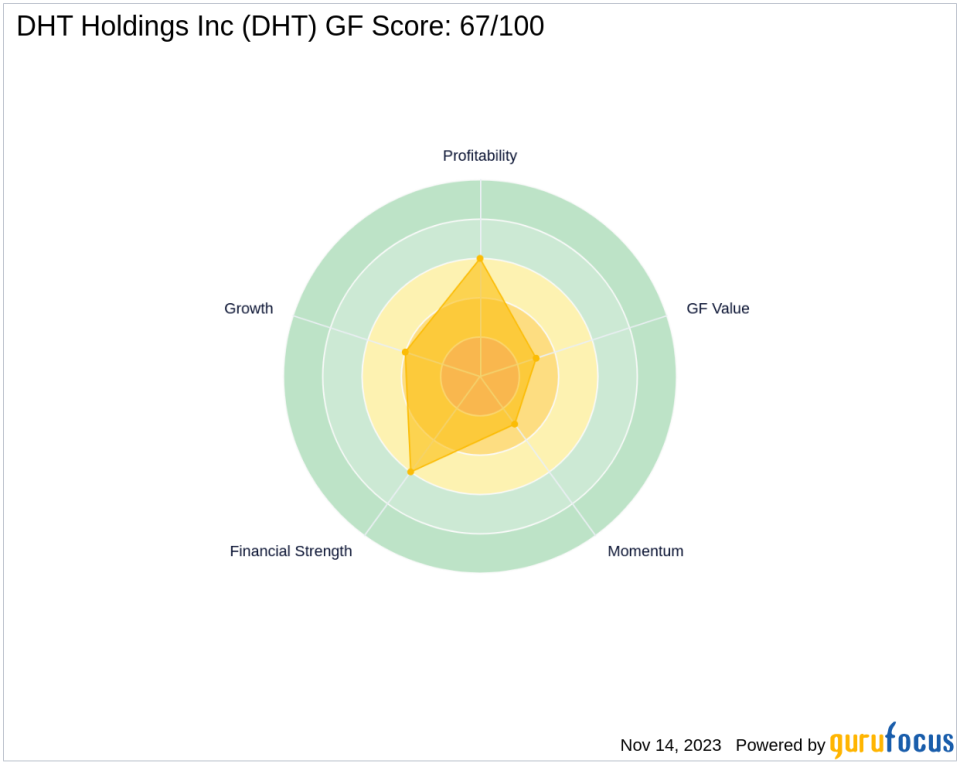

DHT Holdings' performance in the Oil & Gas industry is bolstered by a solid Profitability Rank of 6/10 and a Financial Strength score of 6/10. The company's interest coverage ratio stands at 7.14, and it has a respectable Return on Equity (ROE) of 18.06%. However, DHT Holdings faces challenges in growth, with a Growth Rank of 4/10 and declining three-year revenue and EBITDA growth rates.

Comparison with Largest Shareholder

Gotham Asset Management, LLC, previously the largest shareholder in DHT Holdings, has now been surpassed by FMR LLC (Trades, Portfolio)'s recent acquisition. While specific share percentage data for Gotham Asset Management is not provided, FMR LLC (Trades, Portfolio)'s 11.28% holding size is a clear indicator of its significant position in the company.

Concluding Thoughts on FMR LLC (Trades, Portfolio)'s Strategic Move

FMR LLC (Trades, Portfolio)'s addition of DHT Holdings Inc to its portfolio is a strategic move that aligns with the firm's history of seeking growth potential. For value investors, this trade signifies FMR LLC (Trades, Portfolio)'s confidence in DHT Holdings' future performance, despite the company's modest overvaluation and mixed financial rankings. As the market continues to evolve, FMR LLC (Trades, Portfolio)'s investment decisions will be closely watched for insights into the firm's outlook on the Oil & Gas sector and the broader market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.